|

20.11.2017 17:00:00

|

LendingTree Releases Monthly Mortgage Offer Report for October

CHARLOTTE, N.C., Nov. 20, 2017 /PRNewswire/ -- LendingTree®, the nation's leading online loan marketplace, today released its first monthly Mortgage Offers Report which analyzes data from actual loan terms offered to borrowers on LendingTree.com by lenders on LendingTree's network. The purpose of the report is to empower consumers by providing additional information on how their credit profile affects their loan prospects.

- October's best loan offers for borrowers with the best profiles had an average APR of 3.75% for purchase and 3.70% for refinance, on conforming 30-year loans. Mortgage rates vary dependent upon parameters including credit score, loan-to-value, income and property type.

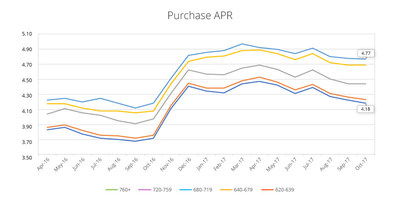

- For the average borrower, purchase APRs for conforming 30-yr fixed loans offered on LendingTree's platform were down 3 bps month over month, to 4.31%, the lowest since November 2016. In contrast, the loan note rate of 4.18% was up 7 bps to the highest since July. The report references APR as opposed to interest rate, as lenders often make changes to other fees in response to the interest rate environment.

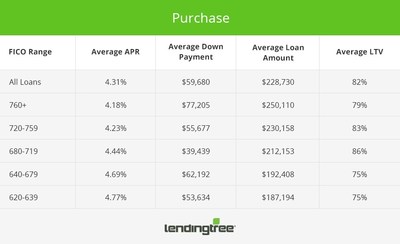

- Consumers with the highest credit scores (760+) saw an average APR offer of 4.18% vs 4.44% for consumers with scores of 680-719. The APR spread of 22 bps between these score ranges was 1 bps lower than in September. The spread represents nearly $12,600 in additional costs for borrowers with lower credit scores over 30-years for the average purchase loan amount of $228,730. Additional costs are due to higher interest rates, larger fees or a combination of the two.

- Refinance APRs for conforming 30-yr fixed loans were up 10 bps to 4.26%. The credit score bracket spread widened to 16bps from 15 bps, nearly $7,500 in extra costs over the life of the loan for lower credit score borrowers given an average refinance loan of $235,844.

- The average proposed down payment for purchase mortgages have been rising for 7 months and reached $59,680 in October.

- Average monthly payments were little changed at just over $1,100 for both purchase and refinance. The credit score bucket spread was $241 for purchase and just $77 for refinance.

*Some borrowers make a down payment when refinancing to bring their LTV to a targeted value.

"Our report illustrates the impact a credit score can have on a borrower in very tangible terms," said Tendayi Kapfidze, LendingTree's Chief Economist and report author. "As much as people obsess over credit scores, many think of its importance in the binary "approve/decline" paradigm. Few borrowers could actually tell you how the credit score impacts the cost of financial products. We hope this report increases consumer education in this regard."

Kapfidze added, "As we move closer to December, there are a few catalysts for interest rate risk. First, the FOMC is almost certain to raise the benchmark interest rate on December 13. Secondly, progress or lack of progress on the tax plan could create volatility. And lastly, Congress must pass a spending bill or short-term continuing resolution by December 8th or we run the risk of a government shutdown, which could push interest rates up further. For those who are considering a refinance or looking to finance a home purchase, consumers should consider locking in an interest rate at today's levels to avoid the risk and costs associated with rising interest rates."

About the Report

The LendingTree Mortgage Offers Report contains data from actual loan terms offered to borrowers on LendingTree.com by lenders. LendingTree believes this is an important addition to standard industry surveys and reports on mortgage rates. Most quoted industry rates are for a hypothetical borrower with prime credit who makes a 20% down payment. Most borrowers do not fit this profile. LendingTree's Mortgage Offer report includes the average quoted APR by credit score, together with the average down payment and other metrics described below. We stratify by credit score, so borrowers have added information on how their credit profile affects their loan prospects. The report covers conforming 30-yr fixed loans for both purchase and refinance.

- Loan Distribution: The share of loans offered by credit score bucket

- APR: Actual APR offers to borrowers on our platform

- Down Payment: Though analogous to the LTV, we find that borrowers identify more closely with the down payment. Academic studies have also found that the down payment is the primary concern for homebuyers and one of the main impediments to entering the homebuying market.

- LTV: Actual LTV offered to borrowers on our platform

- Loan Amount: The average loan amount borrowers are offered

- Monthly Payment: Another key figure that borrowers have top of mind when shopping for loans

To view original report visit: https://www.lendingtree.com/home/lendingtree-mortgage-offers-report-october-2017/

About LendingTree

LendingTree (NASDAQ: TREE) is the nation's leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 65 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 500 lenders offering home loans, personal loans, credit cards, student loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

MEDIA CONTACT:

Megan Greuling

704-943-8208

Megan.greuling@tree.com

View original content with multimedia:http://www.prnewswire.com/news-releases/lendingtree-releases-monthly-mortgage-offer-report-for-october-300559414.html

SOURCE LendingTree

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu LendingTree Incmehr Nachrichten

|

30.10.24 |

Ausblick: LendingTree präsentiert das Zahlenwerk zum abgelaufenen Jahresviertel (finanzen.net) | |

|

16.10.24 |

Erste Schätzungen: LendingTree stellt Quartalsergebnis zum abgelaufenen Jahresviertel vor (finanzen.net) | |

|

24.07.24 |

Ausblick: LendingTree präsentiert Quartalsergebnisse (finanzen.net) |