|

19.10.2020 23:01:00

|

Josemaria Resources Announces Positive Feasibility Study Showcasing a Conventional, Robust and Rapid Pay Back, Open Pit Copper-Gold Project

VANCOUVER, BC, Oct. 19, 2020 /CNW/ - Josemaria Resources Inc. (TSX: JOSE) (OSX: JOSE) ("Josemaria" or the "Company") is pleased to announce the results of the Independent Feasibility Study ("Feasibility Study") prepared by a team of engineering and consulting service providers led by Fluor Canada Ltd ("Fluor") with key sections prepared by SRK Consulting (Canada) Inc. ("SRK"), and Knight Piésold Ltd. ("KP") and input from a variety of independent consultants and qualified persons, and in accordance with the disclosure standards of National Instrument 43-101 ("NI 43-101") for its 100% owned copper-gold-silver Josemaria Project (the "Project") located in San Juan, Argentina. View PDF Version.

The Feasibility Study demonstrates a robust, rapid pay-back, low risk project, with an open pit operation feeding a conventional process plant at 152,000 tonnes per day over a 19 year mine life, yielding average annual metal production of 136,000 tonnes of copper ("Cu"), 231,000 ounces of gold ("Au") and 1,164,000 ounces of silver ("Ag").

Commenting on the results, Adam Lundin, President and CEO, stated, "We are extremely pleased with the results of the Feasibility Study at Josemaria which indicates that this is one of the very few readily developable copper-gold projects in the world today. This study has materially de-risked the project and forecasts an attractive economic outcome which is comparable with other large-scale copper/gold projects already being developed or in production today. We believe that Josemaria is perfectly positioned to commence production by mid-decade, meeting rising copper demand from a rapidly electrifying global economy. I believe the study results will allow us to unlock various financing opportunities as we move toward construction."

FEASIBILITY STUDY HIGHLIGHTS INCLUDE:

Unless otherwise indicated, all dollar amounts are stated in U.S dollars ("$")

- $1.53 billion("B") after-tax Net Present Value at an 8% discount rate ("NPV8")and a 15.4% Internal Rate of Return ("IRR") at metal prices of $3.00 per pound ("lb") copper, $1,500 per ounce ("oz") gold and $18 per ounce silver.

- The Josemaria Project return increases to over $2.16B After-Tax NPV8 and 18% IRR utilising spot metal prices at the close of trading on Friday 16thOct 2020 of $3.04/lb Cu, $1,900/oz Au and $24/oz Ag.

- Total contained metal in the proven and probable mineral reserve of 6.7 billion lb Cu, 7.0 million oz Au and 30.7 million oz Ag with mineral reserves and mineral resources open at depth.

- A proven and probable mineral reserve of 1,012 million tonnes ("Mt") with diluted grades of 0.30% Cu, 0.22 grams per tonne ("g/t") Au and 0.94g/t Ag, of which 197Mt are in the proven mineral reserve category, with a low 0.98:1 (waste:ore) strip ratio.

- Optimised mine production plan with average grades in the initial 3 full years of production notably better than the life of mine average, supporting strong investment payback potential and driving a 3.8-year payback period from start of production.

- 19-year mine life optimised to maximise early cash flow with average annual production over the initial 3 years of 166,000t Cu, 331,000oz Au and 1,248,000oz Ag payable metal in concentrate.

- 152,000 tonnes per day average life-of-mine process plant throughput with a 3-line conventional Semi Autogenous Ball Mill Crushing (SABC) circuit utilising an optimised layout for a maximised gravity flow circuit.

- Simple and conventional metallurgical extraction process utilising conventional flotation reagents without the use of cyanide.

- Life-of-mine average recoveries of 85.2% for Cu, 62.6% Au and 72% Ag, producing clean, precious metal rich concentrate, with 27% Cu content and no significant penalty elements.

- A total initial project capital cost of $3.09B including all engineering, procurement, construction, and management ("EPCM"), site and offsite infrastructure, pre-construction engineering work and contingency.

- Life-of-mine Total Cash Cost(1) of $1.55/lb Copper Equivalent(2) ("CuEq") production including Mining of $0.34/lb, Processing of $0.52/lb, TCRC & Shipment of $0.47/lb, Royalty of $0.06/lb and Sustaining Capex of $0.16/lb with General and Administrative costs ("G&A") being apportioned to appropriate areas.

- 100% of planned infrastructure is within the pro-mining San Juan province, simplifying permitting and approval processes to ensure a clear path to project development.

- Ready access to, and availability of, all essential resources including abundant water, grid power and transportation and logistics infrastructure within San Juan province.

- Concentrate logistics utilising truck and rail transport from site to an export port in Rosario, Argentina.

- Design incorporates the latest technology, including autonomous truck and production drill fleets and optionality to incorporate green energy.

- Clear and achievable project execution plan demonstrates commercial production could be achieved by early 2026.

- Environmental and Social Impact Assessment ("ESIA") is already well underway and is expected to be submitted to relevant authorities for assessment in Q1, 2021.

(1),(2),- See NON GAAP Financial measures section for detail |

The Company intends to continue with an ambitious work plan to advance Josemaria and has already commenced a bridging phase of engineering prior to the initiation of basic and detailed engineering planned for early 2021.

