|

08.11.2017 13:00:00

|

Tinka more than doubles inferred mineral resources at Ayawilca: 42.7 million tonnes grading 7.3 % zinc equiv., & 10.5 million tonnes grading 0.70 % tin equiv.

VANCOUVER, Nov. 8, 2017 /CNW/ - Tinka Resources Limited ("Tinka" or the "Company") (TSXV & BVL: TK) (OTCPK: TKRFF) is pleased to announce a Mineral Resource update for its 100%-owned Ayawilca zinc- indium-silver-lead sulphide deposit in Peru which includes the addition of ~15,000 metres of drilling completed so far in 2017. The zinc resource at Ayawilca is now estimated to be 42.7 million tonnes grading 7.3 % zinc equivalent (ZnEq). In addition, Tinka announces an updated tin-copper-silver resource estimated to be 10.5 million tonnes grading 0.70% tin equivalent (SnEq). The Tin Zone and Zinc Zone resources do not overlap. Both of the Mineral Resources were assigned to the Inferred category and reported at an NSR cut-off value of US$55/tonne, as estimated by Roscoe Postle Associates Inc. (RPA Inc.) of Toronto, Canada. Drilling beyond the Mineral Resource boundaries is continuing.

Key Highlights of Resource Updates

- Inferred Zinc Mineral Resource of 42.7 million tonnes grading 6.0 % zinc, 0.2 % lead, 17 g/t silver & 79 g/t indium (7.3 % ZnEq), including:

- 5.6 billion pounds of zinc;

- 3.4 tonnes of indium;

- 23.1 million ounces of silver; and

- 209 million pounds of lead.

- Inferred Tin Mineral Resource of 10.5 million tonnes grading 0.63 % tin, 0.23 % copper, & 12 g/t silver (0.70 % SnEq), including:

- 145 million pounds of tin;

- 53 million pounds of copper; and

- 4.2 million ounces of silver.

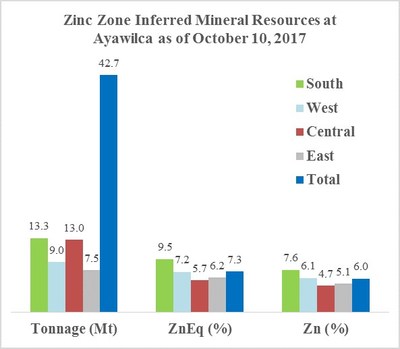

Dr. Graham Carman, Tinka's President and CEO, stated: "These updated Mineral Resource estimates are a major milestone for the Company. Ayawilca now has 5.6 billion pounds of contained zinc classified as Inferred resources, with significant potential for more as the resources are open in several directions. The updated Zinc mineral resource shows a 130 % increase in total contained pounds of zinc since the last resource estimate (May 2016), and a 127 % increase in overall tonnage (from 18.8 Mt to 42.7 Mt). The zinc grade has gone up slightly to 6.0 % Zn (from 5.9 % Zn) while the zinc equivalent grade has decreased to 7.3 % ZnEq (from 8.2 % ZnEq) due to a higher zinc price and a lower indium price. Importantly, South Ayawilca now forms a high-grade core with 13.3 million tonnes grading 7.6 % Zn (9.5 % ZnEq) – see Table 3. In addition, the Tin Mineral Resource has increased by 60 % since the last resource estimate (May 2016) to now include 145 million pounds of contained tin."

"I am very pleased to report that Tinka has exceeded its two initial objectives for the year; firstly, an additional high-grade zinc discovery was made at South Ayawilca; secondly, we doubled the contained pounds of zinc in the resources. Furthermore, Tinka is continuing to aggressively drill outside of the resource areas looking for new zinc discoveries and/or extensions of known mineralization - one rig is currently drilling at Zone 3, while the second rig is testing the extensions of West Ayawilca."

Table 1 – Ayawilca Deposit Inferred Mineral Resources – Zinc Zone (Base Case Highlighted) | ||||||

NSR $/t Cut-off | Tonnage (Mt) | ZnEq% Grade | Zinc % | Lead % | Indium g/t | Silver g/t |

40 | 47.2 | 6.9 | 5.6 | 0.2 | 74 | 16 |

50 | 44.6 | 7.1 | 5.8 | 0.2 | 77 | 17 |

55 | 42.7 | 7.3 | 6.0 | 0.2 | 79 | 17 |

60 | 40.1 | 7.5 | 6.1 | 0.2 | 82 | 17 |

70 | 33.8 | 8.1 | 6.6 | 0.2 | 92 | 18 |

See Table 3 for notes. |

Table 2 – Ayawilca Deposit Inferred Mineral Resources – Tin Zone (Base Case Highlighted) | |||||

