Highlights

- New drill results from the Cortadera copper-gold porphyry deposit in Chile confirm growth of shallow resources at both Cuerpo 1and 2. These include:

CRP0148 - 156m grading 0.4% CuEq* (0.4% copper (Cu), 0.1g/t Gold (Au)) from surface, including 32m grading 0.6%CuEq* (0.5% copper (Cu), 0.2g/t gold (Au))from 90m depth

CRP0183 - 80m grading0.4% CuEq* (0.4% copper (Cu),0.1g/t gold (Au)) from 10m depth including 12m grading0.6%CuEq* (0.6% copper (Cu), 0.1g/t gold (Au)) from 44m depth

CRP0178 - 72m grading0.4% CuEq* (0.4% copper (Cu), 0.1g/t gold (Au)) from surface including 28m grading0.7%CuEq* (0.7% copper (Cu), 0.1g/t gold (Au)) from surface

CRP0176 - 114m grading 0.3% CuEq* (0.3% copper (Cu), 0.1g/t gold (Au)) from surface including 24m grading0.6%CuEq* (0.6% copper (Cu), 0.1g/t gold (Au)) from surface

CRP0158 - 62m grading0.4% CuEq* (0.4% copper (Cu), 0.1g/t gold (Au)) from 4m depth including 18m grading0.7%CuEq (0.6% copper (Cu), 0.2g/t gold (Au)) from 26m depth

- Exploration drilling commenced across the Productora central porphyry target, immediately adjacent to the Productora Mineral Resource - several large copper-gold targets scheduled for testing this year

- Further assay results from Cortadera being compiled for release in advance of a major resource upgrade in Q1 this year, following over 46,000m of additional drilling completed in 2021

Hot Chili Limited (ASX: HCH) (TSXV:HCH) (OTCQB: HHLKF) ('Hot Chili' or 'Company') is pleased to announce that recent drill results from its Cortadera copper-gold discovery continue to expand the deposit ahead of a global resource upgrade for the Company's Costa Fuego coastal copper development in Chile.

Three months of drilling results from the end of the Company's 2021 drilling campaign at Cortadera are being compiled and further announcements are expected.

Hot Chili's Managing Director, Christian Easterday, said 2022 is shaping up to be an exciting year following a very strong set of achievements in 2021.

'We commence the year with $34 million in treasury, 100 percent ownership of Cortadera, Glencore as a strategic investor and our Company now consolidated and dual-listed in Canada.

'It is pleasing to see further growth in Cortadera's open pit potential with these new drill results and we look forward to announcing further results soon.

'A resource upgrade this quarter and a combined pre-feasibility study in the third quarter will position Costa Fuego as a production front-runner in the senior copper development space this year.

'In addition, we have kicked off our next phase of growth, with first drilling well underway across the first of several large exploration targets we will be testing this year, all capable of materially lifting the scale and economics of Costa Fuego even further.'

New Drill Results Expand Shallow Resource Potential at Cortadera

Drilling in late 2021, focussed on expanding any remaining open flanks on each of Cortadera's three porphyries and completing required in-fill drill holes for upgrading resource classification.

Initial results analysed from shallow Reverse Circulation (RC) drilling across Cuerpo 1 and Cuerpo 2 has confirmed wide intersections of copper-gold mineralisation from surface across both porphyries.

Cuerpo 2 has recorded some of the highest grade copper results at Cortadera and the recent campaign to delineate the shallow mineralisation has proven successful. Expansion of the +0.4% CuEq mineralisation from surface was bolstered by several drillholes, particularly to the south and east of Cuerpo 2.

So far, up to five drillholes have recorded significant intercepts of +0.3% CuEq mineralisation at a maximum of 36 m downhole with the majority from less than 10 m downhole. This material is predominately within the oxidised weathering zone and suggests that an expansion of the +0.4% Cu material laterally and vertically is likely at Cuerpo 2.

In addition, several wide intersections of mineralisation were recorded across Cuerpo 1, further expanding the +0.3 CuEq* mineralisation extent.

2022 Drilling Campaign Underway

Hot Chili has commenced an initial 20,000m exploration drilling programme to test several prioritised, large copper-gold targets within its combined Costa Fuego landholding in Chile.

RC drilling commenced in late December 2021 across the Productora central target, located immediately adjacent to the Productora resource and measuring 1.2km by 1.0km in dimension.

Three of eight first-pass RC drill holes are complete, and several diamond hole extensions are planned once RC drill results are received.

Additional targets located within the consolidated Costa Fuego landholdings (Productora, Santiago Z and El Fuego) are scheduled for drilling over the coming months. The Company has received regulatory approval for platform clearing at Santiago Z, which is planned to commence in the coming month.

In addition, drilling is planned across multiple extensional targets located within the Cortadera landholding, outside of the Cortadera resource window.

All priority targets have been selected based on their potential to add further bulk tonnage scale to the Costa Fuego development or alternatively provide higher grade ore sources for early production.

News Flow and Key Catalysts in 2022

Hot Chili is fully funded for 18 months to accelerate its growth and development plan for Costa Fuego. The Company expects to provide further news flow over the coming weeks, including:

* Further Cortadera drilling results being received, reviewed and compiled from 2021 resource drilling.