Adam Lundin also stated, "The Feasibility Study is a major milestone for Josemaria and creates a unique opportunity for our stakeholders. The Lundin Group has enjoyed successful partnerships in Argentina for over 30 years and our commitment and loyalty to Argentina is unwavering. We feel privileged to be working in the pro-mining province of San Juan, Argentina where we enjoy strong relations with all levels of government with whom we have worked collaboratively since 1994. The location of the Josemaria Project affords us a low environmental impact operation that will provide significant opportunities for local stakeholders and is expected to generate attractive returns for investors. The award-winning Lundin Foundation is a proud partner of Josemaria, and we are working together to develop management approaches that are aligned with leading international standards on environmental and social sustainability."

A webinar to discuss the results will be held on Tuesday, October 20, 2020 at 09:00 PDT/ 12:00 EDT/ 18:00 CEST via Zoom and participants will have the opportunity to ask questions directly to the Josemaria management team. Register in advance by clicking here.

A replay of the webinar will be available on the Josemaria website www.josemariaresources.com.

To view a video animation of the Josemaria Project please click here: Watch Now!

PROJECT ECONOMICS

The Feasibility Study uses a discounted cashflow model with constant (real, non-inflated) 2020 US Dollars and models the project cashflows in quarterly periods. The model considers cashflow from January 2021 onward with mid-year discounting at 8% per annum for NPV calculations. The operating costs exclude pre-stripping, which has been included in the mining capital costs shown. Operating unit costs are expressed as total operating costs divided by total tonnage. All projected expenditures for the continued development of the Josemaria project commencing January 2021 have been included in the project economics detailed in Table 1 below.

Table 1 – Summary of Project Economics

Project Metric | Units | Value |

Pre-Tax NPV @ 8% | $Billion | 2.37 |

Pre-tax IRR | % | 18.4 |

After-Tax NPV @ 8% | $Billion | 1.53 |

After Tax IRR | % | 15.4 |

Undiscounted After-Tax Net Cashflow (LOM) | $Billion | 6.36 |

Payback Period from start of processing (undiscounted, nominal after-tax cashflow) | Years | 3.8 |

Initial Capital Expenditure | $Million | 3,091 |

Life-of-Mine Sustaining Capital Expenditure (excluding closure) | $Million | 940 |

Total Cash Cost (co-product excluding closure accrual) (1) | $/lb Copper Equivalent (2) | 1.55 |

Average Process Capacity | tonnes per day | 152,000 |

Mine Life | years | 19 |

Life-of-Mine Mill Feed | Million tonnes | 1,012 |

Life-of-Mine Diluted Grades (ROM) | ||

Copper | % | 0.30 |

Gold | Grams per tonne | 0.22 |

Silver | Grams per tonne | 0.94 |

Life-of-Mine Waste Rock | Million tonnes | 992 |

Life-of-Mine Strip Ratio (Waste:Ore) | ratio | 0.98 |

First Three Years Average Annual Payable Metal Production | ||

Copper | tonnes | 166,000 |

Gold | ounces | 331,000 |

Silver | ounces | 1,248,000 |

Life-of-Mine Average Annual Payable Metal Production | ||

Copper | tonnes | 131,000 |

Gold | ounces | 224,000 |

Silver | ounces | 1,048,000 |

Life-of-Mine Average Process Recovery | ||

Copper | % | 85.2 |

Gold | % | 62.6 |

Silver | % | 72.0 |

Operating Costs | ||

Mine | $/t milled | 2.71 |

Crushing | $/t milled | 0.19 |

Process | $/t milled | 2.94 |

Tailings | $/t milled | 0.03 |

On-Site Infrastructure | $/t milled | 0.36 |

Off-Site Infrastructure | $/t milled | 0.10 |

Indirect costs | $/t milled | 0.49 |

Total Operating Costs | $/t milled | 6.83 |

(1),(2),- See NON GAAP Financial measures section for detail |

FINANCIAL SENSITIVITY ANALYSIS

Sensitivity analysis shows the Josemaria Project is highly leveraged to metal prices (Tables 2 and 3) with copper being the major driver of project value contributing 71.0% of revenue, gold contributing 27.5% and silver 1.5%. A combined increase of 10% of the modelled price of copper to $3.30/lb combined with a 20% increase in gold to $1,800/oz and a 20% increase in silver to $21.60/oz would result in an increase of 59% in After-Tax NPV8 to $2.4 billion and an increase in IRR to 19%. The sensitivity analysis also shows that the project is resilient against increases in capital cost in a rising metal price environment as evidenced in Tables 4 and 5 below.

