|

28.02.2022 13:00:00

|

Huntsman Mails Letter to Shareholders That Highlights Refreshed and Fit-for-Purpose Board and Underscores Starboard Nominees' Lack of Relevance to Huntsman's Transformed Portfolio

THE WOODLANDS, Texas, Feb. 28, 2022 /PRNewswire/ -- Huntsman Corporation (NYSE: HUN) today announced that it has mailed a letter to shareholders in connection with its upcoming Annual Meeting of Stockholders scheduled for March 25, 2022, urging shareholders to vote the WHITE proxy card "FOR ALL" of Huntsman's highly qualified directors standing for election. Stockholders of record as of February 1, 2022, will be entitled to vote at the meeting.

The full text follows and can be found at voteforhuntsman.com or on the investor relations section of the Company's website.

Dear Fellow Huntsman Shareholder:

On February 15, 2022, Huntsman reported a record year with its transformed product portfolio and – under the oversight of its purposefully refreshed Board of Directors – we are performing better than ever. Starboard, the New York-based hedge fund that bought 8.4% of our stock after our transformation was on the path to completion last year, does not care about our progress.

Starboard is pursuing an ill-conceived proxy contest to replace four valuable members of your refreshed Board with nominees who bring nothing but risk to the Company and the progress we have made. Starboard's contest is unnecessary and costly and is already threatening our demonstrated and sustainable momentum.

Do not put the long-term value of your investment at risk. Reject Starboard and vote "FOR ALL" of Huntsman's nominees listed on the WHITE proxy card.

HUNTSMAN TOTAL SHAREHOLDER RETURN OF ~98% OVER THE LAST FIVE YEARS DEMONSTRATES THAT WE ARE ON THE RIGHT PATH

As you know, Huntsman announced ambitious financial targets at our November 2021 Investor Day and then reaffirmed those targets when we reported our record fourth quarter and full year 2021 earnings. Our Adjusted EBITDA for the quarter was $349 million, a 45% increase from the prior year, and we delivered to shareholders continued, sustainable growth and margin improvement.

Under the Board's oversight, Huntsman's management team delivered a total shareholder return of ~98% over the last five years, ~13 percentage points better than the performance of the S&P 500 over the same period[1]. Directors Dr. Mary Beckerle and Daniele Ferrari are critical members of the Board that got us here. Together with your new Lead Independent Director and Non-Executive Vice Chair Cynthia Egan, José Muñoz and the rest of the Board, we are leading a continued commitment to Huntsman's "value over volume" and "upvaluing" product strategies, maintaining our demonstrated momentum, and delivering returns to you.

We urge shareholders to vote "FOR ALL" of Huntsman's nominees listed on the WHITE proxy card

STARBOARD'S DESTRUCTION OF VALUE IN THE CHEMICALS INDUSTRY PROVES THEIR PATH FORWARD IS NOT THE RIGHT PATH FOR HUNTSMAN OR YOU

In contrast to record results and significant value creation overseen by your Board here at Huntsman, Starboard destroyed significant shareholder value at the only chemical company whose board they ever controlled, GCP Applied Technologies (GCP). Just two years ago, Starboard ran a proxy fight for the board at GCP, replacing eight directors and both the CEO and CFO, and made three specific promises to GCP's shareholders: they would deliver 3-5% long-term revenue growth, 300-basis point improvement in gross margin and 300-basis point improvement in SG&A. They broke every one of these promises and, under Starboard's control, GCP lost value and drastically underperformed across each of these metrics.

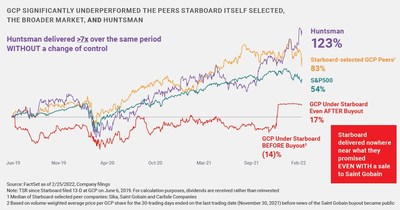

More specifically, Starboard-controlled GCP vastly underperformed Huntsman and its peers. Starboard first disclosed its GCP position on June 6, 2019 and has since delivered a TSR of only 17% through February 25, 2022[2], significantly underperforming compared not only to Huntsman's TSR of 123%[3] but also to every one of the peers Starboard self-selected for GCP over the same period.

And to be clear, GCP's 17% TSR includes the substantial premium that Saint Gobain agreed to pay for GCP[4]. Before Starboard-controlled GCP's sale was announced, its TSR was an astonishing -14% since Starboard disclosed its position.

In other words, Huntsman outperformed Starboard-controlled GCP by over 7x even without the benefit of a change of control premium. Starboard failed to deliver what they promised to GCP shareholders and destroyed value. Don't let Starboard and its short-term focus do that to your investment in Huntsman.

