|

02.10.2017 14:30:00

|

Copper Mountain Mining Corporation announces summer drill results in the Superpit area and also commencement of drilling at New Ingerbelle

Web Site: www.CuMtn.com

TSX: CMMC

VANCOUVER, Oct. 2, 2017 /CNW/ - Copper Mountain Mining Corporation (TSX: CMMC) (the "Company" or "Copper Mountain") is pleased to announce that it has completed its summer drilling program at the Copper Mountain Mine site and has commenced drilling at the New Ingerbelle site hear Princeton, BC.

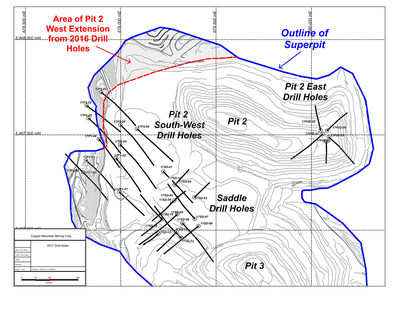

The purpose of the program was to further expand resources on the western side of the pit 2 area. Additional drilling was carried out in the Saddle area as fill-in drilling to upgrade the resources to assist with longer term mine planning. A deep drilling program was completed at the eastern end of Pit 2 to test continuity of high grade mineralization at depth. A total of 8900m of diamond drilling was completed in thirty-two drill holes.

Previous results from the 2016 drill program indicated a significant north-west extension of Pit 2 mineralization while the 2017 program focused on an area to the south-west of Pit 2. The 2017 program was successful in intercepting the high grade mineralization at depth on the eastern end of Pit 2. Drilling south west of Pit 2 continued to intercept mineralization, but was intermittent as drilling moved outside of the western extremities of the current pit limits, indicating that additional drilling may be required. Highlights of the Pit 2 West drilling are in the table below and include 82 meters of 0.55% Cu and 18 meters of 0.80% Cu.

Pit 2 West Significant Drill Results

Hole ID | Azi | Dip | Length (m) | From (m) | To (m) | Interval (m) | Cu % | Au g/t | Ag g/t | Cu Eq2 % |

17P1-02 | 132 | -51 | 334 | 34 | 49 | 15 | 0.55 | 0.09 | 1.18 | 0.62 |

115 | 130 | 15 | 0.43 | 0.14 | 0.99 | 0.53 | ||||

277 | 295 | 18 | 0.53 | 0.16 | 1.71 | 0.64 | ||||

17P1-06 | 312 | -60 | 252 | 177 | 207 | 30 | 0.19 | 0.03 | 0.42 | 0.21 |

17P2-01 | 132 | -55 | 425 | 96 | 150 | 54 | 0.37 | 0.11 | 0.75 | 0.44 |

372 | 387 | 15 | 0.28 | 0.15 | 0.47 | 0.38 | ||||

17P2-02 | 122 | -51 | 324 | 2.1 | 18.6 | 16.5 | 0.25 | 0.07 | 0.64 | 0.30 |

72 | 102 | 30 | 0.27 | 0.07 | 0.63 | 0.32 | ||||

252 | 309 | 57 | 0.36 | 0.14 | 0.91 | 0.45 | ||||

17P2-03 | 132 | -46 | 401 | 29.6 | 44.8 | 15.2 | 0.39 | 0.11 | 0.93 | 0.47 |

17P2-04 | 132 | -50 | 392 | 180 | 201 | 21 | 0.69 | 0.11 | 1.6 | 0.77 |

285 | 321 | 36 | 0.34 | 0.10 | 0.75 | 0.41 | ||||

17P2-05 | 132 | -47 | 370 | 147 | 189 | 42 | 0.36 | 0.08 | 0.85 | 0.42 |

17P2-06 | 132 | -47 | 400 | 44.8 | 63.1 | 18.3 | 0.80 | 0.13 | 1.73 | 0.90 |

279.5 | 361.8 | 82.3 | 0.55 | 0.09 | 1.17 | 0.62 |

In-fill drilling in the Saddle area was successful in upgrading the resource and will provide additional details for the current Life of Mine design. These results are presented in the table below.

Saddle Significant Drill Results

Hole ID | Azi | Dip | Length (m) | From (m) | To (m) | Interval (m) | Cu % | Au g/t | Ag g/t | Cu Eq2 % |

17SD-05 | 42 | -50 | 109 | 3 | 54 | 51 | 0.38 | * | 0.95 | |

17SD-06 | 222 | -45 | 340 | 6.1 | 26.5 | 20.4 | 0.25 | 0.06 | 0.71 | 0.29 |

218.5 | 261.2 | 42.7 | 0.29 | 0.07 | 1.98 | 0.35 | ||||

17SD-07 | 312 | -45 | 298 | 246.4 | 279.6 | 33.2 | 0.37 | 0.06 | 0.83 | 0.41 |

17SD-08 | 222 | -45 | 320 | 248.7 | 270.4 | 21.7 | 0.54 | 0.10 | 2.19 | 0.62 |

17SD-09 | 132 | -48 | 365 | 191.1 | 206.4 | 15.3 | 0.44 | * | 1.36 | |

17SD-11 | 222 | -45 | 210 | 70.5 | 175.5 | 105 | 0.45 | * | 2.02 | |

Incl | 151.5 | 175.5 | 24 | 1.14 | * | 6.07 |

*Gold Assays Pending |

Drilling in the eastern end of Pit 2 demonstrated that the high-grade Pit 2 mineralization does continue at depth towards the east. Highlights from Pit 2 East drilling are listed below and include 105 meters at 0.62% Cu, including 75 meters at 0.80% Cu and 9 meters at 3.68% Cu.

