|

20.02.2019 22:05:00

|

Cloud Drives Strong 2018 Performance and Year-Over-Year Growth

CAMBRIDGE, Mass., Feb. 20, 2019 /PRNewswire/ -- Pegasystems Inc. (NASDAQ: PEGA), the software company empowering digital transformation at the world's leading enterprises, released its financial results for the fourth quarter of 2018.

"We had a strong Q4 capping off a terrific year," said Alan Trefler, founder and CEO, Pegasystems. "Our Cloud Choice offering is clearly resonating with clients and prospects who want the flexibility to run either on Pega Cloud or a Cloud of their choice."

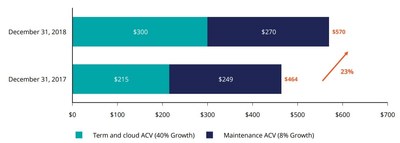

"The significant acceleration in the shift to subscription has propelled our total ACV to $570 million," Ken Stillwell, CFO, said. "This continued shift will increase the ongoing predictability of our revenue and cash flow."

Financial metrics (1) (2)

(Dollars in thousands, except per share amounts) | Three Months Ended | Year Ended | |||||||||||||||||||

2018 | 2017 | Change | 2018 | 2017 | Change | ||||||||||||||||

Total revenue | $ | 256,357 | $ | 254,605 | 1 | % | $ | 891,581 | $ | 888,467 | — | % | |||||||||

Subscription revenue (3) | $ | 142,273 | $ | 134,099 | 6 | % | $ | 524,758 | $ | 499,828 | 5 | % | |||||||||

Net income (GAAP) | $ | 16,413 | $ | 40,595 | (60) | % | $ | 10,617 | $ | 98,548 | (89) | % | |||||||||

Net income (Non-GAAP) | $ | 30,155 | $ | 37,489 | (20) | % | $ | 53,302 | $ | 103,462 | (48) | % | |||||||||

Diluted earnings per share (GAAP) | $ | 0.20 | $ | 0.49 | (59) | % | $ | 0.13 | $ | 1.19 | (89) | % | |||||||||

Diluted earnings per share (Non-GAAP) | $ | 0.36 | $ | 0.45 | (20) | % | $ | 0.64 | $ | 1.25 | (49) | % | |||||||||

(1) On January 1, 2018, we adopted the ASC 606 revenue recognition standard and have adjusted prior periods to conform. | |||||||||||||||||||||

(2) A reconciliation of our GAAP measures to Non-GAAP measures is contained in the financial schedules at the end of this release. | |||||||||||||||||||||

(3) Subscription revenue reflects client arrangements (term license, cloud, and maintenance) which are subject to renewal. | |||||||||||||||||||||

Revenue streams (1)

(Dollars in thousands) | Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||||

2018 | 2017 | Change | 2018 | 2017 | Change | ||||||||||||||||||||||||||||||

Cloud | $ | 24,660 | 10 | % | $ | 14,890 | 6 | % | $ | 9,770 | 66 | % | $ | 82,627 | 9 | % | $ | 51,097 | 6 | % | $ | 31,530 | 62 | % | |||||||||||

Term license | 50,186 | 20 | % | 56,838 | 22 | % | (6,652) | (12) | % | 178,256 | 20 | % | 206,411 | 23 | % | (28,155) | (14) | % | |||||||||||||||||

Maintenance | 67,427 | 25 | % | 62,371 | 25 | % | 5,056 | 8 | % | 263,875 | 30 | % | 242,320 | 27 | % | 21,555 | 9 | % | |||||||||||||||||

Subscription | 142,273 | 55 | % | 134,099 | 53 | % | 8,174 | 6 | % | 524,758 | 59 | % | 499,828 | 56 | % | 24,930 | 5 | % | |||||||||||||||||

Perpetual license | 53,034 | 21 | % | 51,064 | 20 | % | 1,970 | 4 | % | 109,863 | 12 | % | 132,883 | 15 | % | (23,020) | (17) | % | |||||||||||||||||

Consulting | 61,050 | 24 | % | 69,442 | 27 | % | (8,392) | (12) | % | 256,960 | 29 | % | 255,756 | 29 | % | 1,204 | — | % | |||||||||||||||||

Total revenue | $ | 256,357 | 100 | % | $ | 254,605 | 100 | % | $ | 1,752 | 1 | % | $ | 891,581 | 100 | % | $ | 888,467 | 100 | % | $ | 3,114 | — | % | |||||||||||

(1) On January 1, 2018, we adopted the ASC 606 revenue recognition standard and have adjusted prior periods to conform. | |||||||||||||||||||||||||||||||||||

Annual contract value ("ACV") (1)

The change in ACV measures the growth and predictability of future cash flows from committed term, cloud, and maintenance arrangements as of the end of the particular reporting period.

