|

10.02.2021 17:35:00

|

MedinCell Announces a Capital Increase of a c.€30 Million

Regulatory News:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210210005732/en/

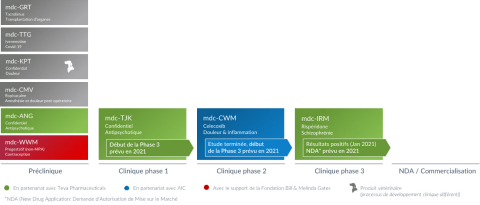

Portefeuille au 31 janvier 2021 (Graphic: Business Wire)

This press release is not intended for publication or distribution in the United States, Canada, Japan or Australia.

MedinCell (FR0004065605 - MEDCL) (Paris:MEDCL), a clinical stage pharmaceutical company developing a portfolio of long-acting injectable products in various therapeutic areas (the "Company”), announces today a capital increase of €c.30 million through an offering to qualified investors, both French and international, by way of an accelerated bookbuilding process (the "Offering”).

Bryan, Garnier & Co Limited1 and ODDO BHF SCA are acting as Joint Global Coordinators and Joint Bookrunners.

Reasons for the Offering

"We have been in the spotlight recently because of the very successful Phase 3 trial of the first product based on our BEPO® technology in schizophrenia. This is a major event because we are getting close to the commercialization but also because all the long-acting injectable products in our portfolio are based on the same technology”, stated Christophe Douat, CEO of MedinCell. "We continue its roll-out into many therapeutic areas. We already have two other Phase 3 launches scheduled for 2021 and several other programs should soon progress to clinical phase.”

The proceeds from this issue are to provide the Company with additional resources in order to:

- fund formulation and R&D activities along with pre-clinical and clinical trials for several of the Company’s programmes in various therapeutic areas such as organ transplantation, pain treatment, prevention (prophylaxis) of Covid-19 and its variants, and animal health;

- accelerate development of its technological platform in other applications; and

- fund the Company’s general corporate purposes.

Terms of the Offering

The gross proceeds of the Offering should be of c.€30 million.

Under the Offering, the preferential subscription rights of the Company’s existing shareholders will be cancelled, on the basis of Articles L. 22-10-52 and R. 22-10-32 of the French Commercial Code (previously article L. 225-136 of the French Commercial Code), and shares will be exclusively offered to qualified investors as defined by Article L. 411-2(1) of the French Monetary and Financial Code in accordance with the 22nd resolution approved in the Company’s combined general meeting of 10 September 2020 and with decisions taken today by the Supervisory Board and the Management Board during those meetings.

The number of shares to be issued through the Offering, with a par value of €0.01 each, will in any case be limited to c.10% of the number of the Company’s shares currently admitted to trading on the regulated market of Euronext Paris.

The issue price will be at least equal to the volume-weighted average share price of the last 3 stock market trading sessions before it is set, possibly with a discount of up to 10% in accordance with the current applicable regulation. The final number of new shares thus issued will be decided by the Company’s Management Board, under the delegation of authority granted by the Company’s Supervisory Board as of the date of this press release and subject to the limits thereof.

The accelerated bookbuilding process will begin immediately and should close as early as possible on 10 February 2021 subject to any extensions. The Company will announce the results of the Offering, the resulting dilution and the new ownership structure as soon as possible after the order book closes, through a press release.

The Offering is open to qualified investors as defined by Article L. 411-2(1) of the French Monetary and Financial Code, in France and outside France, except in the United States under Regulation S of the Securities Act.

The new shares will rank for dividends immediately and will be admitted to trading on the regulated market of Euronext Paris under the same ISIN code FR0004065605 - MEDCL.

Settlement of the new shares issued as part of the Offering and their admission to trading on the regulated market of Euronext Paris are expected to take place on 15 February 2021.

Lock-up commitment

MedinCell will sign a lock-up commitment lasting for 90 days after the Offering settlement date, subject to usual exceptions.

MedinCell has today notified shareholders that are parties to the shareholders’ agreement of 13 July 2018 (the "Agreement”),who hold 55% of the Company’s share capital, that the co-ordinated disposal procedure provided for by the Agreement will be suspended for a maximum period of 30 days.

Placement

The Offering is not underwritten. However, the Offering is subject to a placement agreement between the Company, Bryan, Garnier & Co Limited2 and ODDO BHF SCA acting as Joint Global Coordinators and Joint Bookrunners with respect to the Offering.

The placement agreement may be terminated by the Joint Global Coordinators and Joint Bookrunners at any time up to (and including) the settlement date of the Offering, scheduled to be 15 February 2021, subject to certain conditions.

Where the placement agreement is terminated in accordance with its terms, all investor orders placed as part of the Offering will be null and void.

Risk factors

The public’s attention is drawn to the risk factors concerning the Company and its business, detailed in its universal registration document registered with the AMF under number R.20-015 on 28 July 2020, available free of charge on the Company’s website (https://invest.medincell.com/fr/). The occurrence of some or all of these risk events may have an adverse impact on the Company’s activities, financial position, results, development or outlook. The risk factors presented in that universal registration document are identical to those at the time of this press release.