* Development study updates related to advances in mining optimisations and metallurgical workstreams for the Costa Fuego combined Pre-feasibility study,

* Corporate updates, and

* Exploration drilling updates as results are received Key

Catalysts expected this year include:

1. Global Mineral Resource upgrade for Costa Fuego expected in Q1

2. Off-take agreement with Glencore (60% of first 8 years of production) expected in Q1

3. Pre-feasibility study for Costa Fuego expected in Q3

This announcement is authorised by the Board of Directors for release to ASX. For more information please contact:

Christian Easterday | Tel: +61 8 9315 9009 |

Managing Director - Hot Chili | Email: christian@hotchili.net.au |

Penelope Beattie | Tel: +61 8 9315 9009 |

Company Secretary - Hot Chili | Email: Penelope@hotchili.net.au |

ASX Investor |

Investor & Public Relations (Australia) | Email: eliza@asxinvestor.com.au |

Harbor Access LLC | Email:Graham.Farrell@harboraccessllc.com |

Investor & Public Relations (Canada) | Email:jonathan.paterson@harboraccessllc.com |

or visit Hot Chili's website at www.hotchili.net.au

Table 1 New Significant RC Drill Results at Cortadera

| Coordinates | Azim | Dip | Hole | Intersection | Interval | Copper | Gold | Silver | Molybdenum | Cu Eq |

Hole_ID | Depth |

| North | East | RL | | | | From | To | (m) | (% Cu) | (g/t Au) | (ppm Ag) | (ppm Mo) | (% Cu Eq) |

CRP0148 | 6813870 | 335545 | 993 | 84 | -61 | 252 | 0 | 252 | 252 | 0.3 | 0.1 | 0.6 | 4 | 0.4 |

| | | | | including | | 0 | 156 | 156 | 0.4 | 0.2 | 0.8 | 5 | 0.4 |

| | | | | or | | | | | | | | | |

including | 90 | 122 | 32 | 0.5 | 0.2 | 0.9 | 2 | 0.6 |

CRP0149 | 6813791 | 335636 | 1009 | 10 | -58 | 266 | 112 | 204 | 92 | 0.3 | 0.1 | 0.4 | 3 | 0.3 |

CRP0151 | 6813865 | 335540 | 992 | 169 | -75 | 162 | 0 | 124 | 124 | 0.2 | 0.1 | 0.5 | 15 | 0.3 |

CRP0152 | 6813938 | 335679 | 982 | 180 | -60 | 162 | 10 | 158 | 148 | 0.2 | 0.1 | 0.5 | 10 | 0.2 |

CRP0153 | 6813959 | 335619 | 977 | 31 | -60 | 102 | 36 | 86 | 50 | 0.3 | 0.1 | 0.5 | 18 | 0.3 |

CRP0154 | 6813959 | 335619 | 977 | 321 | -60 | 168 | 8 | 114 | 106 | 0.2 | 0.1 | 0.4 | 17 | 0.2 |

CRP0158 | 6813926 | 335491 | 977 | 200 | -60 | 150 | 4 | 66 | 62 | 0.4 | 0.1 | 0.6 | 11 | 0.4 |

| | | | | including | | 26 | 44 | 18 | 0.6 | 0.2 | 1 | 3 | 0.7 |

CRP0176 | 334831 | 6814172 | 953 | 143 | -71 | 252 | 0 | 114 | 114 | 0.3 | 0.1 | 0.6 | 46.8 | 0.3 |

| | | | | including | | 0 | 24 | 24 | 0.6 | 0.1 | 1.2 | 7.7 | 0.6 |

CRP0177 | 334735 | 6814270 | 976 | 10 | -60 | 294 | 14 | 34 | 20 | 0.3 | 0.1 | 0.5 | 34 | 0.3 |

CRP0178 | 334834 | 6814171 | 953 | 210 | -70 | 312 | 0 | 72 | 72 | 0.4 | 0.1 | 0.8 | 46 | 0.4 |

| | | | | including | | 0 | 28 | 28 | 0.7 | 0.1 | 1.5 | 17 | 0.7 |

CRP0183 | 334935 | 6814283 | 960 | 257 | -74 | 234 | 10 | 90 | 80 | 0.4 | 0.1 | 0.8 | 8 | 0.4 |

| | | | | including | | 44 | 56 | 12 | 0.6 | 0.1 | 1.1 | 12 | 0.6 |

| | | | | | and | 192 | 214 | 22 | 0.3 | 0 | 0.7 | 28 | 0.3 |

CRP0184 | 334814 | 6814328 | 957 | 199 | -75 | 150 | 0 | 80 | 80 | 0.2 | 0.1 | 0.3 | 3 | 0.2 |

| | | | | | and | 124 | 150 | 26 | 0.4 | 0.1 | 1.2 | 2 | 0.4 |

Significant intercepts are calculated above a nominal cut-off grade of 0.2% Cu. Where appropriate, significant intersections may contain up to 30m down-hole distance of internal dilution (less than 0.2% Cu). Significant intersections are separated where internal dilution is greater than 30m down-hole distance. The selection of 0.2% Cu for significant intersection cut-off grade is aligned with marginal economic cut-off grade for bulk tonnage polymetallic copper deposits of similar grade in Chile and elsewhere in the world.

Down-hole significant intercept widths are estimated to be at or around true-widths of mineralisation

* Copper Equivalent (CuEq) reported for the drill holes were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. Average Metallurgical Recoveries used were: Cu=83%, Au=56%, Mo=82%, and Ag=37%