Pit 2 East Significant Drill Results

Hole ID | Azi | Dip | Length (m) | From (m) | To (m) | Interval (m) | Cu % | Au g/t | Ag g/t | Cu Eq2 % |

17P2E-01 | 225 | -46 | 296 | 107 | 212.3 | 105.3 | 0.62 | 0.18 | 1.89 | 0.75 |

Incl | 107 | 182 | 75 | 0.80 | 0.22 | 2.46 | 0.96 | |||

Incl | 9 | 3.68 | 0.79 | 8.66 | 4.25 | |||||

17P2E-02 | 127 | -45 | 281 | 71 | 95 | 24 | 0.33 | * | 0.33 | |

17P2E-02 | 110 | 195.5 | 85.5 | 0.21 | * | 0.74 | ||||

17P2E-02 | 230 | 281 | 51 | 0.36 | * | 1.26 | ||||

17P2E-03 | 177 | -54 | 190 | 74 | 116 | 42 | 0.48 | * | 2.04 | |

17P2E-03 | 128 | 182 | 54 | 0.39 | * | 1.58 |

*Gold Assays Pending |

Results from this drill program are currently being incorporated into an updated resource model, which in turn will lead to revisions of the reserve model and long-term mine plan.

Map of Drill Hole Locations

New Ingerbelle

A review of historical data from the New Ingerbelle Pit has been encouraging and the Company is now drilling the Ingerbelle deposit, located about 1km west of the Superpit. Historically, the Ingerbelle deposit was discovered, developed and mined by Newmont Mines Ltd between 1966 to 1981. The resource at New Ingerbelle is estimated 125 Million tonnes @ 0.31% Cu (Inferred) at a 0.2% Cu cut-off which equates to an additional 1 billion lbs Copper equivalent. Precious metals were not assayed on historical drill core, however production records show that gold and silver recovered grades were 0.17 g/t and 0.8 g/t respectively. Actual head grades for gold were 0.25 g/t using a 70% Mill recovery factor while copper head grades were 0.43%.

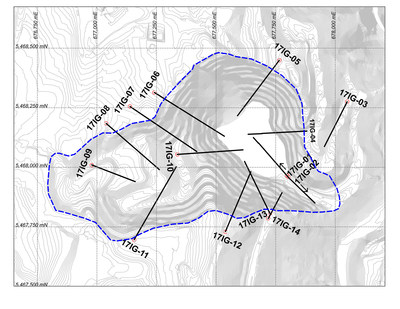

A 5,000m Phase 1 diamond drill program was recently initiated on the New Ingerbelle deposit with the objective of verifying historical drilling while also testing both lateral and depth potential of the resource. The goal of the current drill program is to confirm the historical resource which has the potential to add an extra 10 years to the mine life of the operation. A total of fourteen holes have been designed and results for the first hole are listed below and include 100 meters at 0.37% Cu and 72 meters at 0.42% Cu.

Hole ID | Azi | Dip | Length (m) | From (m) | To (m) | Interval (m) | Cu % | Au g/t | Ag g/t | Cu Eq % |

17IG-01 | 317 | -49 | 303 | 3 | 161 | 158 | 0.29 | 0.21 | 0.47 | 0.42 |

3 | 103 | 100 | 0.37 | 0.28 | 0.6 | 0.55 | ||||

3 | 75 | 72 | 0.42 | 0.3 | 0.65 | 0.61 |

*CuEq calculated using US$3/lb Cu, US$1275/oz Au, US $18/oz Ag. Not adjusted for recovery. |

Historical New Ingerbelle Pit outlined in blue with planned 2017 diamond drill holes |

About Copper Mountain Mining Corporation:

Copper Mountain's flagship asset is the Copper Mountain mine located in southern British Columbia near the town of Princeton. The Company has a strategic alliance with Mitsubishi Materials Corporation who owns 25% of the mine. The Copper Mountain mine has a large resource of copper that remains open laterally and at depth. This significant exploration potential is being explored over the next few years in order to fully appreciate the property's full development potential. Additional information is available on the Company's web page at www.CuMtn.com.

On behalf of the Board of

COPPER MOUNTAIN MINING CORPORATION

"Peter Holbek, P. Geo."

Note: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results. Readers are referred to the documents, filed by the Company on SEDAR at www.sedar.com, specifically the most recent reports which identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company undertakes no obligation to review or confirm analysts' expectations or estimates or to release publicly any revisions to any forward-looking statement.

SOURCE Copper Mountain Mining Corporation

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu Reading International Inc (A) mehr Nachrichten

| Keine Nachrichten verfügbar. |

Analysen zu Reading International Inc (A) mehr Analysen

Aktien in diesem Artikel

| Compx International Inc. (A) | 31,12 | 18,42% |

|

| Reading International Inc (A) | 1,30 | -2,99% |

|