Starboard's abject failure at GCP is a cautionary tale for Huntsman shareholders. Do not be deceived by Starboard!

STARBOARD'S NOMINEES WILL BRING NO BENEFITS TO HUNTSMAN'S BOARD BECAUSE THEY LACK RELEVANT INDUSTRY & OPERATIONAL EXPERIENCE AND INDEPENDENCE

Make no mistake, Huntsman's directors are vastly superior to Starboard's four nominees. Starboard's nominees lack requisite expertise and, most importantly, do not have the needed current and relevant experience to oversee execution of Huntsman's market-tested strategy. Nor are they all truly independent, as referenced below, starting with Jim Gallogly, the long-retired CEO of refining and commodity chemical-maker LyondellBasell Industries, who self-describes his occupation as "philanthropy, ranching and private investing" and has no business experience in nearly a decade[5]:

- Mr. Gallogly's experience in the chemical industry is not only stale, but it is irrelevant to the skillset required to oversee Huntsman's differentiated portfolio and its value over volume strategy. Even when he was working, his entire career was spent in oil & gas, refineries, and commodity chemicals. Mr. Gallogly has no experience working in the downstream and differentiated chemical markets that drive Huntsman's sustainable portfolio today or in leading M&A transactions, much less the sort of bolt-on acquisitions that continue to be a critical element of our strategic plan going forward. As part of Huntsman's portfolio transformation, we divested the Company's lower value and more volatile commodity businesses – the only businesses in which Mr. Gallogly has relevant experience – and focused on a higher-margin, higher-growth mix of differentiated and downstream value-added products and sustainable solutions.

- Mr. Gallogly's experience exclusively in oil & gas, refineries, and commodity chemicals more than a decade ago may have been relevant to the Huntsman of yesterday, but it is entirely irrelevant to the Huntsman of today. Overseeing Huntsman's value over volume strategy requires up-to-date experience and expertise with the more complex and customer-focused markets served by our downstream and differentiated portfolio, and especially with our sustainability-focused platform of customer-driven and innovative solutions going forward.

There is no question that Mr. Gallogly's self-articulated strategy and vision as CEO of Lyondell is fully inconsistent with the direction Huntsman has been going for the past several years. His proposed service on our Board is also inconsistent with the unreserved support Starboard has given our portfolio transformation strategy that continues to move us away from commodity chemicals and towards the value over volume rewards that our differentiated and downstream products and solutions provide:

"There's several companies that like to talk about becoming more specialty oriented. We're very happy with who we are. We compete very well. We have a commodity mindset in the way that we maintain our cost, the way that we work our debottlenecks in adding cheap capacity. We also believe that very well run commodity chemical companies perform better across the cycle than specialty."[1]

Jim Gallogly

| "When Huntsman Initially IPO'd in 2005, the Company Was Primarily a Commodity-Focused Company. However, Over Time, Huntsman Has Improved Its Portfolio MixBy Focusing On Its More Attractive and Higher Margin Businesses."[2]

Starboard

|

You may hear from Starboard that Mr. Gallogly was successful at Lyondell. But Lyondell's improved financial performance and increased stock price benefitted massively from external factors that had nothing to do with Mr. Gallogly. Having just emerged from bankruptcy, Lyondell had the benefit of the "clean slate" that the bankruptcy provided – the legal right to reject onerous contracts and totally refinance its balance sheet – and, during Mr. Gallogly's tenure, Lyondell further benefited from a dramatic decline in the market prices for its primary raw materials. Even with these tailwinds, Lyondell's TSR under Mr. Gallogly underperformed its most comparable commodity chemical peer, Westlake Chemical Corporation.

You may also hear from Starboard that Mr. Gallogly understands Huntsman's business because Lyondell supplied Huntsman with various raw materials almost a decade ago when he was their CEO and Huntsman's portfolio was still commodity-laden. In fact, when Starboard first described Mr. Gallogly to Huntsman, they were still refusing to name their nominees, but they explicitly positioned the then-unnamed Gallogly as a long-time friend of the Huntsman family – hardly the sort of endorsement our Nominating & Corporate Governance Committee should be considering. In reality, Mr. Gallogly looks more like one of Starboard's serial director nominees than a truly independent director candidate. He was a Starboard-nominated candidate in another proxy contest at Corteva, where he ultimately was not appointed to the board, even though four other Starboard nominees were.

In that regard, he is no different from Susan Schnabel, who Starboard has also nominated to your Board just as they nominated her at Corteva where she too failed to be appointed to Corteva's board. Ms. Schnabel would bring absolutely no relevant experience or expertise:

- Ms. Schnabel has served on more than 25 boards of directors in her career but only three of them were in the chemical space, including Rockwood Holdings more than 13 years ago, and her most recent chemical sector experience was when she was recycled by her former Chairman at Rockwood more than five years ago to serve on the board of Versum Materials until 2019.