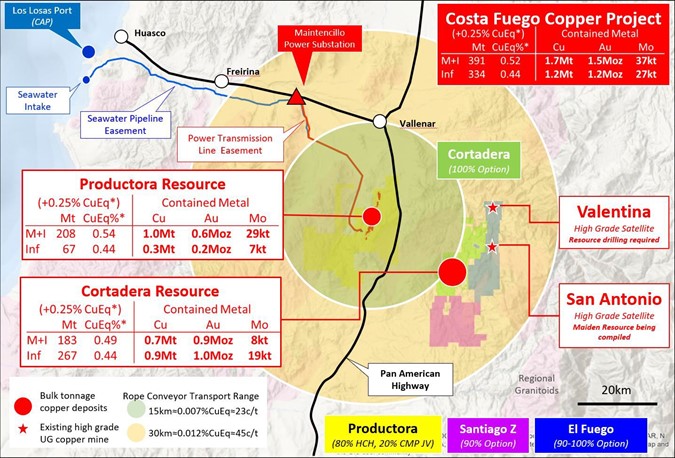

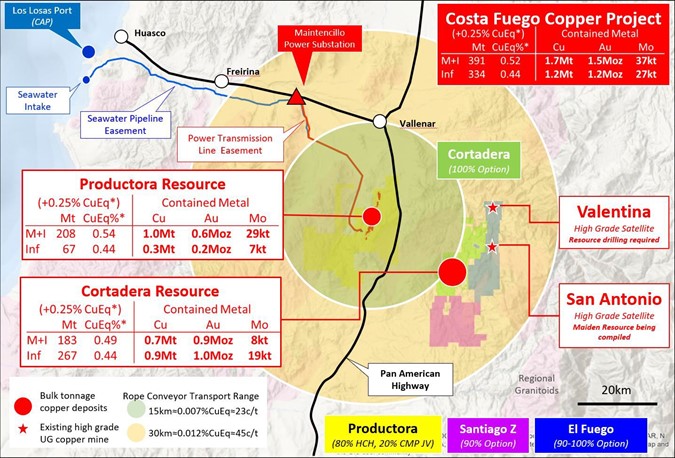

Figure 1 Location of Productora and the Cortadera discovery in relation to the coastal range infrastructure of Hot Chili's combined Costa Fuego copper project, located 600km north of Santiago in ChileRefer to ASX Announcement 'Costa Fuego Becomes a Leading Global Copper Project' (12th October 2020) for JORC Table 1 information related to the Cortadera JORC compliant Mineral Resource estimate by Wood and the Productora re-stated JORC compliant Mineral Resource estimate by AMC Consultants

* Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Reported on a 100% Basis - combining Cortadera and Productora Mineral Resources using a +0.25% CuEq reporting cut-off grade

