|

22.06.2020 22:53:00

|

Metalla Acquires Existing Royalty on Coeur's Producing Wharf Mine

TSXV: MTA

NYSE AMERICAN: MTA

Unless otherwise specified, all references to dollars set forth herein shall mean United States (U.S.) dollars.

VANCOUVER, BC, June 22, 2020 /CNW/ - Metalla Royalty & Streaming Ltd. ("Metalla" or the "Company") (TSXV: MTA) (NYSE American: MTA) is pleased to announce it has entered into agreements with Coeur Mining, Inc. ("Coeur") (NYSE: CDE) and third-parties to jointly acquire an existing 1.3875% royalty interest (the "Royalty") on the operating Wharf mine ("Wharf") for total consideration of $8.0 million consisting of $7.0 million in existing Metalla common shares ("Metalla Shares") and Metalla Shares from treasury, and $1.0 million in cash. Metalla and Coeur will retain 1.0% and 0.3875% of the Royalty for total consideration of $5.77 million and $2.23 million, respectively.

Brett Heath, President & CEO of Metalla commented, "We are pleased to add a high-quality producing gold royalty on one of the premier gold mines located in the United States with a proven operator such as Coeur. Wharf has been in production for more than three decades with an established track record of generating free cash flow. This transaction provides shareholders with immediate exposure to cash flow on a strong performing and well-run gold asset on an accretive basis."

Wharf is an open pit, heap leach operation located in the Northern Black Hills of South Dakota acquired by Coeur in February 2015 from Goldcorp Inc. for cash consideration of approximately $99.5 million. The mine has been a consistent free cash flow generating asset for Coeur and consists of several areas of adjoining gold mineralization, which have been mined as a series of open pits. The mine produced 84,172 ounces of gold in 2019(1).

TRANSACTION STRUCTURE

Metalla has agreed to acquire a 1.3875% royalty on the Wharf mine from third-parties for a total purchase price of $8.0 million. In conjunction with this transaction, Metalla has agreed to sell a 0.3875% royalty to Coeur, which will be satisfied through the transfer of 421,554 Metalla Shares currently held by Coeur, representing $2.23 million in value based on a price of $5.30 per Metalla Share (the "Consideration Share Price") to the third-party sellers. Metalla will satisfy the remainder of the consideration for its 1.0% royalty by paying $1.0 million in cash and issuing 899,201 Metalla Shares representing $4.77 million in value based on the Consideration Share Price. As part of the transaction, Coeur has agreed to waive its pre-emptive right with respect to the Royalty, concurrent with the completion of the secondary offering announced on June 22, 2020. The transaction is subject to other customary closing conditions, including obtaining the requisite TSX Venture Exchange and NYSE American approvals, and is expected to close by June 30, 2020.

Mr. Heath continued, "We are also proud to showcase a successful case-study on how our third-party royalty model can generate a significant amount of value from start to finish for our partners and shareholders. In 2017 Metalla acquired a non-core royalty portfolio from Coeur in a share-based transaction at a price of C$2.16(7). We now welcome the third-parties as new shareholders as we continue to build Metalla into a leading precious metals royalty company."

WHARF MINE(1)(2)

Wharf has been in production since 1983. Coeur acquired the asset in 2015 from Goldcorp Inc. (now Newmont Corporation) and subsequently increased plant efficiency and replaced reserves through exploration. During Coeur's ownership, it has generated cumulative free cash flow from Wharf of approximately $175.0 million. Additionally, Wharf has a mine life of approximately seven years.

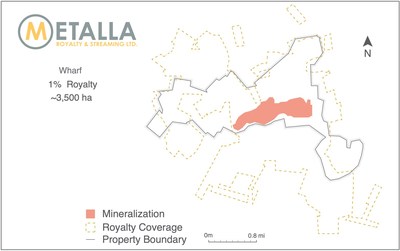

ROYALTY MAP

WHARF RESERVES AND RESOURCES (1)(2)(3)(4)(5)(6)

Reserves & Resources | |||

Short | Gold | ||

(000's) | (Oz/t) | (Koz) | |

Proven Reserves | 23,436 | 0.024 | 571 |

Probable Reserves | 7,530 | 0.026 | 197 |

Proven & Probable Reserves | 30,965 | 0.025 | 768 |

Measured Resources | 6,631 | 0.027 | 178 |

Indicated Resources | 4,926 | 0.032 | 156 |

Measured & Indicated Resources | 11,557 | 0.029 | 334 |

Inferred Resources | 2,483 | 0.033 | 81 |

QUALIFIED PERSON

The technical information contained in this news release has been reviewed and approved by Charles Beaudry, geologist M.Sc., member of the Association of Professional Geoscientists of Ontario and the Ordre des Géologues du Québec and a consultant to Metalla. Mr. Beaudry is a Qualified Person as defined in National Instrument 43-101 Standards of disclosure for mineral projects.

ABOUT METALLA

Metalla was created for the purpose of providing shareholders with leveraged precious metal exposure by acquiring royalties and streams. Our goal is to increase share value by accumulating a diversified portfolio of royalties and streams with attractive returns. Our strong foundation of current and future cash-generating asset base, combined with an experienced team, gives Metalla a path to become one of the leading gold and silver companies for the next commodities cycle.

For further information, please visit our website at www.metallaroyalty.com.