Table 2 – Sensitivity (NPV in $B) – Individual Metal Prices

After-tax NPV at 8% | Metal Prices | ||||

-20% | -10% | 0% | 10% | 20% | |

Copper Price ($/lb) | $2.40 | $2.70 | $3.00 | $3.30 | $3.60 |

After-tax NPV at 8% | $547 | $1,037 | $1,528 | $2,013 | $2,497 |

Gold Price ($/oz) | $1,200 | $1,350 | $1,500 | $1,650 | $1,800 |

After-tax NPV at 8% | $1,120 | $1,327 | $1,528 | $1,730 | $1,931 |

Silver Price ($/oz) | $14.40 | $16.20 | $18.00 | $19.80 | $21.60 |

After-tax NPV at 8% | $1,508 | $1,518 | $1,528 | $1,539 | $1,549 |

Table 3 – Sensitivity (IRR - Real) – Individual Metal Prices

After-tax IRR (Real) | Metal Prices | ||||

-20% | -10% | 0% | 10% | 20% | |

Copper Price ($/lb) | $2.40 | $2.70 | $3.00 | $3.30 | $3.60 |

After-tax IRR (Real) | 10.9% | 13.2% | 15.4% | 17.3% | 19.1% |

Gold Price ($/oz) | $1,200 | $1,350 | $1,500 | $1,650 | $1,800 |

After-tax IRR (Real) | 13.5% | 14.5% | 15.4% | 16.2% | 17.1% |

Silver Price ($/oz) | $14.40 | $16.20 | $18.00 | $19.80 | $21.60 |

After-tax IRR (Real) | 15.3% | 15.3% | 15.4% | 15.4% | 15.4% |

Table 4: Two-Factor Sensitivity (NPV in $B) – Capital Cost & Metal Prices

After-tax NPV at 8% | Metal Prices | |||||

-20% | -10% | 0% | 10% | 20% | ||

Capital | -20% | $644 | $1,347 | $2,043 | $2,738 | $3,435 |

-10% | $381 | $1,090 | $1,786 | $2,481 | $3,177 | |

0% | $111 | $823 | $1,528 | $2,224 | $2,920 | |

10% | -$162 | $560 | $1,265 | $1,967 | $2,663 | |

20% | -$434 | $291 | $1,002 | $1,710 | $2,405 | |

Table 5: Two-Factor Sensitivity (IRR) – Capital Cost & Metal Prices

After-tax IRR | Metal Prices | |||||

-20% | -10% | 0% | 10% | 20% | ||

Capital | -20% | 12.2% | 16.1% | 19.5% | 22.6% | 25.4% |

-10% | 10.3% | 14.0% | 17.3% | 20.2% | 22.9% | |

0% | 8.6% | 12.2% | 15.4% | 18.1% | 20.7% | |

10% | 7.2% | 10.7% | 13.7% | 16.4% | 18.9% | |

20% | 5.9% | 9.3% | 12.2% | 14.9% | 17.2% | |

FEASIBILTY STUDY DETAILS

Geology and Mineral Resource Estimate

The Feasibility Study includes an updated mineral resource estimate for both the oxide and sulphide mineralisation with the inclusion of all data to the end of the 2018-2019 field season including 29 additional drillholes for 10,620m of drilling, increasing data density by 30% on the previous estimate. Geological domaining has been refined and improved with better definition of domain boundaries resulting in improved confidence and more reliable modelling of metal distribution within mineral resource blocks. Grade interpolation has been conducted using an Ordinary Kriging methodology with extensive validation of results using visual, Inverse Distance Squared and Nearest Neighbour comparisons.

Mineral resource classification is based on spatial parameters related to drill density and configuration, in conjunction with constraining by an optimised resource pit using the industry standard Lerchs Grossmann algorithm. Material is classified as indicated mineral resource, where three or more holes are within 150m and measured where 14 or more holes are within 150m of a given mineral resource block. The Josemaria deposit remains open to the south, and at depth. Gold-bearing oxide materials, included in the mineral resource statement have not been considered at this stage of development, but could be incorporated during further project optimisation in light of continued increases in gold price. The Josemaria mineral resources are shown in Tables 6 and 7 below:

Table 6 – Sulphide Mineral resource statement @ 0.1% CuEq Cut-off for the Josemaria Project, San Juan province, Argentina, 10 July 2020

Category | Tonnes | Grade | Contained Metal | |||||

Cu | Au | Ag | CuEq | lb Cu | oz Au | oz Ag | ||

(%) | (g/t) | (g/t) | (%) | (billions) | (millions) | (millions) | ||

Measured | 197 | 0.43 | 0.34 | 1.3 | 0.63 | 1.9 | 2.2 | 8.5 |

Indicated | 962 | 0.26 | 0.18 | 0.9 | 0.36 | 5.5 | 5.6 | 26.6 |

Total (M & I) | 1,159 | 0.29 | 0.21 | 0.9 | 0.41 | 7.4 | 7.8 | 33.5 |

Inferred | 704 | 0.19 | 0.10 | 0.8 | 0.25 | 2.9 | 2.3 | 18.6 |

Table 7 - Oxide Mineral resource statement @ 0.2g/t Gold Cut-off for the Josemaria Project, San Juan province, Argentina, 10 July 2020

Category | Tonnes | Grade | Contained Metal | ||

Au | Ag | oz Au | oz Ag | ||

(g/t) | (g/t) | (thousands) | (thousands) | ||

Measured | 26 | 0.33 | 1.2 | 280 | 994 |

Indicated | 15 | 0.28 | 1.3 | 132 | 632 |

Total (M & I) | 41 | 0.31 | 1.2 | 410 | 1,585 |

Inferred | 0 | ||||

Notes to accompany the Josemaria Mineral Resource statement: | |

1. | Mineral Resources have an effective date of 10 July 2020. The Qualified Person for the mineral resource estimate is Mr. James N. Gray, P.Geo. |

2. | The mineral resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), Definition Standards for Mineral Resources and Reserves, as prepared by the CIM Standing Committee and adopted by CIM Council. |

3. | Sulphide copper equivalence (CuEq) assumes metal prices of $3/lb copper, $1,500/oz gold, $18/oz silver. |

4. | CuEq is based on Cu, Au and Ag recoveries derived from metallurgical test work as applied in the pit optimisation and mine design process. |

5. | The copper Equivalency equation used is: CuEq (%) = (Cu grade (%) * Cu recovery * Cu price ($/t) + Au grade (oz/t) * Au recovery * Au price ($/oz) + Ag grade (oz/t) * Ag recovery * Ag price ($/oz) ) / (Cu price ($/t) * Cu recovery) |