NSR $/t Cut-off | Tonnage (Mt) | SnEq% Grade | Tin % | Copper % | Silver g/t |

40 | 10.9 | 0.68 | 0.61 | 0.23 | 12 |

50 | 10.7 | 0.70 | 0.62 | 0.23 | 12 |

55 | 10.5 | 0.70 | 0.63 | 0.23 | 12 |

60 | 9.9 | 0.72 | 0.64 | 0.24 | 13 |

70 | 8.3 | 0.78 | 0.70 | 0.24 | 13 |

See Table 4 for notes. |

Detail of Mineral Resource Estimates

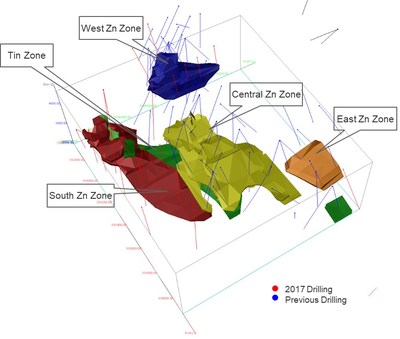

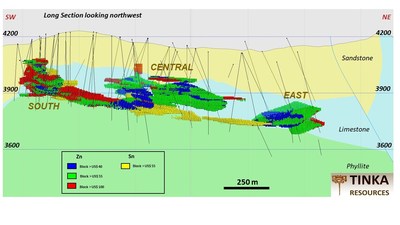

RPA updated the Ayawilca Mineral Resource estimate using the drill results available to October 10, 2017 (Tables 3 and 4). Two types of mineralization occur at Ayawilca, tin-copper mineralization ("Tin Zone") and the zinc-indium-silver-lead mineralization ("Zinc Zone").

The Zinc Zone Mineral Resources are hosted by Triassic Pucará Group limestone approximately 200 metres thick and located beneath the Goyllarisguizga Group sandstone unit which outcrops, and hosts the Colquipucro silver oxide deposit located 1.5 km to the north. The Zinc Zone deposit is made up of multiple, gently dipping lenses or 'mantos' in the Central and East Ayawilca zones and as massive replacement bodies within structural zones in the West and South Ayawilca zones, all located above Paleozoic basement rocks. The bulk of the polymetallic mineralization in central Peru is located in a similar geological environment. Inferred Mineral Resources within the Zinc Zone, reported at a US$55/t Net Smelter Return (NSR) cut-off value, are estimated to total 42.7 million tonnes at average grades of 6.0 % Zn, 79 g/t In, 17 g/t Ag, and 0.2 % Pb.

The increase in tonnage and zinc grade as compared to the May 2016 Mineral Resource estimate is due to an increase in volume of the interpreted mineralized zones as a result of the addition of the high-grade South Zone discovered during the 2017 drilling campaign, higher metal prices, and lower cut-off value.

Table 3 – Zinc Zone Inferred Mineral Resources at Ayawilca as of October 10, 2017 | ||||||||||

Zone | Tonnage | ZnEq | Zn | Pb | In | Ag | Zn | Pb | In | Ag |

West | 9.0 | 7.2 | 6.1 | 0.2 | 64 | 14 | 1,206 | 37 | 577 | 4.0 |

Central | 13.0 | 5.7 | 4.7 | 0.3 | 54 | 13 | 1,338 | 77 | 704 | 5.4 |

East | 7.5 | 6.2 | 5.1 | 0.2 | 69 | 13 | 846 | 34 | 519 | 3.1 |

South | 13.3 | 9.5 | 7.6 | 0.2 | 118 | 25 | 2,228 | 61 | 1,561 | 10.6 |

Total | 42.7 | 7.3 | 6.0 | 0.2 | 79 | 17 | 5,617 | 209 | 3,361 | 23.1 |

Notes: | |

1. | CIM definitions were followed for Mineral Resources. |

2. | Mineral Resources are reported above a cut-off NSR value of US$55 per tonne. |

3. | The NSR value was based on estimated metallurgical recoveries, assumed metal prices and smelter terms, which include payable factors, treatment charges, penalties, and refining charges. Metal price assumptions were: US$1.15/lb Zn, US$300/kg In, US$18/oz Ag, and US$1.10/lb Pb. Metal recovery assumptions were: 90% Zn, 75% In, 60% Ag, and 75% Pb. The NSR value for each block was calculated using the following NSR factors: US$15.34 per % Zn, US$6.15 per % Pb, US$0.18 per gram In, and US$0.27 per gram Ag. |

4. | The NSR value was calculated using the following formula: |

5. | The ZnEq value was calculated using the following formula: ZnEq = NSR/US$15.34 |

6. | Numbers may not add due to rounding. |

The Tin Zone Mineral Resources are hosted as disseminated cassiterite and chalcopyrite in massive to semi-massive pyrrhotite lenses at the contact between the Pucará Group and underlying phyllite of the Devonian Excelsior Group. Parts of the Tin Zone mineralization can occur as quartz sulphide stockwork veinlets hosted by the phyllite. Inferred Mineral Resources within the Tin Zone, also reported at an NSR cut-off value of US$55/t, are estimated to total 10.5 million tonnes at average grades of 0.63 % Sn, 0.23 % Cu and 12 g/t Ag. Similar to the Zinc Zones, the increase in tonnage is due to an increased volume of the interpreted zones due to the newly discovered South Zone and a lower cut-off grade.

