|

26.09.2019 12:31:00

|

NGL Energy Partners LP Announces Definitive Agreement to Acquire Hillstone

NGL Energy Partners LP (NYSE: NGL) ("NGL” or the "Partnership”) announced it has executed a definitive agreement to acquire all of the equity interests of Hillstone Environmental Partners, LLC ("Hillstone”) from Golden Gate Capital for approximately $600 million, subject to certain adjustments. Hillstone provides water pipeline and disposal infrastructure solutions to producers with a core operational focus in the state line area of southern Eddy and Lea Counties, New Mexico and northern Loving County, Texas in the Delaware Basin.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190926005405/en/

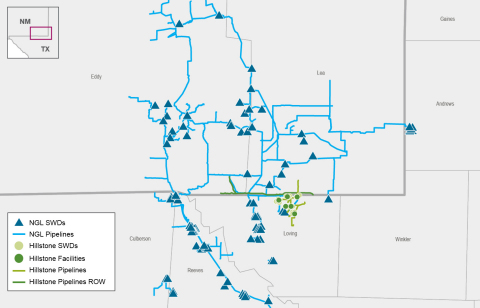

Pro Forma Northern Delaware Basin Asset Map includes existing assets, assets under construction, pipelines and pipeline rights of way. (Photo: Business Wire)

Hillstone has a fully interconnected produced water pipeline transportation and disposal system, which currently consists of 19 salt water disposal wells, representing approximately 580,000 barrels per day of permitted disposal capacity, and a newly-built network of produced water pipelines with approximately 680,000 barrels per day of transportation capacity. Hillstone also has an additional 22 permits to develop another 660,000 barrels per day of disposal capacity. NGL expects to integrate the Hillstone system into its existing Delaware Basin platform to maximize uptime and redundancy for its producer customers.

All of the water volumes on Hillstone’s Northern Delaware Basin system are delivered via multiple, large-diameter pipelines. Hillstone also has an aggregate of over 110,000 acres contracted under long-term dedications with priority disposal rights or minimum volume commitments.

"We have made substantial progress in our ongoing water strategy in the Delaware Basin, and the Hillstone acquisition represents another important milestone for our Water Solutions franchise following the closing of our combination with Mesquite in July,” stated Mike Krimbill, NGL’s CEO. "This transaction is highly complementary to our Delaware Basin asset footprint. It not only adds a redundant, interconnected produced water pipeline system with significant permitted disposal capacity that fits perfectly within our existing footprint, but importantly, it also supports our ongoing strategy of increasing NGL’s cash flow predictability.”

"The integration of the Mesquite assets is fully underway and providing immediate benefit to our customers. The certainty of offtake and reliability of our integrated system of large diameter pipelines will provide approximately 2.7 million barrels per day of operational disposal capacity in the Delaware Basin, including the addition of Hillstone,” stated Doug White, NGL’s Executive Vice President of Water Solutions. "The high-quality Hillstone assets include long-term contracts with investment grade producers. The contracts have an average remaining term of greater than 10 years, minimum volume commitments, and first call priority volume commitments that minimize impacts of timing related to recycle and reuse activities.”

NGL has arranged financing for the transaction including certain preferred equity and debt commitments in an amount necessary to fund the entire purchase price. This transaction, which NGL estimates has been made at an approximately 7x multiple of forecasted run-rate EBITDA once certain contracted volumes are online next year, is expected to be accretive to distributable cash flow per unit in Fiscal 2021, the first full year of ownership.

The transaction remains subject to satisfaction of specified closing conditions, including expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976. NGL expects this transaction to close in 2019.

Barclays is acting as financial advisor to NGL. Barclays and Jefferies have provided a committed debt financing to NGL to support the transaction. Winston & Strawn LLP is acting as legal counsel to NGL on the Hillstone transaction. Hunton Andrews Kurth LLP is serving as legal counsel to NGL on the financing transactions.

Tudor, Pickering, Holt & Co. and Jefferies are acting as financial advisors to Golden Gate Capital and Hillstone. Kirkland & Ellis LLP and Nob Hill Law Group, P.C. are acting as legal counsel to Golden Gate Capital and Hillstone.

Forward-Looking Statements

Certain matters contained in this press release include "forward-looking statements.” All statements, other than statements of historical fact, included in this press release may constitute forward-looking statements. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that these expectations will prove to be correct. These forward-looking statements are subject to certain known and unknown risks and uncertainties, as well as assumptions that could cause actual results to differ materially from those reflected in these forward-looking statements. Factors that might cause actual results to differ include, but are not limited to: the conditions to the completion of the acquisition may not be satisfied or the regulatory approvals required for the acquisition may not be obtained on the terms expected, on the anticipated schedule, or at all; financing may not be available on favorable terms, or at all; closing of the acquisition may not occur or be delayed; the Partnership may be unable to achieve the anticipated benefits of the acquisition (including with respect to contracted volumes); revenues following the acquisition may be lower than expected; the risk factors discussed from time to time in each of our documents and reports filed with the SEC.

Readers are cautioned not to place undue reliance on any forward-looking statements contained in this press release, which reflect management’s opinions only as of the date hereof. Except as required by law, we undertake no obligation to revise or publicly release the results of any revision to any forward-looking statements.

About NGL Energy Partners LP

NGL Energy Partners LP is a Delaware limited partnership. NGL owns and operates a vertically integrated energy business with four primary businesses: Crude Oil Logistics, Water Solutions, Liquids, and Refined Products and Renewables. For further information, visit the Partnership’s website at www.nglenergypartners.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190926005405/en/

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu NGL Energy Partners LP Partnership Unitsmehr Nachrichten

|

11.11.24 |

Ausblick: NGL Energy Partners LP Partnership Units verkündet Quartalsergebnis zum jüngsten Jahresviertel (finanzen.net) | |

|

28.10.24 |

Erste Schätzungen: NGL Energy Partners LP Partnership Units gibt Ergebnis zum abgelaufenen Quartal bekannt (finanzen.net) | |

|

07.08.24 |

Ausblick: NGL Energy Partners LP Partnership Units mit Zahlen zum abgelaufenen Quartal (finanzen.net) |