|

21.10.2020 23:15:00

|

Core Lab Reports Third Quarter 2020 Results From Continuing Operations:

AMSTERDAM, Oct. 21, 2020 /PRNewswire/ -- Core Laboratories N.V. (NYSE: "CLB US" and Euronext Amsterdam: "CLB NA") ("Core", "Core Lab", or the "Company") reported that continuing operations resulted in third quarter 2020 revenue of $105,400,000. Core's operating income was $11,300,000, with earnings per diluted share ("EPS") of $0.07, all in accordance with U.S. generally accepted accounting principles ("GAAP"). Operating income, ex-items, a non-GAAP financial measure, was $12,300,000, yielding operating margins of 12% and EPS, ex-items, of $0.16. A full reconciliation of non-GAAP financial measures is included in the attached financial tables.

The sequential decline in revenue was attributable to continued global industry disruptions associated with COVID-19, as well as four tropical weather systems impacting the Gulf of Mexico during the third quarter of 2020. Geographically, the sequential revenue decline was primarily associated with a decrease in both international product sales, as well as lower activity on international projects. Improved revenue from the U.S. land market was offset by Gulf Coast storm-related disruptions.

Previously announced Cost Reduction Plans (Phase 1 and Phase 2), totaling $61,000,000 of annualized cost savings, have now been fully implemented and were completed in the third quarter of 2020, in line with Core's previously stated expectations. Core's management will continue to evaluate further options to align the Company's cost structure with anticipated client activity as necessary.

Core's CEO, Larry Bruno stated, "Core's third quarter results display both the durability and adaptability of the business model, along with the benefit of our cost reduction plans, as Core continued to generate free cash flow despite the aforementioned industry disruptions. Core's global exposure, talented and dedicated staff, along with our expanding line of proprietary and patented products and services, have us well positioned to navigate today's market and capitalize on future opportunities".

Liquidity, Free Cash Flow, Private Placement Notes and Dividend

During the third quarter of 2020, Core continued to generate free cash flow ("FCF"), with cash from operations of $20,700,000 and incurred capital expenditures of $2,200,000, yielding FCF of $18,500,000. The third quarter of 2020 marks the 76th consecutive quarter that the Company generated positive FCF, despite challenging market and industry conditions. Free cash was almost entirely focused towards reducing the Company's debt, with net debt reduced by $16,200,000 during the third quarter of 2020. Core will continue applying its excess free cash flow towards debt reduction for the foreseeable future.

As previously announced on 16 October 2020, Core Lab entered into an agreement to issue $60,000,000 of new fixed-rate long-term senior notes ("Notes") through a private placement to extend the maturity for a portion of the Company's long-term debt. The Note Purchase Agreement was signed on 16 October 2020, with funding to occur 12 January 2021.

The following table summarizes the terms of the new Notes:

Instrument | Face Value ($ Millions) | Term | Interest | Maturity Date | ||||||||

U.S. Private Placement Notes | $ | 45.0 | 5-Year | 4.09% | 12 January 2026 | |||||||

U.S. Private Placement Notes | 15.0 | 7-Year | 4.38% | 12 January 2028 | ||||||||

TOTAL | $ | 60.0 | ||||||||||

The net proceeds from the new Notes are intended to be used exclusively to reduce outstanding debt on the Company's revolving credit facility ("Credit Facility"), thus increasing the available borrowing capacity by $60,000,000. The Company's Credit Facility has an aggregate borrowing capacity of $225,000,000, of which $116,000,000 was outstanding as of 30 September 2020. The Company's CFO, Chris Hill, had the following statement, "This transaction accomplishes two goals as we manage the Company's corporate debt structure through the disruptions associated with the COVID-19 pandemic. First, it provides additional liquidity under the Company's Credit Facility to address the outstanding $75 million senior notes maturing 30 September 2021, and second, issuing $60 million in new Notes and retiring $75 million of existing notes next year is an additional step toward our long-term strategy of reducing debt and Core Lab's debt leverage ratio". The new Notes include certain financial covenants that align with the financial covenants under the Company's Credit Facility, limiting total Company net debt to a maximum leverage ratio and requiring a minimum interest coverage ratio.