6. | Mineral resources are inclusive of mineral reserves. |

7. | Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

8. | All figures are rounded to reflect the relative accuracy of the estimate. Totals may not sum due to rounding as required by reporting guidelines. |

MINERAL RESERVES AND MINING

The Josemaria Project is to be developed as a large-scale open pit mining operation with over 1 billion tonnes of ore mined at average diluted head grades of 0.30% Cu, 0.22 g/t Au, 0.94g/t Ag and a notably low strip ratio of 0.98:1 (waste:ore) over a 19-year life of mine. The mine plan is optimised to maximise the project NPV by employing an elevated cut-off grade strategy and stockpiling, bringing metal production forward while taking advantage of topography to minimise haulage requirements. Due to the large continuous nature of the deposit and the low-grade mineralisation that exists along much of the mineral reserve boundary, the impact of both dilution and ore loss will be minimal to project economics.

Mining will occur on 15 m benches with an average slope angle typically ranging from 37 to 43 degrees. Large (42 cubic meter capacity) electrically powered, hydraulic shovels will be used in combination with 360-tonne haul trucks. To maximize productivity, efficiency and safety, haul trucks will be autonomously operated, and drill functions will also be autonomously operated when possible.

Measured and indicated sulphide mineral resources were converted to proven and probable mineral reserves detailed in Table 8 below. Optimisation of the Feasibility Study pit was completed using GEOVIA's Whittle™ software, which is based on the industry standard Lerchs-Grossmann pit optimisation algorithm. Amongst other input parameters, mineral reserves used long-term metal price estimates of $3.00/lb Cu, $1500/oz Au and $18.00/oz Ag.

Large, long-life open-pit mines contain significant embedded management optionality with respect to operating strategy. It is anticipated that a value-focused operating strategy that features dynamic mining rate, stockpiling and mill cut-off policies will be implemented at Josemaria. In practice, this will allow for mitigation of downside risk and capitalisation of upside opportunities potentially improving the cashflows over time, when compared to the assumptions used in the Feasibility Study.

Table 8 – Mineral reserve statement for the Josemaria Project, San Juan province, Argentina, 28 September 2020

Category | Tonnage | Grade | Contained Metal | ||||

(Mt) | Cu (%) | Au (g/t) | Ag (g/t) | Cu | Au | Ag | |

Proven | 197 | 0.43 | 0.34 | 1.33 | 1,844 | 2.14 | 8.43 |

Probable | 815 | 0.27 | 0.19 | 0.85 | 4,861 | 4.87 | 22.29 |

Total Proven and Probable | 1,012 | 0.30 | 0.22 | 0.94 | 6,705 | 7.02 | 30.72 |

Notes to accompany the Josemaria Mineral Reserve statement: | |

1. | Mineral reserves have an effective date of 28 September 2020. The Qualified Person for the estimate is Mr. Robert McCarthy, P.Eng. |

2. | The mineral reserves were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), Definition Standards for Mineral Resources and Reserves, as prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council. |

3. | The mineral reserves were based on a pit design which in turn aligned with an ultimate pit shell selected from a Whittle™pit optimisation exercise. Key inputs for that process are:

|

4. | Mining dilution is accounted for by averaging grades in adjacent blocks across a thickness of 2.5 m into each block (5.0 m per block contact). |

5. | The mineral reserve has an economic cut-off for prime mill feed, based on NSR, of $5.22/t, $5.21/t, $5.18/t and $5.16/t milled for tonalite, rhyolite, porphyry and supergene material respectively and an additional $0.53/t for stockpiled ore. |

6. | There are 991 Mt of waste in the ultimate pit. The strip ratio is 0.98 (waste:ore). |

7. | All figures are rounded to reflect the relative accuracy of the estimate. Totals may not sum due to rounding as required by reporting guidelines. |

METALLURGY AND PROCESSING

Extensive metallurgical testing of the mineralisation at Josemaria has been conducted with the 2020 Feasibility Study metallurgical program focused on the initial five years of ore to be processed. The program focused on metallurgical recovery, crushing, grinding, flotation, and liquid-solid separation and included testing of five lithological composites, 29 variability samples and four annual composites. Furthermore, a large sample representing ore from the oxide to fresh boundary, indicative of the early years of mining, was tested in a pilot plant to improve confidence and confirm bench scale assumptions.

Key program findings included:

- Average recoveries over LOM estimated at 85.2% for copper, 62.6% for gold and 72% for silver.

- 130-micron grind size and conventional reagents produce optimal results.

- Main lithologies (Porphyry, Rhyolite, Tonalite and Supergene) process at variable throughput rates allowing for process throughput optimisation by rock-type being incorporated in the mine plan.

- Production of clean concentrate with arsenic being the only impurity identified at low concentrations, and primarily manageable through in-mine stockpiling and concentrate blending.

- Concentrate will be readily saleable to global smelters with 96.3% payable Cu, 97% payable Au and 90% payable Ag.

The Josemaria process facilities are designed for a nominal throughput rate of 150,000 tonnes per day ("t/d") of tonalite material. Tonalite is the hardest of the different feed types at Josemaria, comprising around 46% of the mineral reserve. Rhyolite comprising 34% achieves throughput rates of 151,600t/d, Porphyry comprising 14% achieves 156,800t/d and Supergene comprising 6% achieves 160,800t/d for a life of mine average throughput capacity of 152,000t/d.

Facilities on site include crushing, grinding, flotation, concentrate and tailings thickening, concentrate filtration, storage and loadout. In all key respects, the planned processing flow sheet and planned plant configuration are conventional and have significant precedent in the industry lowering the risk to the project.