Remaining performance obligations

Revenue for the remaining performance obligations on existing contracts is expected to be recognized as follows:

December 31, 2018 | |||||||||||||||||||||||||

(Dollars in thousands) | Perpetual license | Term license | Maintenance | Cloud | Consulting | Total | |||||||||||||||||||

1 year or less | $ | 14,665 | $ | 72,378 | $ | 192,274 | $ | 103,354 | $ | 17,235 | $ | 399,906 | 63 | % | |||||||||||

1-2 years | 2,343 | 10,355 | 10,436 | 80,214 | 2,810 | 106,158 | 17 | % | |||||||||||||||||

2-3 years | 1,661 | 1,414 | 3,644 | 61,906 | 940 | 69,565 | 11 | % | |||||||||||||||||

Greater than 3 years | — | 233 | 1,560 | 53,343 | 208 | 55,344 | 9 | % | |||||||||||||||||

$ | 18,669 | $ | 84,380 | $ | 207,914 | $ | 298,817 | $ | 21,193 | $ | 630,973 | 100 | % | ||||||||||||

Guidance for 2019

As of February 20, 2019, we are providing the following guidance:

Year Ended December 31, 2019 | |||||||

(in millions, except per share amounts) | GAAP | Non-GAAP (1) | |||||

Revenue | $ | 965 | $ | 965 | |||

Net Income | $ | (17.5) | $ | 42.1 | |||

Diluted Earnings Per Share | $ | (0.22) | $ | 0.50 | |||

(1) A reconciliation of our GAAP to Non-GAAP guidance is contained in the financial schedules at the end of this release. | |||||||

Quarterly conference call

A conference call and audio-only webcast will be conducted at 5:00 p.m. EST on February 20, 2019.

Members of the public and investors are invited to join the call and participate in the question and answer session by dialing (800) 289-0438 (domestic), (323) 794-2423 (international), or via webcast by logging onto www.pega.com at least five minutes prior to the event's broadcast and clicking on the webcast icon in the investors section.

A replay of the call will also be available on www.pega.com/about/investors by clicking the earnings calls link in the investors section.

Discussion of non-GAAP financial measures

To supplement the financial results presented in accordance with generally accepted accounting principles in the U.S. ("GAAP"), the Company provides non-GAAP measures, including in this release. Pegasystems' management utilizes a number of different financial measures, both GAAP and non-GAAP, in analyzing and assessing the overall performance of the business, for making operating decisions, and for forecasting and planning for future periods. The Company's annual financial plan is prepared on both a GAAP and non-GAAP basis, and both are approved by our board of directors. In addition, because of the importance of these measures in managing the business, the Company uses non-GAAP measures and financial performance results in the evaluation process to establish management's compensation.

The non-GAAP measures exclude the effects of certain business combination accounting entries, stock-based compensation expense, amortization of intangible assets, acquisition-related and restructuring expenses, certain other adjustments, and the related income tax effects. The Company believes these non-GAAP measures are helpful in understanding its past financial performance and its anticipated future results.

These non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read only in conjunction with the Company's consolidated financial statements prepared in accordance with GAAP.

A reconciliation of the Company's GAAP measures to Non-GAAP measures is included in the financial schedules at the end of this release.

Forward-looking statements

Certain statements contained in this press release may be construed as "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are based on current expectations, estimates, forecasts, and projections about the industry and markets in which we operate, and management's beliefs and assumptions. In addition, other written or oral statements that constitute forward-looking statements may be made by us or on our behalf. Words such as "expect," "anticipate," "intend," "plan," "believe," "could," "estimate," "may," "target," "strategy," "is intended to," "project," "guidance," "likely," "usually," or variations of such words and similar expressions are intended to identify such forward-looking statements.

Important factors that could cause actual future activities and results to differ materially from those expressed in such forward-looking statements include, among others, variation in demand for our products and services; reliance on third party relationships; reliance on key personnel; the inherent risks associated with international operations and the continued uncertainties in the global economy; our continued effort to market and sell both domestically and internationally; foreign currency exchange rates; the potential legal and financial liabilities and reputation damage due to cyber-attacks and security breaches; and management of our growth. These risks and other factors that could cause actual results to differ materially from those expressed in such forward-looking statements are described more completely in Part I of our Annual Report on Form 10-K for the year ended December 31, 2018, as well as other filings we make with the U.S. Securities and Exchange Commission ("SEC"). These documents are available on the Company's website at www.pega.com/about/investors.

The forward-looking statements contained in this press release represent the Company's views as of February 20, 2019. Investors are cautioned not to place undue reliance on such forward-looking statements and there are no assurances that the results contained in such statements will be achieved. Although new information, future events, or risks may cause actual results to differ materially from future results expressed or implied by such forward-looking statements, except as required by applicable law, we do not undertake and specifically disclaim any obligation to publicly update or revise these forward-looking statements whether as the result of new information, future events, or otherwise.

