|

08.05.2017 22:05:00

|

Pfenex Reports First Quarter 2017 Results and Provides Business Update

SAN DIEGO, May 8, 2017 /PRNewswire/ -- Pfenex Inc. (NYSE MKT: PFNX), a clinical-stage biotechnology company engaged in the development of biosimilar therapeutics, including high value and difficult to manufacture proteins, today reported financial results for the first quarter ended March 31, 2017 and provided a business update.

Business Review and Update

The Pfenex Annual Stockholder Meeting was held on May 5, 2017. At the Annual Meeting, respected pharmaceutical industry veterans Sigurdur (Siggi) Olafsson and Jason Grenfell-Gardner were elected to serve on Pfenex's Board of Directors. Mr. Olafsson served most recently as President and Chief Executive Officer of Global Generic Medicines Group of Teva Pharmaceuticals Ltd., a pharmaceutical company, and Mr. Grenfell-Gardner serves as the President and Chief Executive Officer and a member of the Board of Directors of Teligent, Inc., a specialty generic pharmaceutical company. Upon election, Mr. Grenfell-Gardner became Pfenex's Chairman of the Board of Directors as well as a member of the Corporate Governance and Nominating Committee. Pfenex previously announced the retirement of Chairman and Board Member, William R. Rohn, on March 31, 2017. The Company thanks Mr. Rohn for his valuable service.

PF708 is Pfenex's product candidate that is being developed as a therapeutic equivalent to Forteo (teriparatide), marketed by Eli Lilly for the treatment of osteoporosis patients at high risk of fracture. Enrollment in the pivotal immunogenicity/pharmacokinetics clinical study in osteoporosis patients was initiated in the fourth quarter of 2016. The completion of enrollment and interim pharmacokinetic data from this study is expected in the second half of 2017, and the immunogenicity data is expected in the first half of 2018. Pfenex believes this study, along with the positive bioequivalence study, is anticipated to satisfy the filing requirements for PF708 through the 505(b)(2) regulatory pathway.

In August 2016, Pfenex regained full rights from Pfizer to PF582, Pfenex's biosimilar product candidate to Lucentis (ranibizumab) for the treatment of retinal diseases, and announced positive results from the phase 1/2 trial which showed that PF582 was pharmacologically active and had a safety profile that was consistent with that of Lucentis. Pfenex has had ongoing interest in PF582 and expects to complete the strategic review of our development options for PF582 by the time we report our second quarter results in August 2017. As we complete the assessment of the strategic options for this program, we are reviewing the PF582 program resource commitments within the context of our broader ongoing development programs.

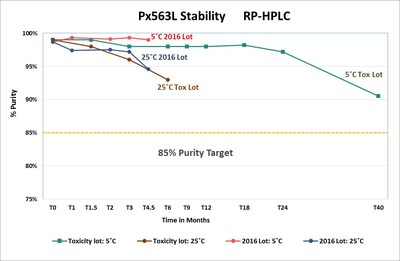

Px563L, a novel anthrax vaccine candidate, is being developed by Pfenex in response to the United States government's unmet demand for increased quantity, stability and dose-sparing regimens of anthrax vaccine. The development of Px563L is funded by the U.S. Department of Health and Human Services, through the Biomedical Advanced Research and Development Authority, or BARDA, in accordance with a cost plus fixed fee advanced development contract valued at up to approximately $143.5 million. Pfenex expects to initiate the phase 2 study in 2018. Ahead of the phase 2 study initiation, the Company expects to continue to demonstrate stability of the vaccine and to complete the manufacturing of the clinical supply. Pfenex has generated stability on its 2016 manufactured lot out to 4.5 months demonstrating the maintenance of approximately 99% purity at 5°C and approximately 95% purity at room temperature (25°C). The purity target is 85% or greater. Pfenex has also demonstrated long term stability data from our toxicology lot showing greater than 90% purity at 5°C at 40 months. Pfenex believes the successful completion of the phase 2 study and activities under this contract could lead to a procurement contract for supply of Px563L to the Strategic National Stockpile.

Financial Highlights for the First Quarter 2017

Total Revenue increased by $0.1 million, or 2%, to $2.8 million in the three month period ended March 31, 2017, compared to just under $2.8 million in the same period in 2016 due primarily to licensing revenue. This was partially offset by a decrease in government contract revenue for our Px563L product candidates. Given the nature of the novel vaccine development process, revenue will fluctuate depending on stage of development.