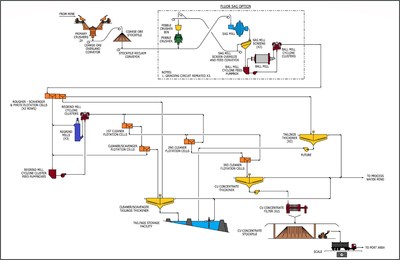

The process design maximises gravity flow of material and minimises direction changes with primary crushed ore being transported via surface conveyor to a covered coarse ore stockpile. Conveyors will supply coarse ore to three Semi Autogenous Grinding ("SAG") mills at a nominal 50,000t/d each, operating in parallel and in a closed circuit with pebble crushers. From the SAG mills, ore moves through conventional ball mills and then conventional sulphide flotation with roughing and three stages of cleaning. The final concentrate is thickened and filtered, ready for shipment. A flowsheet of the process is shown in Figure 1 below.

TAILINGS MANAGEMENT

Tailings storage facilities have been designed to international industry standards with bulk tailings segregated in the process to form two tailings streams; low sulphur rougher tailings and high sulphur cleaner tailings. The tailings streams are segregated to assist with the management of the Potentially Acid Generating ("PAG") material using a Best Management Practice approach. Thickened slurry tailings will be discharged in the Tailings Storage Facility ("TSF") located to the south of the Process Plant. Approximately one billion tonnes of thickened slurry tailings will be discharged over the life of the project within the TSF. The TSF impoundment requires three dams that will be constructed continuously from Years -3 to Year 18 to contain the tailings. Seepage collection systems downstream of the dams collect and recycle seepage back to the Plant for reuse in processing. On closure the tailings storage facility surface will be capped using non-acid generating material to limit ingress of oxygen and water to the tailings material and the area will be returned to its natural desert pavement environment.

INFRASTRUCTURE

On-site infrastructure includes a road network, processing plant, mine support facilities, power and water supply and distribution, camp facilities and water and sewage treatment facilities. The site infrastructure layout has been designed to provide a relatively direct flow of material from mine to tailings storage. The plant facilities were arranged to minimise civil earthwork and locate major equipment in areas with favourable geotechnical characteristics while maximising gravity-assisted material flow where possible.

Groundwater will be the primary source of freshwater supply to the plant site and ancillary facilities. Groundwater will be collected from two wellfields situated within 28km of the process facilities. Detailed studies of aquifer capacity and recharge were conducted during the Feasibility Study and confirm the availability and sustainability of average make up water demand of 550 litres per second ("l/s") for the life of the project.

Access to site will be via a dedicated, gravel surfaced, two-lane access road, approximately 250 km long to be built as part of the early works program. Road designs are tailored to minimize interaction of trucking operations with regional communities. Secured entrance to the road will be located near the town of Rodeo and the road will be located entirely within the province of San Juan. The road will be able to accommodate oversized loads during construction and concentrate transport and other traffic during operation.

A 220 kilovolt, single-circuit high-voltage transmission line 252 km long and following the road corridor will supply electrical power to the project. The line will have two conductors per phase of aluminium-steel-reinforced line carrying 240 megawatts of power. Power supply will be from an existing substation located near the town of Rodeo and upgraded as part of the project.

Copper concentrate will be transported in bulk, by road, to a road-to-rail intermodal facility to be located in Albardon, San Juan, where it will be transferred to an existing rail system for transport to the Terminal Puerto Rosario (TPR) for export to smelters in Asia, Europe and elsewhere in South America. The port of Rosario has been a point of terminal copper concentrate storage and export shipping for many years.

CAPITAL COSTS

The Josemaria Project capital cost estimate was prepared by Fluor with input from SRK, KP and independent qualified person consultants. The level of design definition, methodology and sources of information used to prepare the estimate adheres to The Association for the Advancement of Cost Engineering International guidelines and results in a Class 3 estimate with an accuracy classification of ±15% at the summary level.

The capital cost estimate is based on the Josemaria Project utilising reliable and proven technology, materials and equipment supplied by readily recognised manufacturers with appropriate expertise in supplying large mining operations globally. Extensive analysis of material supply and availability both in country and internationally, robustness of logistics networks as well as local and international labour markets have resulted in a comprehensive and reliable cost estimate for the project. A breakdown of the key capital cost areas is shown in table 9 below.

Table 9 – Josemaria Capital Cost Estimate

Initial Capital Costs | $ Millions |

Mine | 302 |

Crushing | 222 |

Process Facilities | 666 |

Tailing Management | 163 |

On-Site Infrastructure | 184 |

Off-Site Infrastructure | 192 |

Total Direct Cost | 1,729 |

Total Indirect Cost | 756 |

Total Direct Plus Indirect | 2,485 |

Contingency P85 | 348 |

Total Project with Contingency | 2,833 |

Owner's Costs | 258 |

Grand Total Capital Cost | 3,091 |

Sustaining capital for Josemaria has been estimated based on maintaining the operation at full production for the entire 19-year mine life without the expectation of any significant expansion in the process plant capacity or replacement of any significant components of fixed infrastructure. Sustaining capital costs are primarily driven by the continuous expansion of the tailing storage facility and the required replacement of the mining fleet during normal operations over the life of mine. Sustaining capital costs broken down by area are shown in Table 10.