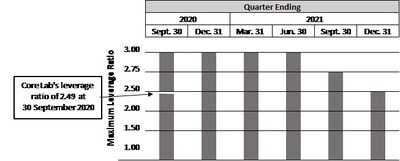

Quarter Ending 2020 2021 Jun. 30 Sept. 30Dec. 31Mar. 31Jun. 30Sept. 30Dec. 31 Maximum Leverage Ratio 3.00 2.75 2.50 2.00 1.50 1.00 Core Lab's leverage ratio of 2.21 at 30 June 2020

As of 30 September 2020, the Company's leverage ratio was 2.49 to 1, with $96,000,000 of excess capacity under the Credit Facility. As stated earlier, the proceeds from the new Notes on 12 January 2021 are intended to reduce outstanding debt on the Company's Credit Facility and provide an additional $60,000,000 of borrowing capacity and liquidity. The Company anticipates it will continue to generate positive cash flow and reduce net debt, while maintaining ample liquidity.

On 17 July 2020, the Board announced a quarterly cash dividend of $0.01 per share of common stock, which was paid on 10 August 2020 to shareholders of record on 27 July 2020. Dutch withholding tax was deducted from the dividend at a rate of 15%.

On 15 October 2020, the Board announced a quarterly cash dividend of $0.01 per share of common stock, payable on 17 November 2020 to shareholders of record on 26 October 2020. Dutch withholding tax will be deducted from the dividend at a rate of 15%.

Reservoir Description

Reservoir Description revenue in the third quarter of 2020 was $80,100,000, down 9% sequentially. Operating income for the third quarter of 2020 on a GAAP basis was $11,000,000, while operating income, ex-items, was $11,700,000, yielding operating margins, ex-items, of 15%, down slightly more than 200 BPS sequentially. Revenue, operating income, and margins were all affected by both continued COVID-19 project disruptions and weather events in the Gulf of Mexico during the third quarter of 2020. Implemented cost controls in the segment helped mitigate the impact to operating margins.

Core's clients continue to be heavily focused on digital transformation technologies to pursue operational excellence. Core Lab has been at the forefront of this movement for more than two decades. Core's extensive, proprietary databases and analog technologies, coupled with artificial intelligence ("AI") and machine learning, help the Company's clients improve efficiencies and lower operating costs throughout the upstream value chain. In the third quarter of 2020, Core Lab's Digital Innovation Group worked collaboratively with multiple international and national oil companies on projects that utilize several of Core's proprietary digital technologies and services. Core's proprietary Advanced Rock Typing technology combines Core's vast, comprehensive database of physical measurements, and Rock CatalogsTM with its proprietary image acquisition technology and the latest in AI image recognition. These technologies provide clients with analog data sets in situations where acquisition of new conventional core may not be possible. High-resolution images of wellbore cuttings and sidewall cores are quickly and efficiently matched with analogs from Core's proprietary database of samples from around the world. Physically measured data sets from the matching analogs are delivered to Core's clients in time to make appraisal and development decisions.

During the third quarter of 2020, Core Laboratories, under the direction of The CarbonNet Project ("CarbonNet") engaged in laboratory analysis of 300 feet of conventional core from the Gular-1 appraisal well in the offshore Gippsland Basin, in the Bass Strait, off the southeast coast of Australia. CarbonNet is funded by the Victorian and Commonwealth governments of Australia. In a recent press release the CarbonNet team mentioned, "The CarbonNet Project is advancing the science and viability for establishing a commercial-scale carbon capture and storage ("CCS") network. The network would bring together multiple carbon dioxide ("CO2") capture projects in Victoria's Latrobe Valley, transporting CO2 via a shared pipeline and injecting it into deep, underground, offshore storage sites in the Bass Strait. CCS is being investigated as part of a suite of solutions with the potential to mitigate greenhouse gas emissions." The cores are progressing through physical laboratory measurements, in an iterative analytical program. The data generated by Core Lab will provide insight into seal capacity, storage capacity, geomechanical properties and the pore system properties of the rock. Core Laboratories is pleased to be playing a role in evaluating this important CCS project, which is among the most promising CO2 storage opportunities in the region.

Production Enhancement

Production Enhancement operations, which are focused on complex completions in unconventional, tight-oil reservoirs in the U.S., as well as conventional offshore projects across the globe, posted third quarter 2020 revenue of $25,300,000, declining 7% sequentially. The revenue decline was primarily associated with decreased international product shipments due to COVID-19 disruptions and weather events in the Gulf of Mexico. More positively, U.S. land revenue increased 23% sequentially, partially mitigating the sequential decline in international sales, and correlating favorably with the improved U.S. land well completion activity during the quarter. Operating loss on a GAAP basis was $300,000, and approximately break-even, ex-items. Although revenue sequentially declined in the third quarter as compared to the second quarter of 2020, the operating loss was minimized, and improved significantly, as a result of cost-control measures completed during the second and third quarters of 2020.