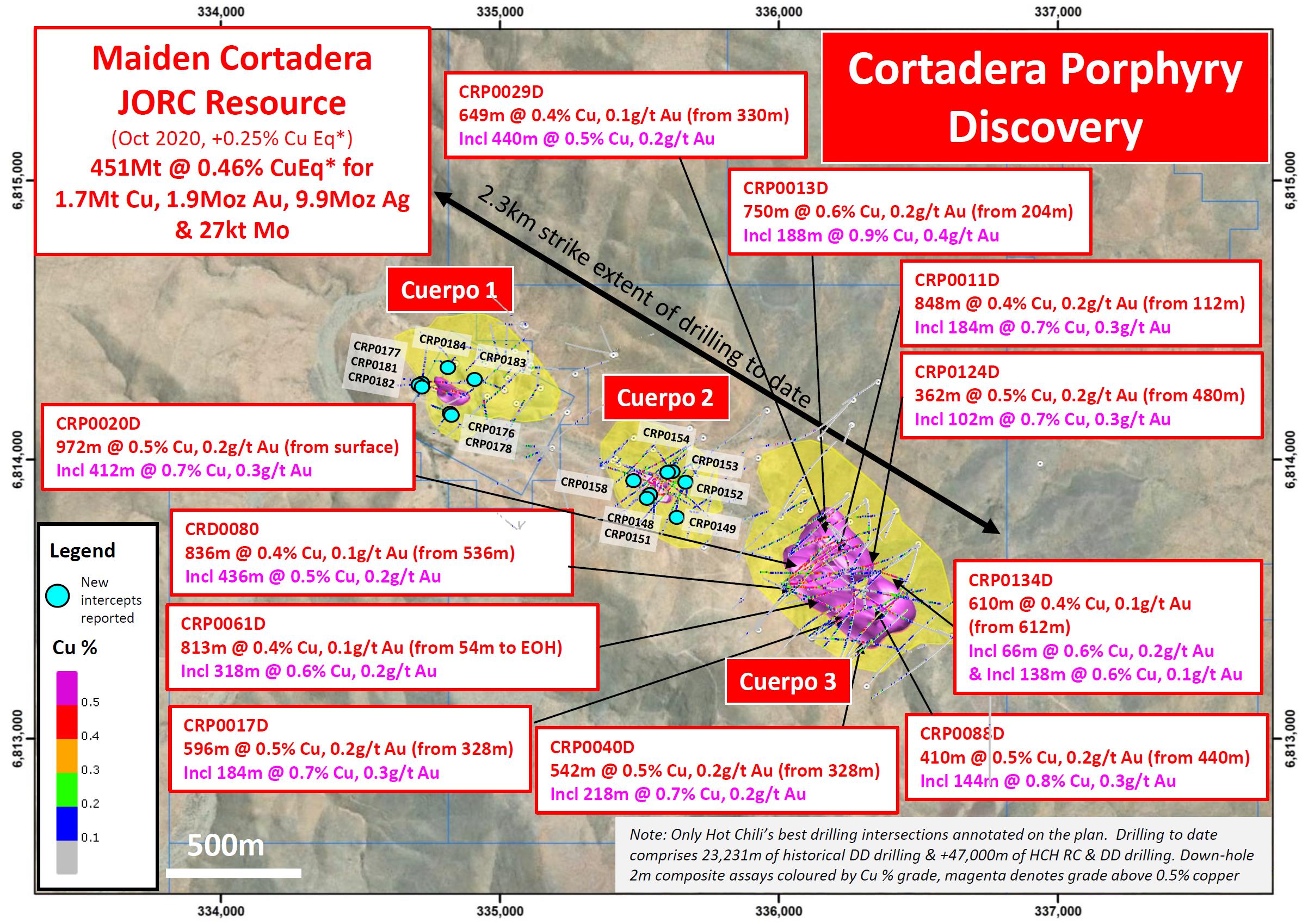

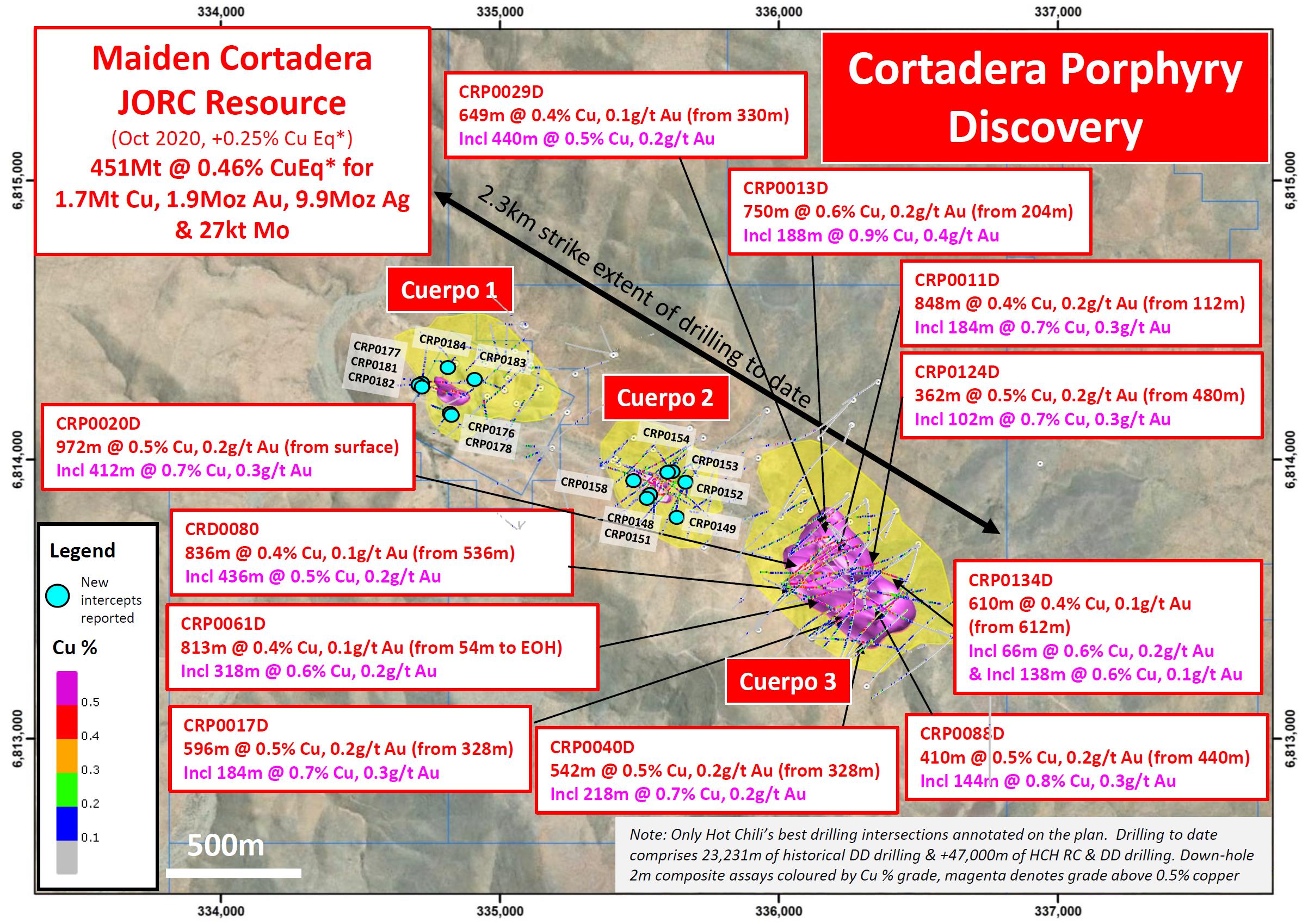

Figure 2 Plan view across the Cortadera discovery area displaying the location of new RC drill results (cyan) in relations to significant historical copper-gold DD intersections across Cuerpo 1, 2, and 3 tonalitic porphyry intrusive centres (represented by modelled copper envelopes, yellow- +0.1% Cu and magenta +0.4% Cu).

Figure 3 Plan view across the Cuerpo 1 of the Cortadera discovery area displaying significant copper-gold DD intersections since the October 2020 resource estimate. The plan view displays the Mineral Resource extents (represented by modelled copper envelope, yellow- +0.1% Cu). Note the new significant results reported including CRP0183, CRP0176 and CRP0178. All new results are shown by cyan collars.

Figure 4 Plan view across the Cuerpo 2 of the Cortadera discovery area displaying significant copper-gold DD intersections since the October 2020 resource estimate. The plan view displays the Mineral Resource extents (represented by modelled copper envelope, yellow- +0.1% Cu). Note the new significant results reported including CRP0158, and CRP0148. All new results are shown by cyan collars.

Figure 5 View across Productora resource looking SE. The figure displays the location of the Productora Central target where first-pass RC drilling is underway

Qualifying Statements

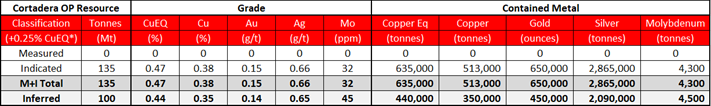

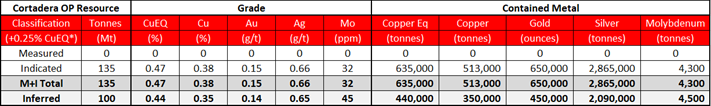

The Mineral Resource summary for the Costa Fuego Project is presented in the following tables.

Productora Mineral Resource Summary - reported by classification (open pit, using +0.25% CuEq cut-off grade), 28 October 2021

Reported at or above 0.25% CuEq*. Figures in the above table are rounded, reported to appropriate significant figures, and reported in accordance with CIM and NI-101. Metal rounded to nearest thousand, or if less, to the nearest hundred.

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula:: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1 % per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%

Cortadera Mineral Resource Summary - reported by classification (using +0.25% CuEq cut-off grade) and by open pit (top), underground (middle) and total (bottom), 28th October 2021

Reported at or above 0.25% CuEq*. Figures in the above table are rounded, reported to appropriate significant figures, and reported in accordance with CIM and NI 43-101. Metal rounded to nearest thousand, or if less, to the nearest hundred.

Copper Equivalent (CuEq) reported for the drill holes were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. Average Metallurgical Recoveries used were: Cu=83%, Au=56%, Mo=82%, and Ag=37%

** Note: Silver (Ag) is only present within the Cortadera Mineral Resource estimate

Competent Person's Statement- Exploration Results

Exploration information in this Announcement is based upon work compiled by Mr Christian Easterday, the Managing Director and a full-time employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a 'Competent Person' as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Competent Person's Statement- Productora Mineral Resources

The information in this Announcement that relates to the Productora Project Mineral Resources, is based on information compiled by Mr N Ingvar Kirchner. Mr Kirchner is employed by AMC Consultants (AMC). AMC has been engaged on a fee for service basis to provide independent technical advice and final audit for the Productora Project Mineral Resource estimates. Mr Kirchner is a Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM) and is a Member of the Australian Institute of Geoscientists (AIG). Mr Kirchner has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves' (the JORC Code 2012). Mr Kirchner consents to the inclusion in this report of the matters based on the source information in the form and context in which it appears.