Table 10 - LOM Sustaining Capital Costs

Description | $ Millions |

Mining | 391 |

Tailings Storage Facility | 502 |

Plant Mobile Equipment Replacement Costs | 12 |

Wellfield B Construction | 19 |

Electrical | 1 |

Road Upgrades | 15 |

Total | 940 |

CLOSURE COSTS

Site Closure costs were also considered as an integral part of the Feasibility Study. The closure plan was developed to take into account current best practice closure methodologies with the aim of achieving long- term geotechnical and geochemical stability with the eventual return of the site to a self-sustaining environment similar to pre-mining usage and capability. All-in closure costs of approximately $277 Million have been allocated in the financial model to be spent over 5 years commencing on completion of commercial production.

OPERATING AND OFF-SITE COSTS

Project operating costs have been developed to reflect the mine production plans, metal recoveries, and processing methods developed in the Feasibility Study. The operating costs benchmark well against other global projects of similar size and scale and with Josemaria planned to be a high-throughput bulk mining operation, with a low strip ratio, high autonomous productivity, simple process flow-sheet, low power cost, ready access to water and a talented and reasonably priced local labour pool. The overall cost of $6.83/t milled reflects estimates built up from the process design criteria and flowsheet, vendor-supplied equipment productivities and operating and maintenance costs, labour, reagents, grinding media and liners, power demand and grid supply price, delivered fuel, explosives and others. Table 11 shows a high-level breakdown by area:

Table 11 - Operating Costs Summary

Operating Costs | $ Millions | Unit Rates in $ | Units |

Mine | 1.20 | $/t moved | |

Mine | 2,747 | 2.71 | $/t milled |

Crushing | 196 | 0.19 | $/t milled |

Process | 2,974 | 2.94 | $/t milled |

Tailings | 27 | 0.03 | $/t milled |

On-Site Infrastructure | 369 | 0.36 | $/t milled |

Off-Site Infrastructure | 101 | 0.10 | $/t milled |

Indirects | 501 | 0.49 | $/t milled |

Total Operating Costs | 6915 | 6.83 | $/t milled |

Off-site costs (concentrate freight, port handling, treatment charges and refining charges) were developed based on an extensive study of concentrate quality, marketing, transport, and logistics and deducted from payable revenue. These are summarised in Table 12:

Table 12 - Summary of Modelled Off-Site Costs

Category | Units | Costs |

Concentrate Freight | ||

Road Freight | $/wet metric tonne | 82.00 |

Port & Handling | $/wet metric tonne | 19.00 |

Ocean Freight | $/wet metric tonne | 42.33 |

Weighing, Assaying & Insurance | $/wet metric tonne | 6.56 |

Total Freight Charges | $/wet metric tonne | 149.89 |

Treatment & Refining Charges | ||

Treatment Charges | $/dry metric tonne | 78.22 |

Losses | % | 0.30 |

Copper Refining charge | $/lb | 0.078 |

Gold Refining Charge | $/oz | 5.00 |

Silver Refining Charge | $/oz | 0.46 |

ROYALTIES AND TAXES

Table 13 below summarizes taxes and royalties factored into the Project Economics.

The current rate of Argentina corporate income tax is 30% and is legislated to reduce to 25% commencing in 2021. Accordingly, the rate of corporate income tax applied in the Project Economics is 25%.

San Juan provincial royalties will be applicable to all copper concentrate sales. According to current legislation, the rate of provincial royalty is capped at 3% of pithead value. The highest rate (3%) of potential provincial royalty has been utilised in the Project Economics to deliver an adequate provision for all potential provincial royalties and taxes, infrastructure funding requirements and municipal levies.

Export duties are currently legislated until the end of 2020, with the Argentina Congress authorised to extend the duties until the end of 2021. As production from the project is expected to commence several years later, export duties have not been included in the Project Economics.

Table 13 - Summary of Modelled Project Tax Contribution and Royalties

Category | Life of Mine ($k) |

San Juan Provincial Royalty | 498,000 |

Lirio Private Royalty | 38,000 |

VAT | 44,000 |

Applied Debits and Credits Tax (Real) | 147,000 |

Corporate Income Tax (Real) | 2,020,000 |

CORPORATE SOCIAL RESPONSIBILITY

The social priority of the Josemaria Project is to become part of a widely understood and accepted local and regional economic development plan. To accomplish this, Josemaria will work towards the goal that the surrounding communities and stakeholders receive direct and indirect benefits from the project. The Company will continue with meetings and dialogue with the local communities and will increase communication frequency and distribution to appropriately inform stakeholders. Dialogue and communication from the Company will be conducted in an earnest and honest way and all measures will be undertaken so that Company and contractor personnel respect local customs, traditions and values during the construction, operation and closure phases of the project.

Josemaria holds safety as a top priority in all activities, comparable to the way that other Lundin group operations approach occupational health and safety (OH&S). The fundamental objective is zero accidents. This will be accomplished by adopting a safety-first mentality by means of establishing robust processes and work practices, training of employees and contractors, improving the physical work environment, eliminating high potential hazards, and working diligently to prevent occupational injuries and illnesses.

Josemaria will implement processes to ensure that recruitment and hiring practices are fair, transparent, non-discriminatory and promote diversity as well as taking into consideration local conditions and expectations that are aligned with regulatory requirements and Josemaria's policies.