During the third quarter of 2020, Core Lab introduced its next generation, best-in-class, HERO®PerFRAC energetic technology, which is now available in combination with the new, patent pending Oriented GoGun™. This new technology provides Core's clients with a technological solution for achieving: 1) extreme limited entry perforating capability, 2) precisely aligned perforations, and 3) minimized connections and completion string length. Casing erosion around perforations can occur when stimulating unconventional reservoirs. Larger perforating holes preferentially increase in size and take more frac fluid, robbing stimulation from smaller perforating holes, which results in inconsistent breakdown of the formation. The consistent-sized holes generated by the latest HERO®PerFRAC charges reduce this problem. Core Lab partnered with major U.S. operators to design custom, consistent-hole-size charges that can be aligned in a specific orientation in order to achieve uniform breakdown across each stage. Core Lab's Production Enhancement development team designed a patent pending method to orient the GoGun™, with both very high accuracy and wellsite efficiency. By eliminating the need for reusable orientation subassemblies, the Oriented GoGun™ minimizes the number of connections and saves time at the wellsite by not having to recapture and redress the orienting subs.

Also during the third quarter of 2020, Core Lab's Production Enhancement engineers developed and introduced a new application for its proprietary SpectraChem® chemical frac water tracer to determine whether horizontal wells are unobstructed and flowing through the entire length of the lateral. Leveraged by operators in the Permian, Eagle Ford, and Haynesville, this technology can identify wellbore obstructions, often caused by inter-well communication or dissolvable plug remnants. By applying this technology, Core's clients can identify and remediate well obstructions that can negatively impact well performance, reserve calculations and reserve-based lending.

Return On Invested Capital

Core's Board of Supervisory Directors ("Board") and the Company's Executive Management continue to focus on strategies that maximize return on invested capital ("ROIC") and FCF, a non-GAAP financial measure defined as cash from operations less capital expenditures, factors that have high correlation to total shareholder return. Core's commitment to an asset-light business model and disciplined capital stewardship promote capital efficiency and are designed to produce more predictable and superior long-term ROIC.

Events associated with the COVID-19 pandemic have caused significant disruptions in global markets and economies, with adverse effects throughout the energy sector. These adverse effects have triggered significant asset impairments for goodwill, intangible assets, inventory and other fixed assets, which further distort underlying financial performance and performance metrics, such as ROIC.

The Board has established an internal performance metric of demonstrating superior ROIC performance relative to the oilfield service companies listed as Core's Comp Group by Bloomberg. In the first half of 2020, Core Lab recorded $133 million in non-cash charges associated with the impairments and inventory write-down. Excluding these non-cash asset impairments and write-down, Bloomberg's calculation of Core's ROIC was 4.3%. Under the current circumstances, and considering the magnitude of the asset and goodwill impairment charges incurred across the energy industry, it is difficult to appropriately determine the underlying relative performance across the Bloomberg Comp Group as compared with Core Lab.

Industry and Core Lab Outlook

Conversations with Core's clients broadly reaffirm the Company's expectation that international projects already underway will continue; however, the pace and breadth of recovery from COVID-19 restrictions remains uncertain, making it difficult to forecast both the level and timing of such activity. Core Lab projects international activity in the fourth quarter of 2020 may slightly to modestly improve sequentially for both operating segments, if COVID-19 travel restrictions and supply chain disruptions begin to ease.

Within Reservoir Description, Core expects reservoir fluid analysis, which accounts for more than 65% of the segment's revenue, to be more resilient as this work is diversified across the life of reservoir and less reliant on drilling and completion of new wells.

U.S. land activity improved from the lows experienced during the middle of the second quarter as the third quarter of 2020 unfolded. This trend of gradual improvement in U.S. land activity is expected to continue into the fourth quarter of 2020. As a result, Core Lab projects overall fourth quarter 2020 U.S. land activity to modestly improve sequentially, and expects Production Enhancement to continue to track or outperform activity levels in U.S. land completions.

Collectively, these trends point toward slightly to modestly improved sequential operational performance for Core Lab, barring any COVID-19-related retrenchments in client activity. Additionally, Core expects to generate positive FCF in the fourth quarter of 2020 as Core's aggressive adjustments to its cost structure further align with client activity, with continued focus on free cash generation and strategic debt reduction.

Earnings Call Scheduled

The Company has scheduled a conference call to discuss Core's third quarter 2020 earnings announcement. The call will begin at 7:30 a.m. CDT / 2:30 p.m. CEST on Thursday, 22 October 2020. To listen to the call, please go to Core's website at www.corelab.com.