Competent Person's Statement- Cortadera and Costa Fuego Mineral Resources

The information in this report that relates to Mineral Resources for the Cortadera and combined Costa Fuego Project is based on information compiled by Elizabeth Haren, a Competent Person who is a Member and Chartered Professional of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Elizabeth Haren is employed as an associate Principal Geologist of Wood, who was engaged by Hot Chili Limited. Elizabeth Haren has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Elizabeth Haren consents to the inclusion in the report of the matters based on her information in the form and context in which it appears. For further information on the Costa Fuego Project, refer to the technical report titled "Resource Report for the Costa Fuego Technical Report", dated December 13, 2021, which is available for review under Hot Chili's profile at www.sedar.com.

Reporting of Copper Equivalent

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery)+(Mo ppm × Mo price per g/t × Mo_recovery)+(Au ppm × Au price per g/t × Au_recovery)+ (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1 % per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,550 USD/oz, Mo=12 USD/lb, and Ag=18 USD/oz. For Cortadera (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

Forward Looking Statements

This Announcement is provided on the basis that neither the Company nor its representatives make any warranty (express or implied) as to the accuracy, reliability, relevance or completeness of the material contained in the Announcement and nothing contained in the Announcement is, or may be relied upon as a promise, representation or warranty, whether as to the past or the future. The Company hereby excludes all warranties that can be excluded by law. The Announcement contains material which is predictive in nature and may be affected by inaccurate assumptions or by known and unknown risks and uncertainties and may differ materially from results ultimately achieved.

The Announcement contains 'forward-looking statements'. All statements other than those of historical facts included in the Announcement are forward-looking statements including estimates of Mineral Resources. However, forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements. Such risks include, but are not limited to, copper, gold and other metals price volatility, currency fluctuations, increased production costs and variances in ore grade recovery rates from those assumed in mining plans, as well as political and operational risks and governmental regulation and judicial outcomes. The Company does not undertake any obligation to release publicly any revisions to any 'forward-looking statement' to reflect events or circumstances after the date of the Announcement, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. All persons should consider seeking appropriate professional advice in reviewing the Announcement and all other information with respect to the Company and evaluating the business, financial performance and operations of the Company. Neither the provision of the Announcement nor any information contained in the Announcement or subsequently communicated to any person in connection with the Announcement is, or should be taken as, constituting the giving of investment advice to any person

Disclaimer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Appendix 1. JORC Code Table 1 for Cortadera

Section 1 Sampling Techniques and Data

Criteria | JORC Code explanation | Commentary |

Sampling techniques | Nature and quality of sampling (e.g. cut channels, random chips, or specific specialised industry standard measurement tools appropriate to the minerals under investigation, such as down hole gamma sondes, or handheld XRF instruments, etc.). These examples should not be taken as limiting the broad meaning of sampling. Include reference to measures taken to ensure sample representivity and the appropriate calibration of any measurement tools or systems used. Aspects of the determination of mineralisation that are Material to the Public Report. In cases where 'industry standard' work has been done this would be relatively simple (e.g. 'reverse circulation drilling was used to obtain 1 m samples from which 3 kg was pulverised to produce a 30 g charge for fire assay'). In other cases more explanation may be required, such as where there is coarse gold that has inherent sampling problems. Unusual commodities or mineralisation types (eg submarine nodules) may warrant disclosure of detailed information. | Drilling undertaken by Hot Chili Limited ('HCH' or 'the Company') includes both Diamond and Reverse Circulation (RC). Drilling has been carried out under Hot Chili (HCH) supervision by an experienced drilling contractor (BlueSpec Drilling). The majority of DD drilling completed by HCH comprises RC pre-collars to an average depth of 300), followed by HQ3 DD core to an average depth of 660m, followed by NQ2 DD core at depths greater than approximately 660 metres. Samples were obtained using both reverse circulation (RC) and diamond drilling (DD). RC drilling produced a 1m bulk sample and representative 2m cone split samples (nominally a 12.5% split) were collected using a cone splitter, with sample weights averaging 5 kg. Geological logging was completed, and mineralised sample intervals were determined by the geologists to be submitted as 2m samples for RC. In RC intervals assessed as unmineralised, 4m composite (scoop) samples were collected for analysis. If these 4m composite samples return results with anomalous grade the corresponding original 2m split samples are then submitted to the laboratory for analysis. HQ3 and NQ2 diamond core were drilled on a 3m run. The core was cut using a manual core-saw and half core samples were collected on 2m intervals. Both RC and DD samples were crushed and split at the laboratory, with up to 1kg pulverised, and a 150g pulp sample analysed by industry standard methods - ICP-OES (33 element, 4 acid digest) and Au 30 gram fire assay. Sampling techniques used are deemed appropriate for exploration and resource estimation purposes for this style of deposit and mineralisation. Data compiled from historical drilling has been collated from documents supplied by SCM Carola. All historical drilling was diamond core (DD) from surface. Historical diamond sampling was predominantly HQ3 half core. 99% of the sample data comprises 2m composited samples (taken at 2m intervals). Assay techniques for legacy data comprise 30g fire assay for gold, and for copper, either 4-acid or 3-acid digest followed by either an ICP-OES, ICP-MS, ICP-AAS or HF-ICP-AES. HCH has verified as much as possible the location, orientation, sampling methods, analytical techniques, and assay values of legacy data. HCH has completed a review of SCM Carola QA/QC data with no issues detected in that review. |