Cost of revenue decreased by approximately $0.5 million, or 37%, to $0.8 million in the three month period ended March 31, 2017, compared to $1.3 million in the same period in 2016. The decrease in cost of revenue for the periods presented was due primarily to a decrease in costs for our Px563L product candidate under our government contracts related to planning and start-up activities for newly exercised option periods. Given the nature of the novel vaccine development process, these costs will fluctuate depending on stage of development.

Research and development expenses increased by approximately $0.9 million, or 17%, to $6.4 million in the three month period ended March 31, 2017, compared to $5.5 million in same period in 2016. The increases in research and development expenses during the periods presented were primarily due to the increase in development activity of our product candidates, including PF708 and PF582, and the hiring of additional personnel dedicated to our research and development efforts. Clinical trial activities and manufacturing for PF708 and PF582, respectively, during the first quarter of 2017 increased costs in the three months ended March 31, 2017 over the same period in 2016.

Selling, general and administrative expenses increased by $1.5 million, or 35%, to $5.7 million in the three month period ended March 31, 2017, compared to $4.2 million in the same period in 2016. The increase in selling, general and administrative expenses during the periods presented were primarily due to costs incurred in connection with the separation of our former Chief Executive Officer.

Cash and cash equivalents as of March 31, 2017 was $70.2 million which we expect will be sufficient to fund operations for at least the next 12 months.

Cautionary Note Regarding Forward-Looking Statement

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Pfenex's future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as "may," "will," "should," "expects," "plans," "anticipates," "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential" or "continue" or the negative of these words or other similar terms or expressions that concern Pfenex's expectations, strategy, plans or intentions. Forward-looking statements in this press release include, but are not limited to, statements regarding the future potential of Pfenex's product candidates, including future plans to advance, develop, manufacture and commercialize its product candidates; Pfenex's belief in its potential to obtain a U.S. government procurement contract for Px563L for the Strategic National Stockpile; Pfenex's expectation to receive data from the PF708 clinical program in the second half of 2017 and in the first half of 2018; Pfenex's expectations regarding the timing of the release of additional clinical trial data for its product candidates; Pfenex's expectations regarding the timing and advancement of clinical trials and the types of future clinical trials for its product candidates, including PF708 and Px563L; Pfenex's expectations regarding the expected regulatory pathways for its product candidates, including the development of PF708 pursuant to the 505(b)(2) regulatory pathway; Pfenex's expectations regarding the sufficiency of its clinical trials to satisfy regulatory requirements; Pfenex's plan to explore strategic opportunities for PF582, including the timing of the completion of such review; Pfenex's expectation that it will continue to demonstrate stability of Px563L and complete manufacturing of the clinical supply; and Pfenex's projections related to fluctuations and changes in revenue and expenses. Pfenex's expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected. Actual results may differ materially from those indicated by these forward-looking statements as a result of the uncertainties inherent in the clinical drug development process, including, without limitation, Pfenex's ability to successfully demonstrate the efficacy and safety of its product candidates; the pre-clinical and clinical results for its product candidates, which may not support further development of product candidates or may require Pfenex to conduct additional clinical trials or modify ongoing clinical trials or regulatory pathways; challenges related to commencement, patient enrollment, completion, and analysis of clinical trials; difficulties in achieving and demonstrating biosimilarity in formulations; Pfenex's ability to manage operating expenses; Pfenex's ability to obtain additional funding to support its business activities and establish and maintain strategic business alliances and new business initiatives; Pfenex's dependence on third parties for development, manufacture, marketing, sales and distribution of products; unexpected expenditures; and difficulties in obtaining and maintaining intellectual property protection for its product candidates. Information on these and additional risks, uncertainties, and other information affecting Pfenex's business and operating results is contained in Pfenex's Annual Report on Form 10-K for the period ended December 31, 2016 and in its other filings with the Securities and Exchange Commission. Additional information will also be set forth in Pfenex's Quarterly Report on Form 10-Q for the period ended March 31, 2017 to be filed with the Securities and Exchange Commission. The forward-looking statements in this press release are based on information available to Pfenex as of the date hereof, and Pfenex disclaims any obligation to update any forward-looking statements, except as required by law.