Core Laboratories N.V. is a leading provider of proprietary and patented reservoir description and production enhancement services and products used to optimize petroleum reservoir performance. The Company has over 70 offices in more than 50 countries and is located in every major oil-producing province in the world. This release, as well as other statements we make, includes forward-looking statements regarding the future revenue, profitability, business strategies and developments of the Company made in reliance upon the safe harbor provisions of Federal securities law. The Company's outlook is subject to various important cautionary factors, including risks and uncertainties related to the oil and natural gas industry, business conditions, international markets, international political climates, public health crises, such as the COVID-19 pandemic, and any related actions taken by businesses and governments, and other factors as more fully described in the Company's most recent Forms 10-K, 10-Q and 8-K filed with or furnished to the U.S. Securities and Exchange Commission. These important factors could cause the Company's actual results to differ materially from those described in these forward-looking statements. Such statements are based on current expectations of the Company's performance and are subject to a variety of factors, some of which are not under the control of the Company. Because the information herein is based solely on data currently available, and because it is subject to change as a result of changes in conditions over which the Company has no control or influence, such forward-looking statements should not be viewed as assurance regarding the Company's future performance. The Company undertakes no obligation to publicly update or revise any forward-looking statement to reflect events or circumstances that may arise after the date of this press release, except as required by law.

Visit the Company's website at www.corelab.com. Connect with Core Lab on Facebook, LinkedIn and YouTube.

CORE LABORATORIES N.V. & SUBSIDIARIES | |||||||||||||||||||||

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||||||||||||||

(amounts in thousands, except per share data) | |||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||

Three Months Ended | % Variance | ||||||||||||||||||||

September 30, | June 30, | September 30, | vs. Q2-20 | vs. Q3-19 | |||||||||||||||||

REVENUE | $ | 105,382 | $ | 115,736 | $ | 173,200 | (8.9)% | (39.2)% | |||||||||||||

OPERATING EXPENSES: | |||||||||||||||||||||

Costs of services and sales | 81,038 | 90,680 | 125,996 | (10.6)% | (35.7)% | ||||||||||||||||

General and administrative expense | 8,937 | 9,221 | 11,012 | (3.1)% | (18.8)% | ||||||||||||||||

Depreciation and amortization | 5,164 | 5,425 | 5,697 | (4.8)% | (9.4)% | ||||||||||||||||

Inventory write-down | — | 9,932 | — | NM | NM | ||||||||||||||||

Other (income) expense, net | (1,088) | 3,045 | (712) | NM | NM | ||||||||||||||||

Total operating expenses | 94,051 | 118,303 | 141,993 | (20.5)% | (33.8)% | ||||||||||||||||

OPERATING INCOME (LOSS) | 11,331 | (2,567) | 31,207 | NM | (63.7)% | ||||||||||||||||

Interest expense | 4,672 | 3,369 | 3,662 | 38.7% | 27.6% | ||||||||||||||||

Income (loss) from continuing operations before income tax expense | 6,659 | (5,936) | 27,545 | NM | (75.8)% | ||||||||||||||||

Income tax expense (benefit) | 3,663 | (261) | 3,335 | NM | 9.8% | ||||||||||||||||

Income (loss) from continuing operations | 2,996 | (5,675) | 24,210 | NM | (87.6)% | ||||||||||||||||

Income (loss) from discontinued operations, net of income taxes | — | — | (397) | NM | NM | ||||||||||||||||

Net income (loss) | 2,996 | (5,675) | 23,813 | NM | (87.4)% | ||||||||||||||||

Net income (loss) attributable to non- controlling interest | 33 | 41 | 84 | (19.5)% | (60.7)% | ||||||||||||||||

Net income (loss) attributable to Core Laboratories N.V. | $ | 2,963 | $ | (5,716) | $ | 23,729 | NM | (87.5)% | |||||||||||||

Diluted EPS (loss per share) from continuing operations | $ | 0.07 | $ | (0.13) | $ | 0.54 | NM | (87.0)% | |||||||||||||

Diluted EPS (loss per share) attributable to Core Laboratories N.V. | $ | 0.07 | $ | (0.13) | $ | 0.53 | NM | (86.8)% | |||||||||||||

Weighted average diluted common shares outstanding | 44,899 | 44,470 | 44,716 | 1.0% | 0.4% | ||||||||||||||||

Effective tax rate | 55 | % | 4 | % | 12 | % | NM | NM | |||||||||||||

SEGMENT INFORMATION: | |||||||||||||||||||||

Revenue: | |||||||||||||||||||||

Reservoir Description | $ | 80,060 | $ | 88,442 | $ | 109,339 | (9.5)% | (26.8)% | |||||||||||||

Production Enhancement | 25,322 | 27,294 | 63,861 | (7.2)% | (60.3)% | ||||||||||||||||

Total | $ | 105,382 | $ | 115,736 | $ | 173,200 | (8.9)% | (39.2)% | |||||||||||||