Drilling techniques | Drill type (eg core, reverse circulation, open-hole hammer, rotary air blast, auger, Bangka, sonic, etc) and details (eg core diameter, triple or standard tube, depth of diamond tails, face-sampling bit or other type, whether core is oriented and if so, by what method, etc). | HCH drilling consisted of RC with face sampling bit (140 to130mm diameter) ensuring minimal contamination during sample extraction. HCH DD drilling uses NQ2 bits (50.5mm internal diameter) and HQ3 bits (61.24mm internal diameter). DD core was oriented using a Reflex ACT III RD tool. At the end of each run, the low side of the core was marked by the drillers and this was used at the site for marking the whole drill core with a reference line. Historical DD drilling used HQ bits (61.24mm internal). Historical drill core was not oriented. |

Drill sample recovery | Method of recording and assessing core and chip sample recoveries and results assessed. | Core recovery was measured and recorded continuously from the start of core drilling to the end of the hole for each drill hole. The end of each 3m length run was marked by a |

| Measures taken to maximise sample recovery and ensure representative nature of the samples. Whether a relationship exists between sample recovery and grade and whether sample bias may have occurred due to preferential loss/gain of fine/coarse material. | core block which provided the depth, the core drilled and the core recovered. Generally, the core recovery was >99% All DD drilling utilised HQ3 and NQ2 core with sampling undertaken via half core cutting and 2m sample intervals. Drilling techniques to ensure adequate RC sample recovery and quality included the use of 'booster' air pressure. Air pressure used for RC drilling was 700-800psi. Logging of all samples followed established company procedures which included recording of qualitative fields to allow discernment of sample quality. This included (but was not limited to) recording: sample condition (wet, dry, moist), sample recovery (poor, moderate, good), sample method (RC: scoop, split; DD core: half, quarter, whole). The majority of HCH drilling had acceptable documented recovery and expectations on the ratio of wet and dry drilling were met, with no bias detected between the differing sample conditions. Historical DD core recovery has not been quantitatively assessed. However, inspection of core photography has been undertaken, with good core recovery observed, and no material issues noted. Methods taken to maximise historical sample recovery, quality and condition are unknown, however it is noted that the drill method (HQ3 DD) is consistent with best practice for sample recovery. No analysis of historical samples weights, sample condition or recovery has been undertaken. Twin analysis of RC and DD drilling has identified a slight sample bias. RC samples appear to display a negative bias for assay results, meaning that RC samples appear to under call the assay grades. This is not yet fully understood or confirmed, and requires further analysis and investigation with future twin holes. |

Logging | Whether core and chip samples have been geologically and geotechnically logged to a level of detail to support appropriate Mineral Resource estimation, mining studies and metallurgical studies. Whether logging is qualitative or quantitative in nature. Core (or costean, channel, etc) photography. The total length and percentage of the relevant intersections logged. | HCH Drilling: Detailed descriptions of RC chips and diamond core were logged qualitatively for lithological composition and texture, structures, veining, alteration and copper speciation. Visual percentage estimates were made for some minerals, including sulphides. Geological logging was recorded in a systematic and consistent manner such that the data was able to be interrogated accurately using modern mapping and 3D geological modelling software programs. Field logging templates were used to record details related to each drill hole. |

| | Historical Drilling: Geological logs were provided as part of historical data from SCM Carola. These logs have been reviewed and are deemed to be of an appropriate standard. HCH has also completed a verification and re-logging programme of historical diamond drill core and has aligned the codification of both generations of geological data to one unified coding system. |

| | Core reconstruction and orientation was completed where possible prior to structural and geotechnical observations being recorded. The depth and reliability of each orientation mark is also recorded. |

| | All logging information is uploaded into an acQuire(TM) database which ensures validation criteria are met upon upload. |

Sub- sampling techniques and sample preparation | If core, whether cut or sawn and whether quarter, half or all core taken. If non-core, whether riffled, tube sampled, rotary split, etc and whether sampled wet or dry. | HQ3 (85mm) and NQ2 (63.5mm) diamond core was sawn in half, with half core collected in a bag and submitted to the laboratory for analysis, the other half was retained in the tray and stored. All DD core was sampled at 2m intervals. RC drilling was sampled at two metre intervals by a fixed cone splitter with two nominal 12.5% samples taken: with the primary sample submitted to the laboratory, and the second sample retained as a field duplicate sample. Cone splitting of RC drill samples occurred regardless of the sample condition. RC drill sample weights range from 0.6kg to 17kg, but typically average 5kg. All HCH samples were submitted to ALS Coquimbo (Chile) for multi-element analysis. The sample preparation included: DD half core and RC samples were weighed, dried and crushed to 70% passing 2 mm and then split using a rotary splitter to produce a 1kg sub-sample. The crushed sub- |

| For all sample types, the nature, quality and appropriateness of the sample preparation technique. |

| Quality control procedures adopted for all sub-sampling stages to maximise representivity of samples. |

| Measures taken to ensure that the sampling is representative of the in situ material collected, including for instance results for field duplicate/second-half sampling. |

| Whether sample sizes are appropriate to the grain size of the material being sampled. |

| | sample was pulverised with 85% passing 75 m using a LM2 mill and a 110 g pulp was then subsampled, 20 g for ICP and 90g for Au fire assay analysis. ALS method ME-ICP61 involves a 4-acid digestion (Hydrochloric-Nitric-Perchloric-Hydrofluoric) followed by ICP- AES determination. Samples that returned Cu grades >10,000ppm were analysed by ALS 'ore grade' method Cu-AA62, which is a 4- acid digestion, followed by AES measurement to 0.001%Cu. Samples determined by geologists to be either oxide or transitional were also analysed by Cu-AA05 method to determine copper solubility (by sulphuric acid). Pulp samples were analysed for gold by ALS method Au- ICP21; a 30g lead-collection Fire Assay, followed by ICP- OES to a detection limit of 0.001ppm Au. Historical half DD core was routinely sampled on 2m intervals. All samples were submitted to accredited laboratories- ACTLAB, ACME Labs (now Bureau Veritas), ALS Global and Andes Analytical Assay. Typical analysis methods used for historical samples included; For copper and multi-element; either 4-acid or 3-acid digest followed by either an ICP-MS, ICP-AAS, or a HF digest with ICP-AES. E.g. ACTLAB method 3ACID-AAS, ALS method Cu-AA61, Andes Analytical Assay method (4A-AAS1E01 or ICP_AES_HH22). Gold grades were analysed for Fire Analysis (30g charge). E.g. ACTLABS method FA-AAS, ALS method Au-AA23, Andes Analytical Assay method AEF_AAS1EE9. HCH has verified historical sampling methods, analytical techniques, and assay values with no material issues identified. Field duplicates were collected for RC drill samples at a rate of 1 in 50 drill meters ie. 1 in every 25 samples (when 2m sampling intervals observed). The procedure involves placing a second sample bag on the cone splitter to collect a duplicate sample. Field duplicates for DD samples were submitted at a rate of 1 in 50 drill metres (ie. 1 in 25 samples). The procedure involves cutting the half core and the lab (instructed by Hot Chili) collected a second coarse duplicate sample after the initial crushing process of the original sample. Crushed samples were split into two halves, with one half flagged as the original sample and the other half flagged as the duplicate sample. Review of duplicate results indicates that there is good correlation between the primary and duplicate assay values, implying that the selected sample size is reasonable for this style of mineralisation. The selected sample sizes and sample preparation techniques are considered appropriate for this style of mineralisation, both for exploration purposes and MRE. |