- Ms. Schnabel's other involvement in the chemical sector did not end well. She served as Lead Director of STR Holdings, a manufacturer of encapsulates used in solar panels, after it went public until she resigned in 2014. At STR, she described her role as being the "quarterback of the board"[8] and she also chaired the Nominating and Corporate Governance Committee and provided counsel to the President and CEO. During Ms. Schnabel's four-year tenure, STR's stock price declined nearly 95% from a peak of $83 per share to its closing price of $4.80 per share the day she resigned.

- Ms. Schnabel did not fare any better the one and only time she took an actual operating company job. In February 1997, she became the CFO of publicly-traded PetSmart, Inc., but she resigned just nine months later after leading the company through two disastrous financial reporting quarters. After the first, Ms. Schnabel had to admit that the company had "made some misguided decisions" and the shares "tumbled to a 12-month low."[9] After the second, during which PetSmart had to warn investors that its Q2 earnings would be bad and then delivered more "dismal numbers," she told markets that Q3 would need to be a 'transition' period with lingering weakness, and she quit three months later.[10]

- As a career investment banker and serial board member who performed poorly in her only C-suite role more than 25 years ago, Ms. Schnabel would add nothing relevant to the Huntsman Board.

Starboard's third nominee, Sandra Beach Lin, has not had any relevant operating experience in over a decade and she has never served as a C-suite executive in the chemical business. In fact, Ms. Beach Lin's only C-suite experience, when she was CEO at Calisolar, a solar cell manufacturer that employed fewer than 400 people, ended poorly. At Calisolar, Ms. Beach Lin lasted less than 18 months, burned through millions in her investors' money, alienated communities in California and Ohio, laid off nearly 25% of its workforce, and left the company considering more layoffs amid stalled expansion plans.

- Ms. Beach Lin's operating company experience, the most recent and relevant of which is over 12 years old, would not add any incremental value to the Huntsman Board, where your current directors José Muñoz, David Sewell, Curt Espeland, Daniele Ferrari and Peter Huntsman together have more than a century of active or recent industrials and materials sector executive and operating experience globally.

And finally, Jeff Smith is a hedge fund owner who is focused solely on his fund's short-term outlook, with an average holding period of 15-18 months, and does not have your longer-term interests at heart. As Starboard's CEO, Mr. Smith does not meet the rigorous criteria we look for in potential director candidates, including independence and deep and recent executive and operational experience. The Board already has a director with the long-time experience and perspective of a long-term focused, institutional investor – your Lead Independent Director and Non-Executive Vice Chair, Cynthia Egan – one of your directors Starboard is seeking to replace.

Starboard's nominees do not add any differentiation or value to your Board; If elected, they would destroy your investment and disrupt Huntsman's significant progress.

HUNTSMAN'S NOMINEES ARE BETTER QUALIFIED THAN THE STARBOARD CANDIDATES AND HAVE THE CURRENT AND RELEVANT EXPERTISE NEEDED TO ADVANCE HUNTSMAN'S STRATEGY

Cynthia Egan, Dr. Mary Beckerle, Daniele Ferrari and José Muñoz– along with the rest of your 10 Board nominees – all possess the necessary differentiated chemicals and industrials experience, R&D and customer-focused innovation focus, and portfolio management expertise, to effectively oversee the Company's sustainable long-term growth:

- Cynthia Eganbrings extensive investment company experience into the boardroom, having served in senior leadership positions at T. Rowe Price, Fidelity and several other well-respected asset management and financial services companies over the course of her career. Working closely with the fiduciaries of thousands of public and corporate defined contribution plan sponsors, she developed a deep understanding of, and an appreciation for, the responsibilities and fiduciary perspective of the long term investor. Her long-term investor orientation and fiduciary perspective are complemented by decades of strong executive oversight experience, demonstrated leadership, and financial acumen gained during her career and especially as a T. Rowe Price executive responsible for overseeing 2,900 retirement plans with more than 1.5 million participants.

- Cynthia serves as Huntsman's Vice Chair & Lead Independent Director.

- She also serves as the Chair of Huntsman's Nominating & Corporate Governance Committee.

- Dr. Mary C. Beckerle, whose tenure provides valuable and historical context and continuity to Huntsman's refreshed board, also contributes years of executive experience and R&D expertise to our critical areas of technology development and innovation. Dr. Beckerle is an internationally recognized scientist, an elected member of the prestigious National Academy of Sciences, who has served on the Advisory Committee of the National Institute of Health. Dr. Beckerle is also a hard-charging and successful CEO in the field of cancer treatment and research.