ON BEHALF OF METALLA ROYALTY & STREAMING LTD.

Neither the TSXV nor it's Regulation Services Provider (as that term is defined in the policies of the Exchange) accept responsibility for the adequacy or accuracy of this release.

Notes:

(1) | For details on the estimation of mineral resources and reserves, including the key assumptions, parameters |

(2) | See Coeur news release filed on February 19, 2020 and Coeur news release filed on April 22, 2020. |

(3) | Numbers may not add due to rounding. |

(4) | Mineral resources which are not mineral reserves do not have demonstrated economic viability. |

(5) | Mineral resource are exclusive of mineral reserves. |

(6) | See technical report titled The Technical Report for the Wharf Operation" dated February 7, 2018. |

(7) | See Metalla's condensed consolidated interim financial statements ending August 31, 2017. |

TECHNICAL AND THIRD-PARTY INFORMATION

Except where otherwise stated, the disclosure in this press release relating to Wharf is based on information publicly disclosed by the owners or operators of this property and information/data available in the public domain as at the date hereof and none of this information has been independently verified by Metalla. Specifically, as a royalty holder, Metalla has limited, if any, access to the property subject to the Royalty. Although Metalla does not have any knowledge that such information may not be accurate, there can be no assurance that such third party information is complete or accurate. Some information publicly reported by the operator may relate to a larger property than the area covered by Metalla's Royalty interest. Metalla's royalty interests often cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, mineral resources and production of a property.

The disclosure was prepared in accordance with Canadian National Instrument 43-101 ("NI 43-101"), which differs significantly from the current requirements of the U.S. Securities and Exchange Commission (the "SEC") set out in Industry Guide 7. Accordingly, such disclosure may not be comparable to similar information made public by companies that report in accordance with Industry Guide 7. In particular, this news release may refer to "mineral resources", "measured mineral resources", "indicated mineral resources" or "inferred mineral resources". While these categories of mineralization are recognized and required by Canadian securities laws, they are not recognized by Industry Guide 7 and are not normally permitted to be disclosed in SEC filings by U.S. companies that are subject to Industry Guide 7. U.S. investors are cautioned not to assume that any part of a "mineral resource", "measured mineral resource", "indicated mineral resource", or "inferred mineral resource" will ever be converted into a "reserve." In addition, "reserves" reported by the Company under Canadian standards may not qualify as reserves under Industry Guide 7. Under Industry Guide 7, mineralization may not be classified as a "reserve" unless the mineralization can be economically and legally extracted or produced at the time the "reserve" determination is made. Accordingly, information contained or referenced in this news release containing descriptions of mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of Industry Guide 7.

"Inferred mineral resources" have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Further, while NI 43-101 permits companies to disclose economic projections contained in preliminary economic assessments and pre-feasibility studies, which are not based on "reserves", U.S. companies have not generally been permitted under Industry Guide 7 to disclose economic projections for a mineral property in their SEC filings prior to the establishment of "reserves". Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian reporting standards; however, Industry Guide 7 normally only permits issuers to report mineralization that does not constitute "reserves" by Industry Guide 7 standards as in-place tonnage and grade without reference to unit measures. Historical results or feasibility models presented herein are not guarantees or expectations of future performance.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements and information include, but are not limited to, statements with respect to the closing of the proposed transactions, stock exchange acceptance, waiver of Coeur's pre-emptive right and completion of a secondary offering, continuance of commercial production and payments related thereto at Wharf, future development, production, recoveries, cash flow and other anticipated or possible future developments at Wharf and the properties on which the Company currently holds royalty and stream interests or relating to the companies owning or operating such properties; and current and potential future estimates of mineral reserves and resources. Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties, and contingencies. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Metalla to control or predict, that may cause Metalla's actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: the risk that the parties may be unable to satisfy the closing conditions for the contemplated transactions or that the transactions may not be completed; risks associated with the impact of general business and economic conditions; the absence of control over mining operations from which Metalla will purchase precious metals or from which it will receive stream or royalty payments and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; regulatory, political or economic developments in any of the countries where properties in which Metalla holds a royalty, stream or other interest are located or through which they are held; risks related to the operators of the properties in which Metalla holds a royalty or stream or other interest, including changes in the ownership and control of such operators; risks related to global pandemics, including the novel coronavirus (COVID-19) global health pandemic, and the spread of other viruses or pathogens; influence of macroeconomic developments; business opportunities that become available to, or are pursued by Metalla; reduced access to debt and equity capital; litigation; title, permit or license disputes related to interests on any of the properties in which Metalla holds a royalty, stream or other interest; the volatility of the stock market; competition; future sales or issuances of debt or equity securities; use of proceeds; dividend policy and future payment of dividends; liquidity; market for securities; enforcement of civil judgments; and risks relating to Metalla potentially being a passive foreign investment company within the meaning of U.S. federal tax laws; and the other risks and uncertainties disclosed under the heading "Risk Factors" in the Company's most recent annual information form, annual report on Form 40-F and other documents filed with or submitted to the Canadian securities regulatory authorities on the SEDAR website at www.sedar.com and the U.S. Securities and Exchange Commission on the EDGAR website at www.sec.gov. Metalla undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management's best judgment based on information currently available. No forward-looking statement can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

SOURCE Metalla Royalty and Streaming Ltd.

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!