PROJECT EXECUTION AND OPERATION TIMELINE

Josemaria through its affiliation with the Lundin group of companies has the backing of a strong organization, experienced in the development and operation of major resource extraction projects. Josemaria is planning to form a fit for purpose, core owner's team and augment itself with a full-service EPCM firm to manage and execute the overall construction of the Josemaria Project. It is envisaged that the selected EPCM firm will self-perform the EPCM services for the process plant, on-site infrastructure and the power supply portion of the off-site scopes. Other significant members of the team are envisaged to include specialized mine engineering, tailings storage facility engineering, regional access road, and environmental consultants of international calibre.

The Josemaria Project is expected to continue progressing rapidly toward construction with basic engineering tentatively planned to begin in the first quarter of 2021, detailed engineering in the third quarter of 2021 and commencement of construction of a pioneering access road in the third quarter of 2021 predicated on achieving appropriate permitting and financing milestones. Once all necessary prerequisites have been met, and the Josemaria Project is approved for construction, bulk earthworks could commence by the fourth quarter 2022, which will be the first major construction activity on site. Assuming a clear path to construction, commissioning could commence in late 2025 and commercial production could be achieved in 2026.

NEXT STEPS

Josemaria is on track to become one of the next major copper project developments globally, and a detailed plan has been developed to continue on the path to production for Josemaria. In conjunction with preparations for the submission of the Environmental and Social Impact Assessment, planned for early in 2021, the Company has commenced discussions with Provincial and Federal authorities, aimed at finalizing and securing commercial and fiscal terms applicable to the project. The Company's goal is to utilise the 30 year stability provision, applicable under Argentina Mining legislation, to ensure an equitable and sustainable tax and commercial regime is agreed that is appropriate for large scale open-pit copper-gold-silver projects and enables project financing.

It is anticipated that by successfully progressing the Company's discussions with the authorities and continuing to arrange the necessary financial facilities, the next steps for Josemaria are to continue with the already commenced bridging engineering phase to lead into basic and detailed engineering while concurrently completing and submitting the Environmental and Social Impact Assessment.

Furthermore, although Josemaria has collected all necessary field data to continue with the project development unabated, the Company is planning to conduct a field season commencing in the first quarter of 2021 to gather additional data and information to improve confidence in selected infrastructure foundation conditions as well as to further de-risk the design and construction of all major facilities. Potential work for a field season includes additional foundation testing for the various facilities and data collection along the proposed access road. Continued baseline data collection and associated environmental and social studies are also planned.

Figure 1 – Josemaria process flow sheet

QUALIFIED PERSONS

The Technical Report summarizing the results of the Feasibility Study is being prepared in accordance with the disclosure standards of NI 43-101 and will be filed under the Company's profile on SEDAR within 45 days of this press release. The Qualified Persons named below have reviewed and verified that the scientific technical information in this press release is accurate and have approved the contents of this press release.

The Qualified Persons who will prepare the Technical Report and who have reviewed and approved this press release are:

James N. Gray, P.Geo | Advantage Geoservices Ltd. |

Fionnuala Devine, P.Geo | Merlin Geosciences Inc. |

Jeff Austin, P.Eng | Austin International Ltd. |

Brian Johnston, P.Eng | Fluor Canada Ltd. |

Marcel Bittel, P.Eng | Fluor Canada Ltd. |

Daniel Ruane, P.Eng | Knight Piésold Ltd. |

Bob McCarthy, P.Eng | SRK Consulting (Canada) Inc. |

Neil Winkelmann, F. AusIMM | SRK Consulting (Canada) Inc. |

Andy Thomas M.Eng., P.Eng. | SRK Consulting (Canada) Inc. |

DATA VERIFICATION

The Qualified Persons responsible for the preparation of the Technical Report have verified the data disclosed, including sampling, analytical, and test data underlying the information contained in this news release. Geological, mine engineering and metallurgical reviews included, among other things, reviewing mapping, core logs, review of geotechnical and hydrological studies, environmental and community factors, the development of the life of mine plan, capital and operating costs, transportation, taxation and royalties, and review of existing metallurgical test work. In the opinion of the Qualified Persons responsible for the preparation of the Technical Report, the data, assumptions, and parameters used to estimate mineral resources and mineral reserves, and to develop the metallurgical model, the economic analysis, and the Feasibility Study are sufficiently reliable for those purposes. The Technical Report, when filed, will contain more detailed information concerning associated QA/ QC and other data verification matters, and the key assumptions, parameters and methods used by the Company.

NON-GAAP FINANCIAL MEASURE

"Total Cash Cost" per pound of Copper Equivalent ("CuEq") production is a non-GAAP measure. Adoption of this measure is voluntary, and the cost measures presented may not be comparable to other similarly titled measures of other companies. The Company believes that certain investors will use this information to evaluate performance and as such it is considered a key indicator of the Company's ability to generate operating cash flow from the Josemaria Project. "Total Cash Cost" includes mining, processing, TCRC & Shipment, Royalty and Sustaining Capex components with General and Administration (G&A) appropriately apportioned among these cost components. Total costs are then divided by CuEq pounds produced to arrive at a per Copper Equivalent per pound figure. The copper Equivalency equation used is: CuEq (%) = (Cu grade (%) * Cu recovery * Cu price ($/t) + Au grade (oz/t) * Au recovery * Au price ($/oz) + Ag grade (oz/t) * Ag recovery * Ag price ($/oz)) / (Cu price ($/t) * Cu recovery). "Total Cash Cost" does not have a standardised meaning under International Financial Reporting Standards ("IFRS"), the Company's financial reporting framework, and as such it is considered to be a non-GAAP financial measure. It should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS and is not necessarily indicative of cash flow from operations or operating costs presented thereunder.