Operating income (loss): | |||||||||||||||||||||

Reservoir Description | $ | 11,022 | $ | 13,534 | $ | 18,835 | (18.6)% | (41.5)% | |||||||||||||

Production Enhancement | (321) | (16,324) | 11,456 | NM | NM | ||||||||||||||||

Corporate and Other | 630 | 223 | 916 | NM | NM | ||||||||||||||||

Total | $ | 11,331 | $ | (2,567) | $ | 31,207 | NM | (63.7)% | |||||||||||||

"NM" means not meaningful | |||||||||||||||||||||

CORE LABORATORIES N.V. & SUBSIDIARIES | |||||||||||||

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||||||

(amounts in thousands, except per share data) | |||||||||||||

(Unaudited) | |||||||||||||

Nine Months Ended | % Variance | ||||||||||||

September 30, | September 30, | ||||||||||||

REVENUE | $ | 373,518 | $ | 511,432 | (27.0)% | ||||||||

OPERATING EXPENSES: | |||||||||||||

Costs of services and sales | 286,849 | 377,830 | (24.1)% | ||||||||||

General and administrative expense | 37,725 | 38,250 | (1.4)% | ||||||||||

Depreciation and amortization | 16,030 | 17,070 | (6.1)% | ||||||||||

Inventory write-down and impairments | 132,136 | — | NM | ||||||||||

Other (income) expense, net | 987 | 2,653 | (62.8)% | ||||||||||

Total operating expenses | 473,727 | 435,803 | 8.7% | ||||||||||

OPERATING INCOME (LOSS) | (100,209) | 75,629 | NM | ||||||||||

Interest expense | 11,452 | 11,102 | 3.2% | ||||||||||

Income (loss) from continuing operations before income tax expense | (111,661) | 64,527 | NM | ||||||||||

Income tax expense (benefit) | (644) | (19,467) | NM | ||||||||||

Income (loss) from continuing operations | (111,017) | 83,994 | NM | ||||||||||

Income (loss) from discontinued operations, net of income taxes | — | 7,833 | NM | ||||||||||

Net income (loss) | (111,017) | 91,827 | NM | ||||||||||

Net income (loss) attributable to non-controlling interest | 157 | 174 | (9.8)% | ||||||||||

Net income (loss) attributable to Core Laboratories N.V. | $ | (111,174) | $ | 91,653 | NM | ||||||||

Diluted EPS (loss per share) from continuing operations | $ | (2.50) | $ | 1.87 | NM | ||||||||

Diluted EPS (loss per share) attributable to Core Laboratories N.V. | $ | (2.50) | $ | 2.04 | NM | ||||||||

Weighted average diluted common shares outstanding | 44,470 | 44,854 | (0.9)% | ||||||||||

Effective tax rate | 1 | % | (30) | % | NM | ||||||||

SEGMENT INFORMATION: | |||||||||||||

Revenue: | |||||||||||||

Reservoir Description | $ | 271,203 | $ | 318,280 | (14.8)% | ||||||||

Production Enhancement | 102,315 | 193,152 | (47.0)% | ||||||||||

Total | $ | 373,518 | $ | 511,432 | (27.0)% | ||||||||

Operating income (loss): | |||||||||||||

Reservoir Description | $ | 35,618 | $ | 40,892 | (12.9)% | ||||||||

Production Enhancement | (137,944) | 31,792 | NM | ||||||||||

Corporate and Other | 2,117 | 2,945 | NM | ||||||||||

Total | $ | (100,209) | $ | 75,629 | NM | ||||||||

"NM" means not meaningful | |||||||||||||

CORE LABORATORIES N.V. & SUBSIDIARIES | |||||||||||||||||||||

CONDENSED CONSOLIDATED BALANCE SHEET | |||||||||||||||||||||

(amounts in thousands) | |||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||

% Variance | |||||||||||||||||||||

ASSETS: | September 30, | June 30, | December 31, | vs. Q2-20 | vs. Q4-19 | ||||||||||||||||

Cash and cash equivalents | $ | 15,146 | $ | 20,958 | $ | 11,092 | (27.7)% | 36.5% | |||||||||||||

Accounts receivable, net | 85,366 | 101,464 | 131,579 | (15.9)% | (35.1)% | ||||||||||||||||

Inventory | 42,908 | 41,528 | 50,163 | 3.3% | (14.5)% | ||||||||||||||||

Other current assets | 26,469 | 27,443 | 28,403 | (3.5)% | (6.8)% | ||||||||||||||||

Total Current Assets | 169,889 | 191,393 | 221,237 | (11.2)% | (23.2)% | ||||||||||||||||

