|

30.12.2020 23:09:00

|

US Housing Market & Softwood Lumber Prices 2020 - Madison's Lumber Reporter

VANCOUVER, BC, Dec. 30, 2020 /CNW/ - A consistent bright point in the confusing US economy for 2020 has been real estate and the housing market. As February US housing starts and home sales data came out, it became clear that home building and buying activity was headed for quite an upswing. While the economic effects of the response to the global pandemic unfolded in the spring, by summer the buying and selling of real estate in the US really took off. Due to this, new housing construction responded likewise upward. Naturally, due to high demand, home sales and prices also bounced up markedly.

A report from the Federal Reserve Bank of New York released this week found that the median household expects to increase their spending by +3.7% in the next twelve months, the most optimistic outlook since 2016. The median listing prices grew at +13% over last year, marking the 18th consecutive week of double-digit price growth.

Unseasonably strong softwood lumber sales persisted in the last full sales week of 2020, as prices on virtually every commodity advanced again. For the week ending December 18, 2020the price of benchmark softwood lumber commodity item Western S-P-F KD 2x4 #2&Btr rose another +$130, or +17%, over the previous week to US$874 mfbm, said Madison's Lumber Reporter. That week's price is +$278, or +47%, more than it was one month ago.

The USA purchases approximately 65% of Canada's dimension lumber production mostly for home construction framing, while Canadian buyers account for about 10%, and those in Japan take 6%.

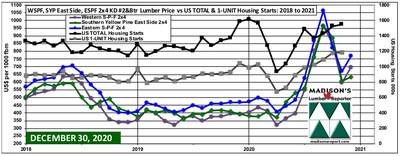

US Housing Starts & Benchmark Softwood Lumber Prices: 2018 - 2020

* Madison's Lumber Prices, weekly, are a good forecast indicator of US home builder's current lumber buying activity ——> DETAILS

December 28, 2020 "Housing demand is strong entering 2021, however, the coming year will see housing affordability challenges as inventory remain low and construction costs are rising. Policymakers should take avoid increasing regulatory costs associated with land development and residential construction." — US National Association of Home Builders Chair Chuck Fowke

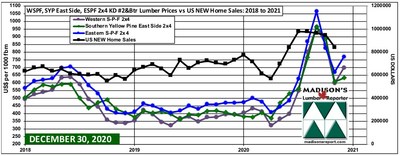

US New Home Sales & Benchmark Softwood Lumber Prices: 2018 - 2020

Sales of new single-family houses in November 2020 were at a seasonally adjusted annual rate of 841,000, according to estimates released jointly Tuesday by the US Census Bureau and the Department of Housing and Urban Development. This is +11% below the revised October rate of 945,000 but is +21% above the November 2019 estimate of 696,000. The seasonally-adjusted estimate of new houses for sale at the end of November was 286,000. This represents a supply of 4.1 months at the current sales rate. The median sales price of new houses sold in November 2020 was US$335,300.

"US buyers of Western S-P-F softwood lumber commodities continued to scramble to find limited material. Even as business slowed down across much of the continent with the approach of the holiday break, demand was unseasonably strong due to a persistent lack of supply and depleted inventories. Producers of Western S-P-F lumber in Canada, meanwhile, raised prices of bread and butter items by another +$90 to +$162. Sales activity only intensified as Canadian buyers cleaned out every stick of lumber before any cash wood could hit the starved US market." — Madison's Lumber Reporter

Benchmark Dimension Softwood Lumber and Panel Wholesaler Prices: December 2020

In order to be in a good position for tax reporting, sawmills want to empty their yards of manufactured wood products before year-end. Also they want to have their log yards stacked as full as possible. Because demand has been so consistently strong, which is very unusual for December, lumber suppliers have been quoting wood sales into January 2021. This with the accompanying increase in prices, of course. Customers, while reluctant, can do nothing but accept the higher price lists because none have been stocking inventory and there continues to be rush of real building projects to serve.

The below table is a comparison of recent highs, in June 2018, and current December 2020 benchmark dimension softwood lumber 2x4 prices compared to historical highs of 2004/05 and compared to recent lows of Sept 2015:

2x4 Dimension Lumber Prices: Current Compared to Recent and Historical Highs, and to Recent Lows | |||||||||||

2014 | to | 2020 | madisonsreport.com | ||||||||

US$ per thousand board feet | Current: | Recent | % | All Time High | % Change: | Previous | % | ||||

SYP East Side KD #2&Btr | $ | 680 | $ | 550 | 23.6% | 3Q2005 | $ 460 | 47.8% | $ | 311 | 118.6% |

WSPF KD #2&Btr | $ | 874 | $ | 622 | 40.5% | 2Q2004 | $ 443 | 97.3% | $ | 249 | 251.0% |

ESPF KD #2&Btr | $ | 920 | $ | 690 | 33.3% | 2Q 2004 | $ 529 | 73.9% | $ | 350 | 162.9% |

Douglas fir Green | $ | 700 | $ | 590 | 18.6% | 2Q 2004 | $ 500 | 40.0% | $ | 302 | 131.8% |

WSPF 2x4 STUDS (PET) | $ | 666 | $ | 445 | 49.7% | 2Q 2005 | $ 445 | 49.7% | $ | 230 | 189.6% |

STAY AHEAD of US housing price data by getting access to softwood lumber prices. Released every Friday for that week, since 1952 Madison's Lumber Prices is used by the forest products industry as a price guide for North American construction framing dimension softwood lumber. These are, of course, the inputs into US and Canadian home building materials.

Shrewd investors know that construction framing softwood lumber prices are a good leading indicator for US housing activity, including home building and home sales. Don't miss out, get lumber price data updates directly to your desktop every Friday morning:

To subscribe, simply fill out an order form here: https://madisonsreport.com/subscribe/

Established in 1952, Madison's Lumber Prices is your premiere source for North American softwood lumber news, prices, industry insight, and industry contacts. The weekly Madison's Lumber Reporter publishes current Canadian and US construction framing dimension lumber and panel wholesaler pricing information 50 weeks a year and access to historical pricing as well.

Madison's offers a variety of products to meet your information needs regarding the North American forest products industry including:

Madison's Lumber Prices: https://madisonsreport.com/products/madisons-reporter/

Madison's Heating Wood Pellet Prices: https://madisonsreport.com/products/madisons-north-american-heating-wood-pellet-price-report/

Madison's British Columbia Coast Log Prices: https://madisonsreport.com/bc-coastal-log-prices/

Madison's Forest Pulse: https://madisonsreport.com/products/forest-pulse/

Madison's Canadian Sawmill Listings: https://madisonsreport.com/products/madisons-directory/

SOURCE Madison's Lumber Reporter

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!