ABOUT JOSEMARIA RESOURCES

Josemaria Resources Inc. is a Canadian natural resources company focused on advancing the development of its wholly-owned Josemaria copper-gold project in San Juan Province, Argentina. The Company is a reporting issuer in all provinces and territories of Canada and its corporate head office is in Vancouver, B.C. The Company's shares are listed on the TSX and on Nasdaq Stockholm under the trading symbol "JOSE".

ADDITIONAL INFORMATION

This is information that the Corporation is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out below on October 19, 2020, at 17:00 Eastern Time.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release includes certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein, including, without limitation, the future price of copper, gold and silver; the results of the Feasibility Study and expected timelines; the timing and amount of estimated future production; net present values and internal rates of return at the Josemaria Project; recovery rates; payback periods; costs of production; capital expenditures; costs and timing of the development of the Josemaria Project; mine life; the potential future development of the Josemaria Project and the future operating or financial performance of the Company; the effect of government regulations (or changes thereto) with respect to restrictions on production, export controls and duties, income taxes, royalties, expropriation of property, repatriation of profits, environmental legislation, land use, water use, mine safety, approval processes and the receipt of necessary permits are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "intends", "estimates", "potential", "possible", and similar expressions, or statements that events, conditions, or results "will", "may", "could", or "should" occur or be achieved. These forward-looking statements may also include statements regarding perceived merit of properties; exploration plans and budgets; mineral reserves and resource estimates; work programs; capital expenditures; timelines; strategic plans; market prices for precious and base metals; or other statements that are not statements of fact. In addition, statements relating to "mineral resources" and "mineral reserves" are deemed to be forward-looking information, as they involve the implied assessment, based on certain estimates and assumptions that the mineral resources and mineral reserves described can be profitably produced in the future.

Forward-looking statements involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include the Company's ability to finance the development of its mineral properties; commodity price fluctuations; assumptions and discount rates being appropriately applied to the Feasibility Study, uncertainty as to whether there will ever be production at the Company's Josemaria Project and any other future mineral exploration and development properties; risks related to the Company's ability to commence production and generate revenues or obtain adequate financing for its planned exploration and development activities; risks related to lack of infrastructure including but not limited to the risk whether or not the Josemaria Project will receive the requisite permits and, if it does, whether the Company will build the Josemaria Project; risks related to inclement weather which may delay or hinder activities at the Company's mineral properties; risks related to the Company's dependence on third parties for the development of its projects; uncertainties relating to the assumptions underlying resource and reserve estimates; mining and development risks, including risks related to infrastructure, accidents, equipment breakdowns, labor disputes, bad weather, non-compliance with environmental and permit requirements or other unanticipated difficulties with or interruptions in development, construction or production; the geology, grade and continuity of the Company's mineral deposits; the uncertainties involving success of exploration, development and mining activities; permitting timelines; risks pertaining to the outbreak of the global pandemics, including the coronavirus (COVID-19); government regulation of mining operations; environmental risks; unanticipated reclamation expenses; prices for energy inputs, labour, materials, supplies and services; uncertainties involved in the interpretation of drilling results and geological tests and the estimation of mineral reserves and mineral resources; the need for cooperation of government agencies and indigenous groups in the development and operation of properties including the Josemaria Project; unanticipated variation in geological structures, metal grades or recovery rates; fluctuations in currency exchange rates; unexpected cost increases in estimated capital and operating costs; the need to obtain permits and government approvals; uncertainty related to title to the Company's mineral properties and other risks and uncertainties disclosed in the Company's periodic filings with Canadian securities regulators and in other Company reports and documents filed with applicable securities regulatory authorities from time to time, including the Company's Annual Information Form available under the Company's profile at www.sedar.com. In addition, these statements involve assumptions made with regard to the Company's ability to develop the Josemaria Project and to achieve the results outlined in the Feasibility Study; the ability to raise the capital required to fund construction and development of the Josemaria Project; and the results and impact of future exploration at the Josemaria Project.

The Company's forward-looking statements reflect the beliefs, opinions, and projections on the date the statements are made. The Company assumes no obligation to update the forward-looking statements or beliefs, opinions, projections, or other factors, should they change, except as required by law.

Estimates of Mineral Reserves and Mineral Resources

Information regarding mineral reserve and mineral resource estimates included or referenced in this press release has been prepared in accordance with Canadian standards under applicable Canadian securities laws, which differ from United States standards. All mineral resource and mineral reserve estimates included or referenced in this press release have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM")—CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended ("CIM Definition Standards"). NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including the CIM Definition Standards and NI 43-101, differ significantly from the from standards in the United States included in U.S. Securities and Exchange Commission (the "SEC") Industry Guide 7.

The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act"). These amendments became effective February 25, 2019 (the "SEC Modernization Rules") with compliance required for the first fiscal year beginning on or after January 1, 2021. Under the SEC Modernization Rules, the historical property disclosure requirements for mining registrants included in SEC Industry Guide 7 will be rescinded and replaced with disclosure requirements in subpart 1300 of SEC Regulation S-K. Following the transition period, as a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards.

As a result of the adoption of the SEC Modernization Rules, the SEC will recognize estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding definitions under the CIM Standards that are required under NI 43-101. Accordingly, during this period leading up to the compliance date of the SEC Modernization Rules, information regarding mineral resources or mineral reserves contained or referenced in this press release may not be comparable to similar information made public by companies that report in accordance with U.S. standards. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.

SOURCE Josemaria Resources Inc.

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!