Property, plant and equipment, net | 117,123 | 119,866 | 123,506 | (2.3)% | (5.2)% | ||||||||||||||||

Right-of-use assets | 69,228 | 70,147 | 75,697 | (1.3)% | (8.5)% | ||||||||||||||||

Intangibles, goodwill and other long-term assets, net | 234,574 | 233,035 | 354,233 | 0.7% | (33.8)% | ||||||||||||||||

Total assets | $ | 590,814 | $ | 614,441 | $ | 774,673 | (3.8)% | (23.7)% | |||||||||||||

LIABILITIES AND EQUITY: | |||||||||||||||||||||

Accounts payable | $ | 22,806 | $ | 23,693 | $ | 35,611 | (3.7)% | (36.0)% | |||||||||||||

Short-term operating lease obligations | 11,807 | 12,028 | 11,841 | (1.8)% | (0.3)% | ||||||||||||||||

Current maturities of long-term debt | 75,000 | — | — | NM | NM | ||||||||||||||||

Other current liabilities | 62,523 | 63,563 | 64,142 | (1.6)% | (2.5)% | ||||||||||||||||

Total current liabilities | 172,136 | 99,284 | 111,594 | 73.4% | 54.3% | ||||||||||||||||

Long-term debt, net | 189,566 | 286,610 | 305,283 | (33.9)% | (37.9)% | ||||||||||||||||

Long-term operating lease obligations | 56,649 | 57,449 | 64,660 | (1.4)% | (12.4)% | ||||||||||||||||

Other long-term liabilities | 100,754 | 104,951 | 110,996 | (4.0)% | (9.2)% | ||||||||||||||||

Total equity | 71,709 | 66,147 | 182,140 | 8.4% | (60.6)% | ||||||||||||||||

Total liabilities and equity | $ | 590,814 | $ | 614,441 | $ | 774,673 | (3.8)% | (23.7)% | |||||||||||||

"NM" means not meaningful | |||||||||||||||||||||

CORE LABORATORIES N.V. & SUBSIDIARIES | |||||||||||||

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||||||||

(amounts in thousands) | |||||||||||||

(Unaudited) | |||||||||||||

Three Months Ended | |||||||||||||

September 30, | June 30, | September 30, | |||||||||||

CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||||||

Income (loss) from continuing operations | $ | 2,996 | $ | (5,675) | $ | 24,210 | |||||||

Income (loss) from discontinued operations | — | — | (397) | ||||||||||

Net Income (loss) | $ | 2,996 | $ | (5,675) | $ | 23,813 | |||||||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||||

Stock-based compensation | 2,859 | 2,865 | 3,311 | ||||||||||

Depreciation and amortization | 5,164 | 5,425 | 5,697 | ||||||||||

Deferred income tax | (5,460) | (180) | (3,353) | ||||||||||

Inventory write-down | — | 9,932 | — | ||||||||||

Adjustment to gain on sale of discontinued operations | — | — | 397 | ||||||||||

Accounts receivable | 16,157 | 24,288 | (2,603) | ||||||||||

Inventory | (1,582) | 987 | (4,287) | ||||||||||

Accounts payable | (1,051) | (12,343) | 815 | ||||||||||

Other adjustments to net income (loss) | 1,610 | 1,697 | 2,199 | ||||||||||

Net cash provided by operating activities | $ | 20,693 | $ | 26,996 | $ | 25,989 | |||||||

CASH FLOWS FROM INVESTING ACTIVITIES | |||||||||||||

Capital expenditures | $ | (2,172) | $ | (3,066) | $ | (5,307) | |||||||

Proceeds from sale of discontinued operations | — | — | (1,853) | ||||||||||

Other investing activities | (202) | (206) | (437) | ||||||||||

Net cash used in investing activities | $ | (2,374) | $ | (3,272) | $ | (7,597) | |||||||

CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||||||

Repayment of debt borrowings | $ | (25,000) | $ | (26,000) | $ | (28,000) | |||||||

Proceeds from debt borrowings | 3,000 | 10,000 | 35,000 | ||||||||||

Dividends paid | (445) | (445) | (24,399) | ||||||||||

Repurchase of treasury shares | (157) | (198) | (411) | ||||||||||

Other financing activities | (1,529) | (13) | — | ||||||||||

Net cash used in financing activities | $ | (24,131) | $ | (16,656) | $ | (17,810) | |||||||

NET CHANGE IN CASH AND CASH EQUIVALENTS | (5,812) | 7,068 | 582 | ||||||||||

CASH AND CASH EQUIVALENTS, beginning of period | 20,958 | 13,890 | 12,546 | ||||||||||