In addition, investors are invited to take into account the following risks specific to the issue: (i) the market price of the Company’s shares may fluctuate and may fall below the subscription price of the shares issued, (ii) the volatility and liquidity of the Company’s shares may fluctuate significantly, (iii) disposals of the Company’s shares may take place in the market and may have an adverse impact on the Company’s share price, and (iv) the Company’s shareholders may see potentially significant dilution as a result of any future capital increases that may become necessary to finance the Company.

Prospectus

Applying the provisions of article L. 411-2(1) of the French Monetary and Financial Code, the Offering will not imply a prospectus requiring the AMF’s approval.

About Medincell

MedinCell is a clinical stage pharmaceutical company that develops a portfolio of long-acting injectable products in various therapeutic areas by combining its proprietary BEPO® technology with active ingredients already known and marketed. Through the controlled and extended release of the active pharmaceutical ingredient, MedinCell makes medical treatments more efficient, particularly thanks to improved compliance, i.e. compliance with medical prescriptions, and to a significant reduction in the quantity of medication required as part of a one-off or chronic treatment. The BEPO® technology makes it possible to control and guarantee the regular delivery of a drug at the optimal therapeutic dose for several days, weeks or months starting from the subcutaneous or local injection of a simple deposit of a few millimeters, fully bioresorbable. Based in Montpellier, MedinCell currently employs more than 130 people representing over 25 different nationalities.

Disclaimer

This press release contains forward-looking statements that relate to the Company’s objectives. While the Company considers such forward-looking statements to be reasonable, such forward-looking statements are based solely on the current expectations and assumptions of the Company’s management and involve risk and uncertainties, which may result in different outcomes than those contained in the forward-looking statements.

This press release and the information contained herein are only for information purposes and do not constitute an offer to sell or subscribe to, or a solicitation of an offer to buy or subscribe to, shares in the Company in any country, including France.

The distribution of this press release may be subject to legal or regulatory restrictions in certain jurisdictions. Any person who comes into possession of this press release must inform him or herself of and comply with any such restrictions, and as the case may be, to abide by such restrictions. This press release does not, and will not, constitute an offer nor an invitation to solicit the interest of public in France.

This announcement is an advertisement and not a prospectus within the meaning of regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 (the "Prospectus Regulation”).

In France, the offering of the Company’s securities as described above will be carried exclusively through an offer to the benefit of qualified investors, as defined in Article 2(1)(e) of the Prospectus Regulation and in accordance with article L. 411-2(1) of the French Monetary and Financial code (code monétaire et financier) and applicable regulatory provisions. No prospectus will require to be approved or subject to approval from the AMF (Autorité des Marchés Financiers).

With respect to Member States of the European Economic Area other than France (the "Member States”), no action has been taken or will be taken to permit a public offering of the securities referred to in this press release requiring the publication of a prospectus in any Member State. Therefore, such securities may not be and shall not be offered in any Member State (other than France) other than in accordance with the exemptions of Article 1(4) of the Prospectus Regulation or, otherwise, in cases not requiring the publication by MedinCell of a prospectus under Article 3 of the Prospectus Regulation and/or the applicable regulations in such Member State.

In the United Kingdom, this press release has been prepared on the basis that any offering of the Company’s securities in the United Kingdom will benefit from an exemption under Regulation (EU) 2017/1129, which is part of UK law under the European Union (Withdrawal) Act 2018 (the "UK Prospectus Regulation”), regarding the obligation to publish a prospectus for offerings of the Company’s securities. This press release is not a prospectus within the meaning of the UK Prospectus Regulation.

This press release and the information it contains are being distributed to and are only intended for persons who are (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "Order”), (ii) high net worth entities and other such persons falling within Article 49(2)(a) to (d) of the Order ("high net worth companies”, "unincorporated associations”, etc.) or (iii) other persons to whom an invitation or inducement to participate in investment activity (within the meaning of Section 21 of the Financial Services and Market Act 2000) may otherwise lawfully be communicated or caused to be communicated (all such persons in (i), (ii) and (iii) together being referred to as "Relevant Persons”).

This press release is only being distributed to Relevant Persons and any person who is not a Relevant Person should not act or rely on this press release or any of its contents. Any invitation, offer or agreement to subscribe, purchase or otherwise acquire securities to which this press release relates will only be engaged with Relevant Persons.

This press release and the information it contains are not intended to be distributed, directly or indirectly, in the United States of America and do not, and will not constitute an offer to subscribe for or sell, nor the solicitation of an offer to subscribe for or buy, securities of MedinCell in the United States of America. Securities may not be offered or sold in the United States of America absent from registration or an exemption from registration under the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act”), it being specified that the securities of MedinCell have not been and will not be registered within the U.S. Securities Act. MedinCell does not intend to register securities or conduct a public offering in the United States of America.

This press release may not be published, forwarded or distributed, directly or indirectly, in the United States of America, Canada, Japan or Australia. The information contained in this document does not constitute an offer of securities for sale in the United States of America, Canada, Japan or Australia.

1 Acting through Bryan Garnier Securities SAS.

2

Acting through Bryan Garnier Securities SAS.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210210005732/en/

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu Medincell SA Reg Smehr Nachrichten

| Keine Nachrichten verfügbar. |