Table 4 – Tin Zone Inferred Mineral Resources at Ayawilca as of October 10, 2017 | ||||||||

Tonnage | Sn Eq. (%) | Sn (%) | Cu (%) | Ag | Sn (Mlb) | Cu (Mlb) | Ag (Moz) | |

Tin Zones | 10.5 | 0.70 | 0.63 | 0.23 | 12 | 145 | 53 | 4.2 |

Notes: | |

1. | CIM definitions were followed for Mineral Resources. |

2. | Mineral Resources are reported above a cut-off grade of US$55 per tonne NSR value. |

3. | The NSR grade was based on estimated metallurgical recoveries, assumed metal prices and smelter terms, which include payable factors, treatment charges, penalties, and refining charges. Metal price assumptions were: US$9.50/lb Sn, US$3/lb Cu, and US$18/oz Ag. Metal recovery assumptions were: 86% Sn, 75% Cu, and 60% Ag. The NSR value for each block was calculated using the following NSR factors: US$164.53 per % Sn, US$39.95 per % Cu, and US$0.27 per gram Ag. |

4. | The NSR value was calculated using the following formula: |

5. | The SnEq value was calculated using the following formula: |

6. | Numbers may not add due to rounding. |

The Ayawilca drill database includes 44,846 m in 122 drill holes. A set of cross-sections and level plans were interpreted to construct three-dimensional wireframe models at approximate NSR cut-off value of $50/t for both Zinc and Tin Zones. Prior to compositing to two metre lengths, high Zn, Sn, In, and Ag values were cut to 25%, 4%, 500 g/t, and 100 g/t, respectively. Block model grades within the wireframe models were interpolated by inverse distance cubed. Despite lead grades being low it is assumed that lead and silver will be recovered in a lead concentrate. Density was estimated to be 3.6 t/m3 for the Zinc Zones and 3.9 t/m3 for the Tin Zones. All Mineral Resources were assigned to the Inferred category due to the widely spaced drilling. No Mineral Reserves have yet been estimated at Ayawilca.

The Mineral Resource estimate for the Colquipucro silver oxide deposit (Indicated Mineral Resource of 7.4 Mt at a grade of 60 g/t Ag for 14.3 Moz Ag and Inferred Mineral Resource of 8.5 Mt at a grade of 48 g/t Ag for 13.2 Moz Ag, using US$15/t cut-off and a metal price of $24/oz Ag) remains unchanged from the February 26, 2015 news release.

The Mineral Resource estimates in this news release have been classified in accordance with Canadian Institute of Mining Metallurgy and Petroleum's " CIM Definition Standards - For Mineral Resources and Mineral Reserves " 2014

Qualified Person – Mineral Resources: The Mineral Resources disclosed in this press release have been estimated by Mr. David Ross, P.Geo., an employee of RPA and independent of Tinka. By virtue of his education and relevant experience, Mr. Ross is a "Qualified Person" for the purpose of National Instrument 43-101. The Mineral Resources have been classified in accordance with CIM Definition Standards for Mineral Resources and Mineral Reserves (May, 2014). Mr. Ross, P.Geo. has read and approved the contents of this press release as it pertains to the disclosed Mineral Resource estimates.

A National Instrument 43-101 Technical Report will be filed on SEDAR within 45 days.

The qualified person, Dr. Graham Carman, Tinka's President and CEO, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed and verified the technical contents of this release.

On behalf of the Board,

"Graham Carman"

Dr. Graham Carman, President & CEO

About Tinka Resources Limited

Tinka is an exploration and development company with its flagship property being the 100%-owned Ayawilca carbonate replacement deposit (CRD) in the zinc-lead-silver belt of central Peru, 200 kilometres northeast of Lima. The Ayawilca Zinc Zone Inferred Mineral Resource estimate now consists of 42.7 Mt at 6.0 % zinc, 0.2 % lead, 17 g/t silver & 79 g/t indium, and a Tin Zone Inferred Mineral Resource of 10.5 Mt at 0.63 % tin, 0.23 % copper & 12 g/t silver (this release). Drilling for resource extensions and the testing of new targets is ongoing.

Forward Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively "forward-looking statements"). All statements, other than statements of historical fact are forward-looking statements. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka's management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations, drilling results, the Company's expectations regarding mineral resource calculations, capital and other costs varying significantly from estimates, production rates varying from estimates, changes in world metal markets, changes in equity markets, uncertainties relating to the availability and costs of financing needed in the future, equipment failure, unexpected geological conditions, imprecision in resource estimates or metal recoveries, success of future development initiatives, competition, operating performance, environmental and safety risks, delays in obtaining or failure to obtain necessary permits and approvals from local authorities, community agreements and relations, and other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

SOURCE Tinka Resources Limited

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu Teekay Shipping Corp.mehr Nachrichten

| Keine Nachrichten verfügbar. |