CASH AND CASH EQUIVALENTS, end of period | $ | 15,146 | $ | 20,958 | $ | 13,128 | |||||||

CORE LABORATORIES N.V. & SUBSIDIARIES | |||||||||

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||||

(amounts in thousands) | |||||||||

(Unaudited) | |||||||||

Nine Months Ended | |||||||||

September 30, | September 30, | ||||||||

CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||

Income (loss) from continuing operations | $ | (111,017) | $ | 83,994 | |||||

Income (loss) from discontinued operations | — | 7,833 | |||||||

Net Income (loss) | $ | (111,017) | $ | 91,827 | |||||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||

Stock-based compensation | 16,254 | 17,652 | |||||||

Depreciation and amortization | 16,030 | 17,070 | |||||||

Deferred income tax | (13,014) | (38,469) | |||||||

Inventory write-down and impairments | 132,136 | — | |||||||

Gain on sale of business | — | (1,154) | |||||||

Gain on sale of discontinued operations | — | (8,411) | |||||||

Accounts receivable | 45,229 | (8,924) | |||||||

Inventory | (2,880) | (7,202) | |||||||

Accounts payable | (13,262) | 1,762 | |||||||

Other adjustments to net income (loss) | 238 | 4,074 | |||||||

Net cash provided by operating activities | $ | 69,714 | $ | 68,225 | |||||

CASH FLOWS FROM INVESTING ACTIVITIES | |||||||||

Capital expenditures | $ | (8,578) | $ | (17,537) | |||||

Proceeds from sale of business | — | 2,980 | |||||||

Proceeds from sale of discontinued operations | — | 14,789 | |||||||

Other investing activities | (952) | (775) | |||||||

Net cash used in investing activities | $ | (9,530) | $ | (543) | |||||

CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||

Repayment of debt borrowings | $ | (71,000) | $ | (96,000) | |||||

Proceeds from debt borrowings | 30,000 | 103,000 | |||||||

Dividends paid | (12,001) | (73,168) | |||||||

Repurchase of treasury shares | (1,593) | (1,502) | |||||||

Other financing activities | (1,536) | — | |||||||

Net cash used in financing activities | $ | (56,130) | $ | (67,670) | |||||

NET CHANGE IN CASH AND CASH EQUIVALENTS | 4,054 | 12 | |||||||

CASH AND CASH EQUIVALENTS, beginning of period | 11,092 | 13,116 | |||||||

CASH AND CASH EQUIVALENTS, end of period | $ | 15,146 | $ | 13,128 | |||||

Non-GAAP Information

Management believes that the exclusion of certain income and expenses enables it to evaluate more effectively the Company's operations period-over-period and to identify operating trends that could otherwise be masked by the excluded Items. For this reason, we use certain non-GAAP measures that exclude these Items; and we feel that this presentation provides a clearer comparison with the results reported in prior periods. The non-GAAP financial measures should be considered in addition to, and not as a substitute for, the financial results prepared in accordance with GAAP, as more fully discussed in the Company's financial statement and filings with the Securities and Exchange Commission.

Reconciliation of Operating Income, Income from Continuing Operations and Earnings Per | ||||||||||||