- Dr. Beckerle drove the transformation of the Huntsman Cancer Institute from an unranked and unrecognized cancer hospital into the 30th best cancer program in the country (out of more than 4,500 programs evaluated) and the only National Cancer Institute-designated Comprehensive Cancer Center in the Northwest.

- As CEO of the Institute, she now oversees a nationally-recognized cancer research and clinical care center with over $1 billion in revenue, more than 3,000 personnel, and an R&D spending budget of more than $100 million.

- Dr. Beckerle ensures historical context and continuity on our refreshed Board, gained during her 10 years of service on our Audit Committee, where she and her colleagues on the Committee oversaw the transformation of Huntsman's highly-leveraged balance sheet into an investment-grade balance sheet.

- Daniele Ferrariis a successful veteran of the differentiated chemicals business, having spent more than 35 years in the industry in numerous operational and executive roles in the U.S. and in Europe. He brings decades of relevant international market and operational experience to our Board, along with a deep understanding of how Huntsman can become the industry leader in sustainable solutions.

- As CEO of Versalis, formerly known as EniChem, Daniele completely transformed Italy's largest chemical company and fifth largest in Europe from a perennial money loser (-€481 million) to a money maker (peak profit of €495 million) in less than three years by cutting more than €250 million in costs and selling off, closing or re-purposing nearly 30% of its commodity chemical facilities.

- Daniele then established Versalis as a clear leader in the sustainable chemical industry by transforming the company's product portfolio from low value and money losing commodity chemicals to higher value, differentiated and sustainable products, the same transformation that Huntsman is continuing.

- He maintains close connections and relationships with key players in the industry and within relevant EU institutions by serving as President of Plastics Europe (past) and continuing to serve on the board of directors of Cefic, Europe's largest chemical trade association, as Vice President and the Chair of its nominating committee.

- José Muñoz, Global Chief Operating Officer of Hyundai Motor Company, brings to our boardroom strong operational and turn-around expertise, deep expertise in innovation, sales, marketing, and branding, and a track record of demonstrated success in restructuring global businesses and delivering profitable growth in the automotive sector, one of Huntsman's critical and growing markets.

- José directs global operations for the 10th largest automotive company in the world, employing more than 75,000 associates, selling nearly 4 million vehicles, and generating more than $85 billion in revenues in 2021, and is responsible for implementing Hyundai's electric vehicle fuel cell vehicle and mobility services strategies globally.

- As President and CEO of Hyundai Motor North America and Hyundai Motor America, José completely restructured Hyundai's U.S. and Americas operations, taking just three years to transform a region that lost more than $1 billion the year before he joined the company into Hyundai's top region globally with more $2 billion in profits in 2021. Hyundai brands have been the fastest growing in the U.S. market for three years in a row and Hyundai is now the top-ranked automaker in the U.S. (according to the IQS study by J.D. Power).

- His experience and insights into international vehicle markets, including emerging trends and key innovations, is especially valuable to Huntsman and our Board going forward.

YOUR BOARD IS SUBSTANTIALLY REFRESHED, HIGHLY QUALIFIED, INDEPENDENT AND ENGAGED

We are asking for your support to vote "FOR ALL" of the Company's director slate. Eight new independent directors have been appointed since 2018. The newest three of these directors, including José Muñoz, were identified by an independent, internationally recognized executive search firm and appointed in January 2022 as part of your Board's ongoing refreshment process.

The Huntsman Board is proud of our deliberate and thoughtful refreshment process, and we will continue to bring on diverse expertise and fresh perspectives committed to best-in-class accountability and oversight. Your Board is ideally positioned to oversee Huntsman's next chapter of growth to deliver substantial value to all shareholders.

YOUR VOTE IS CRITICAL TO ENSURE HUNTSMAN'S POSITIVE MOMENTUM

Your Board nominees are best qualified to guide our strategy, with the experience and expertise necessary to successfully deliver Huntsman's vision and drive enhanced shareholder value. Do not allow Starboard to derail Huntsman's positive trajectory by replacing four critical members of your Board. More importantly, Starboard has proposed no strategic plan or viable suggestions.

Protect the value of your investment and vote the WHITE proxy card today "FOR ALL" of Huntsman's highly qualified nominees TODAY.

We appreciate your support.

Sincerely,

Peter Huntsman, Chairman, President and Chief Executive Officer

Cynthia Egan, Lead Independent Director and Non-Executive Vice Chair

Advisors:

BofA Securities and Moelis & Company LLC are serving as financial advisors to Huntsman. Kirkland & Ellis LLP is serving as legal advisor to Huntsman.