Quality of assay data and laboratory tests | The nature, quality and appropriateness of the assaying and laboratory procedures used and whether the technique is considered partial or total. For geophysical tools, spectrometers, handheld XRF instruments, etc, the parameters used in determining the analysis including instrument make and model, reading times, calibrations factors applied and their derivation, etc. Nature of quality control procedures adopted (eg standards, blanks, duplicates, external laboratory checks) and whether acceptable levels of accuracy (ie lack of bias) and precision have been established. | All HCH drill samples were assayed by industry standard methods through accredited laboratories in Chile. Typical analytical methods are detailed in the previous section and are considered 'near total' techniques. HCH undertakes several steps to ensure the quality control of assay results. These include, but are not limited to, the use of duplicates, certified reference material (CRM) and blank media: Routine 'standard' (mineralised pulp) Certified Reference Material (CRM) was inserted at a nominal rate of 1 in 25 samples. Blank certified material is inserted every 100 samples (Coarse unmineralised quartz) at the logging geologist's discretion- with particular weighting towards submitting blanks immediately following mineralised field samples. Routine field duplicates for RC and DD samples were submitted at a rate of 1 in 25 samples. Analytical laboratories provided their own routine quality controls within their own practices. No significant issues have been noted. |

| | All results are checked in the acQuire(TM) database before being used, and analysed batches are continuously reviewed to ensure they are performing within acceptable tolerance for the style of mineralisation. Any QC failures require the batch to be re-analysed prior to acceptance into the database. No umpire laboratory checks have been undertaken by HCH. It is a recommendation of the MRE that umpire checks be completed. Assessment of historical QA/QC data was undertaken as part of the MRE. CRM and duplicate assay data were reviewed with no significant issues identified. Umpire laboratory checks were undertaken on historical drilling, however the results of this have not yet been assessed. Historical assay data comprised approximately 10% QA/QC data. |

Verification of sampling and assaying | The verification of significant intersections by either independent or alternative company personnel. The use of twinned holes. Documentation of primary data, data entry procedures, data verification, data storage (physical and electronic) protocols. Discuss any adjustment to assay data. | All DD sample intervals were visually verified using high quality core photography, with selected samples taken within mineralised intervals for petrographic and mineragraphic microscopy. All assay results have been compiled and verified by an independent database consultant to ensure veracity of assay results and the corresponding sample data. This includes a review of QA/QC results to identify any issues prior to incorporation into the Company's geological database. |

| | No adjustment has been made to assay data following electronic upload from original laboratory certificates to the database. Where samples returned values below the detection limit, these assay values were set to half the lowest detection limit for that element for the purposes of MRE. |

| | The capture of drill logging data was managed by a computerised system and strict data validation steps were followed. The data is stored in a secure acQuire(TM) database with access restricted to an external database manager. |

| | Documentation of primary data, data entry procedures, data verification and data storage protocols have all been validated through internal database checks and by a third- party audit as part of the Cortadera MRE. |

| | Visualisation and validation of drill data was also undertaken in 3D through the use of multiple software packages- Surpac, Datamine and Leapfrog with no errors detected. |

| | Twinned drilling was completed by HCH, to compare the results of RC samples to historical HQ DD samples. Four sets of twin drill holes were completed, with no appreciable assay variance observed between the different drilling and associated sampling methodologies. |

| | A slight negative bias was observed for RC samples in select intervals, however overall, the twin hole assay results correlated well for both techniques. This supports the use of both RC or DD samples as being representative and appropriate for mineral exploration and resource estimation for this style of mineralisation. |

| | Hot Chili has undertaken quarter core duplicate sampling across selected intervals of historical half DD core and its own DD core to test assay repeatability and to provide metallurgical samples. |

| | An analysis of field duplicate samples was undertaken, with results from duplicates returned within acceptable range for this type of mineralisation and for classification of the MRE. The comparison showed no evidence of bias, with a robust correlation achieved between duplicate samples. |

| | All retained core and pulp samples are stored in a secured site and are available for verification if required. |

Location of data points | Accuracy and quality of surveys used to locate drill holes (collar and down-hole surveys), trenches, mine workings and other locations used in Mineral Resource estimation. Specification of the grid system used. Quality and adequacy of topographic control. | The WGS84 UTM zone 19S coordinate system was used for all undertakings. Drill hole collar locations were surveyed on completion of each drill hole using a handheld Garmin GPS with an accuracy of +/-5 m. On completion of each HCH drill campaign an independent survey company was contracted to survey drill collar locations using a CHCNAV model i80 Geodetic GPS, dual frequency, Real Time with 0.1cm accuracy. |

| | Drill collar survey methods used by SCM Carola are unknown, however all collars were located by HCH and have been surveyed using the same method as HCH drilling. |

| | Downhole surveys for HCH drilling were completed by the drilling contractor every 30m using an Axis Champ Navigator north seeking gyroscope tool. Downhole surveys for historical drilling were completed every 10m by gyroscope. Exact specifications for the gyroscope tool are unknown. Some drill holes could not be surveyed due to downhole blockages, these holes used planned survey or compass bearing/ dip measurements for survey control, and the majority of these holes lie outside of the resource area. The topographic model used at Cortadera is deemed adequate for topographic control. It comprises a high resolution topographical elevation model as supplied by SCM Carola. Validation of the final topographical model used for resource estimation was completed via visual validation against: high resolution drone orthophotography, drill collars, and known infrastructure (roads, tenement pegs etc.) Topography at the project ranges from ~900m to 1050m ASL. PSAD56 zone 19S coordinate system was used for all historical undertakings, with all data since converted to WGS84 zone 19S. |