Pfenex investors and others should note that we announce material information to the public about the Company through a variety of means, including our website (http://www.pfenex.com/), our investor relations website (http://pfenex.investorroom.com/), press releases, SEC filings, public conference calls, corporate Twitter account (https://twitter.com/pfenex), Facebook page (https://www.facebook.com/Pfenex-Inc-105908276167776/timeline/), and LinkedIn page (https://www.linkedin.com/company/pfenex-inc) in order to achieve broad, non-exclusionary distribution of information to the public and to comply with our disclosure obligations under Regulation FD. We encourage our investors and others to monitor and review the information we make public in these locations as such information could be deemed to be material information. Please note that this list may be updated from time to time.

About Pfenex Inc.

Pfenex Inc. is a clinical-stage biotechnology company engaged in the development of biosimilar therapeutics and high-value and difficult to manufacture proteins. The Company's lead product candidates are PF708, a therapeutic equivalent candidate to Forteo (teriparatide) for the treatment of osteoporosis, and PF582, a biosimilar candidate to Lucentis (ranibizumab), for the potential treatment of patients with retinal diseases. Pfenex has leveraged its Pfēnex Expression Technology® platform to build a pipeline of product candidates and preclinical products under development including other biosimilars, as well as vaccines, therapeutic equivalents to reference listed drug products, and next generation biologics.

PFENEX INC. | |||

Consolidated Statements of Operations | |||

(unaudited) | |||

Three Months Ended | |||

(in thousands, except per share data) | 2017 | 2016 | |

Revenue | $ 2,818 | $ 2,764 | |

Cost of revenue | 810 | 1,276 | |

Gross profit | 2,008 | 1,488 | |

Operating expense | |||

Selling, general and administrative | 5,686 | 4,209 | |

Research and development | 6,398 | 5,487 | |

Total operating expense | 12,084 | 9,696 | |

Loss from operations | (10,076) | (8,208) | |

Other income, net | 44 | — | |

Net loss before income taxes | (10,032) | (8,208) | |

Income tax expense | — | (1) | |

Net loss | $ (10,032) | $ (8,209) | |

Net loss per share: | |||

Basic and diluted | $ (0.43) | $ (0.35) | |

Shares used in calculating net loss per share: | |||

Basic and diluted | 23,436 | 23,353 | |

PFENEX INC. | |||

Consolidated Balance Sheets | |||

March 31, | December 31, | ||

(in thousands) | |||

Assets | |||

Current assets | |||

Cash and cash equivalents | $ 70,197 | $ 81,501 | |

Restricted cash | 200 | — | |

Accounts and unbilled receivables, net | 1,358 | 2,822 | |

Income tax receivable | 717 | 717 | |

Other current assets | 1,766 | 1,878 | |

Total current assets | 74,238 | 86,918 | |

Property and equipment, net | 5,496 | 5,246 | |

Other long term assets | 80 | 80 | |

Intangible assets, net | 5,169 | 5,301 | |

Goodwill | 5,577 | 5,577 | |

Total assets | $ 90,560 | $ 103,122 | |

Liabilities and Stockholders' Equity | |||

Current liabilities | |||

Accounts payable | $ 1,184 | $ 1,284 | |

Accrued liabilities | 7,635 | 9,412 | |

Current portion of deferred revenue | 5,966 | 6,516 | |

Total current liabilities | 14,785 | 17,212 | |

Deferred revenue, less current portion | 4,632 | 5,739 | |

Other long-term liabilities | 24 | 26 | |

Total liabilities | 19,441 | 22,977 | |

Stockholders' equity | |||

Preferred stock, $0.001 par value, 10,000,000 shares authorized; no shares issued and outstanding | — | — | |

Common stock, $0.001 par value, 200,000,000 shares authorized; 23,443,352 and 23,429,501 shares issued and outstanding at March 31, 2017 and December 31, 2016, respectively | 24 | 24 | |

Additional paid-in capital | 217,150 | 216,144 | |

Accumulated deficit | (146,055) | (136,023) | |

Total stockholders' equity | 71,119 | 80,145 | |

Total liabilities and stockholders' equity | $ 90,560 | $ 103,122 | |

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/pfenex-reports-first-quarter-2017-results-and-provides-business-update-300453374.html

SOURCE Pfenex Inc.

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu Pfenex Incmehr Nachrichten

| Keine Nachrichten verfügbar. |