About Huntsman:

Huntsman Corporation is a publicly traded global manufacturer and marketer of differentiated and specialty chemicals with 2021 revenues of approximately $8 billion. Our chemical products number in the thousands and are sold worldwide to manufacturers serving a broad and diverse range of consumer and industrial end markets. We operate more than 70 manufacturing, R&D and operations facilities in approximately 30 countries and employ approximately 9,000 associates within our four distinct business divisions. For more information about Huntsman, please visit the company's website at www.huntsman.com.

Social Media:

Twitter: www.twitter.com/Huntsman_Corp

Facebook: www.facebook.com/huntsmancorp

LinkedIn: www.linkedin.com/company/huntsman

Forward-Looking Statements

This press release includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements include statements concerning our plans, objectives, goals, financial targets, strategies, future events, future revenue or performance, capital expenditures, plans or intentions relating to acquisitions, divestitures or strategic transactions, including the review of the Textile Effects Division, business trends and any other information that is not historical information. When used in this press release, the words "estimates," "expects," "anticipates," "likely," "projects," "outlook," "plans," "intends," "believes," "forecasts," "targets," or future or conditional verbs, such as "will," "should," "could" or "may," and variations of such words or similar expressions are intended to identify forward-looking statements. These forward-looking statements, including, without limitation, management's examination of historical operating trends and data, are based upon our current expectations and various assumptions and beliefs. In particular, such forward-looking statements are subject to uncertainty and changes in circumstances and involve risks and uncertainties that may affect the Company's operations, markets, products, prices and other factors as discussed in the Company's filings with the Securities and Exchange Commission (the "SEC"). In addition, there can be no assurance that the review of the Textile Effects Division will result in one or more transactions or other strategic change or outcome. Significant risks and uncertainties may relate to, but are not limited to, ongoing impact of COVID-19 on our operations and financial results, volatile global economic conditions, cyclical and volatile product markets, disruptions in production at manufacturing facilities, timing of proposed transactions, reorganization or restructuring of the Company's operations, including any delay of, or other negative developments affecting the ability to implement cost reductions and manufacturing optimization improvements in the Company's businesses and to realize anticipated cost savings, and other financial, operational, economic, competitive, environmental, political, legal, regulatory and technological factors. Any forward-looking statement should be considered in light of the risks set forth under the caption "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2021, which may be supplemented by other risks and uncertainties disclosed in any subsequent reports filed or furnished by the Company from time to time. All forward-looking statements apply only as of the date made. Except as required by law, the Company undertakes no obligation to update or revise forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events.

Contacts:

Investors

Ivan Marcuse

VP, Investor Relations

Huntsman Corporation

(281) 719-4637

Or

Scott Winter

Innisfree M&A Incorporated

(212) 750-7271

Media

Gary Chapman

Huntsman Corporation

(281) 719-4324

Or

Steve Frankel / Meaghan Repko / Clayton Erwin

Joele Frank, Wilkinson Brimmer Katcher

(212) 355–4449

1 Represents the period from February 25, 2017 to February 25, 2022

2 FactSet as of 2/25/22, Company filings

3 Since June 6, 2019

4 Transaction announced November 30, 2021

5 Starboard definitive proxy statement filed February 10, 2022

6 LyondellBasell Earnings call, August 2014

7 Active-Passive Investor Summit Presentation, October 2021

8 "An ideal first step: if your goal is to be a public company director, start by 'going private…'" The Free Library. 12/22/13 Directors and Boards

9 "PetSmart Stock Slumps After Earnings Warning," The Buffalo News. 5/9/97

10 "Phoenix-Based PetSmart Reports Second-Quarter Loss," The Arizona Republic. 8/28/97

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/huntsman-mails-letter-to-shareholders-that-highlights-refreshed-and-fit-for-purpose-board-and-underscores-starboard-nominees-lack-of-relevance-to-huntsmans-transformed-portfolio-301491210.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/huntsman-mails-letter-to-shareholders-that-highlights-refreshed-and-fit-for-purpose-board-and-underscores-starboard-nominees-lack-of-relevance-to-huntsmans-transformed-portfolio-301491210.html

SOURCE Huntsman Corporation

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu Huntsman Corp.mehr Nachrichten

|

04.08.24 |

Ausblick: Huntsman gewährt Anlegern Blick in die Bücher (finanzen.net) | |

|

21.07.24 |

Erste Schätzungen: Huntsman informiert über die jüngsten Quartalsergebnisse (finanzen.net) |