Data spacing and distribution | Data spacing for reporting of Exploration Results. Whether the data spacing and distribution is sufficient to establish the degree of geological and grade continuity appropriate for the Mineral Resource and Ore Reserve estimation procedure(s) and classifications applied. Whether sample compositing has been applied. | Drill spacing is nominally 80 metres across strike by 80 metres along strike. In total there were 82 drillholes used to inform the Cortadera geological model, of which 72 were contained within the mineralisation wireframe used to constrain the MRE. The current drilling density provides sufficient information to support a robust geological and mineralisation interpretation as the basis for Indicated and Inferred Mineral Resources for the majority of the drill defined deposit. The mineralisation is still open laterally and at depth and further drilling is planned to explore these zones in 2021 and beyond. Compositing of drillhole samples was undertaken on 2 metre intervals, and in some cases 4 metre intervals in unmineralised areas. |

Orientation of data in relation to geological structure | Whether the orientation of sampling achieves unbiased sampling of possible structures and the extent to which this is known, considering the deposit type. If the relationship between the drilling orientation and the orientation of key mineralised structures is considered to have introduced a sampling bias, this should be assessed and reported if material. | The spacing and location of drilling at Cortadera is variable, ranging from 80m to 300m. The selected drill spacing and orientation over the resource area ensures that drilling is optimised to intersect perpendicular to mineralisation. The majority of drilling was oriented from -60 to -80° toward northeast, with some scissor holes drilled to the southwest. In addition, some other drill orientations were used to ensure geological representivity and to maximise the use of available drill platforms. The orientation of drilling is considered appropriate for this style of mineralisation, and no sampling bias is inferred from drilling completed as part of the MRE. In addition, copper-gold porphyry mineralisation is typically fairly homogenous meaning a limited chance of bias likely to be caused from drilling orientation. The coordinates and orientations for all of the historical Cortadera drill holes have been reported to ASX in Table 1, Section 2 of the Company's previous drilling announcements, most recently 10th July 2020. |

Sample security | The measures taken to ensure sample security. | HCH has strict chain of custody procedures that are adhered to. All samples have the sample submission number/ticket inserted into each bulk polyweave sample bag with the id number clearly visible. The sample bag is stapled together such that no sample material can spill out and no one can tamper with the sample once it leaves Hot Chili's custody. Measures taken to ensure sample security during historical drilling are unknown. All retained core and pulp samples are currently stored in a secured warehouse facility and are available for verification if required. |

Audits or reviews | The results of any audits or reviews of sampling techniques and data. | As part of the Cortadera MRE WoodPLC have conducted an independent review of the drill database. This review has |

| | found the data to be accurate and acceptable for MRE purposes. |

About Hot Chili

Hot Chili Limited is a mineral exploration company with assets in Chile. The Company's flagship project, Costa Fuego, is the consolidation into a hub of the Cortadera porphyry copper-gold discovery and the Productora copper-gold deposit, set 14 km apart in an excellent location - low altitude, coastal range of Chile, infrastructure rich, low capital intensity.The Costa Fuego landholdings, contains an Indicated Resource of 391Mt grading 0.52% CuEq (copper equivalent), containing 1.7 Mt Cu, 1.5 Moz Au, 4.2 Moz Ag, and 37 kt Mo and an Inferred Resource of 334Mt grading 0.44% CuEq containing 1.2Mt Cu, 1.2 Moz Au, 5.6 Moz Ag and 27 kt Mo, at a cut-off grade of 0.25% CuEq.The Company is working to advance its Costa Fuego Project through a preliminary feasibility study (followed by a full FS and DTM), and test several high-priority exploration targets.

Certain statements contained in this news release, including information as to the future financial or operating performance of Hot Chili and its projects may include statements that are "forward-looking statements" which may include, amongst other things, statements regarding targets, estimates and assumptions in respect of mineral reserves and mineral resources and anticipated grades and recovery rates, production and prices, recovery costs and results, and capital expenditures and are or may be based on assumptions and estimates related to future technical, economic, market, political, social and other conditions.These forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Hot Chili, are inherently subject to significant technical, business, economic, competitive, political and social uncertainties and contingencies and involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from estimated or anticipated events or results reflected in such forward-looking statements.

Hot Chili disclaims any intent or obligation to update publicly or release any revisions to any forward-looking statements, whether as a result of new information, future events, circumstances or results or otherwise after the date of this news release or to reflect the occurrence of unanticipated events, other than as may be required by law. The words "believe", "expect", "anticipate", "indicate", "contemplate", "target", "plan", "intends", "continue", "budget", "estimate", "may", "will", "schedule" and similar expressions identify forward-looking statements.

All forward-looking statements made in this news release are qualified by the foregoing cautionary statements. Investors are cautioned that forward-looking statements are not a guarantee of future performance and accordingly investors are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Contact DetailsInvestor Relations

Graham Farrell

+1 416-842-9003

Graham.Farrell@harboraccessllc.com

Investor Relations

Jonathan Paterson

+1 475-477-9401

Jonathan.Paterson@HarborAccessllc.com

Hot Chili, CEO

Christian EasterDay

admin@hotchili.net.au

Company Websitehttps://www.hotchili.net.au/investors/

News Source: News Direct

13.01.2022 Dissemination of a Corporate News, transmitted by DGAP - a service of EQS Group AG.

The issuer is solely responsible for the content of this announcement.

The DGAP Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases.

Archive at www.dgap.de

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!