(amounts in thousands, except per share data) | ||||||||||||

(Unaudited) | ||||||||||||

Operating Income (loss) from Continuing Operations | ||||||||||||

Three Months Ended | ||||||||||||

September 30, | June 30, 2020 | September 30, | ||||||||||

GAAP reported | $ | 11,331 | $ | (2,567) | $ | 31,207 | ||||||

Inventory write-down 1 | — | 9,932 | — | |||||||||

Cost reduction and other charges | — | 3,415 | — | |||||||||

Foreign exchange losses (gains) | 982 | (98) | 569 | |||||||||

Excluding specific items | $ | 12,313 | $ | 10,682 | $ | 31,776 | ||||||

Income (loss) from Continuing Operations | ||||||||||||

Three Months Ended | ||||||||||||

September 30, | June 30, 2020 | September 30, | ||||||||||

GAAP reported | $ | 2,996 | $ | (5,675) | $ | 24,210 | ||||||

Inventory write-down 1 | — | 9,495 | — | |||||||||

Cost reduction and other charges | — | 3,265 | — | |||||||||

Debt issuance cost write-off | — | 328 | — | |||||||||

Debt restructuring | 1,223 | — | — | |||||||||

Impact of higher (lower) tax rate 2 | 2,773 | (1,208) | (2,172) | |||||||||

Foreign exchange losses (gains) | 344 | (79) | 455 | |||||||||

Excluding specific items | $ | 7,336 | $ | 6,126 | $ | 22,493 | ||||||

Earnings (Loss) Per Diluted Share from Continuing Operations | ||||||||||||

Three Months Ended | ||||||||||||

September 30, | June 30, 2020 | September 30, | ||||||||||

GAAP reported | $ | 0.07 | $ | (0.13) | $ | 0.54 | ||||||

Inventory write-down 1 | — | 0.21 | — | |||||||||

Cost reduction and other charges | — | 0.07 | — | |||||||||

Debt issuance cost write-off | — | 0.01 | — | |||||||||

Debt restructuring | 0.03 | — | — | |||||||||

Impact of higher (lower) tax rate 2 | 0.06 | (0.02) | (0.05) | |||||||||

Foreign exchange losses | — | — | 0.01 | |||||||||

Excluding specific items | $ | 0.16 | $ | 0.14 | $ | 0.50 | ||||||

(1) Three months ended June 30, 2020 includes inventory write-down charge of $9.9 million, pretax. | ||||||||||||

(2) Includes adjustments to reflect tax expense at a normalized rate of 20%. | ||||||||||||

Segment Information | ||||||||||||

(amounts in thousands) | ||||||||||||

(Unaudited) | ||||||||||||

Operating Income (Loss) from Continuing Operations | ||||||||||||

Three Months Ended September 30, 2020 | ||||||||||||

Reservoir | Production | Corporate and | ||||||||||

GAAP reported | $ | 11,022 | $ | (321) | $ | 630 | ||||||

Foreign exchange losses | 696 | 275 | 11 | |||||||||

Excluding specific items | $ | 11,718 | $ | (46) | $ | 641 | ||||||

Return on Invested Capital

Return on Invested Capital ("ROIC") is based on Bloomberg's calculation on the trailing four quarters from the most recently reported quarter and the balance sheet of the most recent reported quarter, and is presented based on our belief that this non-GAAP measure is useful information to investors and management when comparing our profitability and the efficiency with which we have employed capital over time relative to other companies. ROIC is not a measure of financial performance under GAAP and should not be considered as an alternative to net income.

ROIC is defined by Bloomberg as Net Operating Profit (Loss) ("NOP") less Cash Operating Tax ("COT") divided by Total Invested Capital ("TIC"), where NOP is defined as GAAP net income before minority interest plus the sum of income tax expense, interest expense, and pension expense less pension service cost and COT is defined as income tax expense plus the sum of the change in net deferred taxes, and the tax effect on interest expense and TIC is defined as GAAP stockholder's equity plus the sum of net long-term debt, allowance for doubtful accounts, net balance of deferred taxes, income tax payable, and other charges.

Reconciliation of ROIC | ||||||||||||

(amounts in millions, except for ROIC and WACC data) | ||||||||||||

(Unaudited) | ||||||||||||

Bloomberg | Effect of non-cash | Excluding non-cash | ||||||||||

Net operating profit | $ | (59.5) | $ | 132.6 | $ | 73.1 | ||||||

Cash operating taxes | 42.6 | 8.8 | 51.4 | |||||||||

Total invested capital | 381.3 | 126.7 | 508.0 | |||||||||

Return on invested capital | (26.8) | % | NM | 4.3 | % | |||||||

Weighted average cost of capital | 7.7 | % | ||||||||||

Free Cash Flow

Core uses the non-GAAP measure of free cash flow to evaluate its cash flows and results of operations. Free cash flow is an important measurement because it represents the cash from operations, in excess of capital expenditures, available to operate the business and fund non-discretionary obligations. Free cash flow is not a measure of operating performance under GAAP, and should not be considered in isolation nor construed as an alternative consideration to operating income, net income, earnings per share, or cash flows from operating, investing, or financing activities, each as determined in accordance with GAAP. Free cash flow should not be considered a measure of liquidity. Moreover, since free cash flow is not a measure determined in accordance with GAAP and thus is susceptible to varying interpretations and calculations, free cash flow as presented may not be comparable to similarly titled measures presented by other companies.

Computation of Free Cash Flow | |||||||||

(amounts in thousands) | |||||||||

(Unaudited) | |||||||||

Three Months Ended | Nine Months Ended | ||||||||

September 30, 2020 | September 30, 2020 | ||||||||

Net cash provided by operating activities | $ | 20,693 | $ | 69,714 | |||||

Capital expenditures | (2,172) | (8,578) | |||||||

Free cash flow | $ | 18,521 | $ | 61,136 | |||||

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/core-lab-reports-third-quarter-2020-results-from-continuing-operations-301157405.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/core-lab-reports-third-quarter-2020-results-from-continuing-operations-301157405.html

SOURCE Core Laboratories N.V.

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!