About Pegasystems

Pegasystems Inc. is the leader in software for customer engagement and operational excellence. Pega's adaptive, cloud-architected software - built on its unified Pega Platform™ - empowers people to rapidly deploy, and easily extend and change applications to meet strategic business needs. Over its 35-year history, Pega has delivered award-winning capabilities in CRM and digital process automation (DPA), powered by advanced artificial intelligence and robotic automation, to help the world's leading brands achieve breakthrough business results.

For more information on Pegasystems (NASDAQ: PEGA) visit www.pega.com.

Press contact:

Lisa Pintchman

Pegasystems Inc.

lisa.pintchman@pega.com

(617) 866-6022

Twitter: @pega

Investor contact:

Garo Toomajanian

ICR for Pegasystems

pegainvestorrelations@pega.com

(617) 866-6077

All trademarks are the property of their respective owners.

PEGASYSTEMS INC. | |||||||||||||||

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (1) | |||||||||||||||

(in thousands, except per share amounts) | |||||||||||||||

Three Months Ended | Year Ended | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Revenue | |||||||||||||||

Software license | $ | 103,220 | $ | 107,902 | $ | 288,119 | $ | 339,294 | |||||||

Maintenance | 67,427 | 62,371 | 263,875 | 242,320 | |||||||||||

Services | 85,710 | 84,332 | 339,587 | 306,853 | |||||||||||

Total revenue | 256,357 | 254,605 | 891,581 | 888,467 | |||||||||||

Cost of revenue | |||||||||||||||

Software license | 1,397 | 1,259 | 5,169 | 5,085 | |||||||||||

Maintenance | 6,530 | 6,960 | 24,565 | 27,905 | |||||||||||

Services | 69,984 | 65,758 | 272,031 | 246,683 | |||||||||||

Total cost of revenue | 77,911 | 73,977 | 301,765 | 279,673 | |||||||||||

Gross profit | 178,446 | 180,628 | 589,816 | 608,794 | |||||||||||

Operating expenses | |||||||||||||||

Selling and marketing | 103,650 | 86,334 | 373,495 | 300,578 | |||||||||||

Research and development | 46,449 | 41,797 | 181,710 | 162,886 | |||||||||||

General and administrative | 12,894 | 13,979 | 51,643 | 52,153 | |||||||||||

Total operating expenses | 162,993 | 142,110 | 606,848 | 515,617 | |||||||||||

Income (loss) from operations | 15,453 | 38,518 | (17,032) | 93,177 | |||||||||||

Foreign currency transaction gain (loss) | 1,863 | 136 | 2,421 | (6,413) | |||||||||||

Interest income, net | 629 | 315 | 2,705 | 862 | |||||||||||

Other (expense) income, net | — | (1,678) | 363 | (1,391) | |||||||||||

Income (loss) before provision (benefit) from income taxes | 17,945 | 37,291 | (11,543) | 86,235 | |||||||||||

Provision (benefit) from income taxes | 1,532 | (3,304) | (22,160) | (12,313) | |||||||||||

Net income | $ | 16,413 | $ | 40,595 | $ | 10,617 | $ | 98,548 | |||||||

Earnings per share | |||||||||||||||

Basic | $ | 0.21 | $ | 0.52 | $ | 0.14 | $ | 1.27 | |||||||

Diluted | $ | 0.20 | $ | 0.49 | $ | 0.13 | $ | 1.19 | |||||||

Weighted-average number of common shares outstanding | |||||||||||||||

Basic | 78,680 | 77,944 | 78,564 | 77,431 | |||||||||||

Diluted | 82,536 | 83,168 | 83,064 | 82,832 | |||||||||||

(1) On January 1, 2018, we adopted the ASC 606 revenue recognition standard and have adjusted prior periods to conform. | |||||||||||||||

PEGASYSTEMS INC. | |||||||||||||||||||||

UNAUDITED RECONCILIATION OF SELECTED GAAP MEASURES TO NON-GAAP MEASURES (1)(2) | |||||||||||||||||||||

(in thousands, except percentages and per share amounts) | |||||||||||||||||||||

Three Months Ended | Year Ended | ||||||||||||||||||||

2018 | 2017 | Change | 2018 | 2017 | Change | ||||||||||||||||

Total revenue (GAAP and Non-GAAP) | $ | 256,357 | $ | 254,605 | 1 | % | $ | 891,581 | $ | 888,467 | — | % | |||||||||

Gross profit (GAAP) | $ | 178,446 | $ | 180,628 | (1) | % | $ | 589,816 | $ | 608,794 | (3) | % | |||||||||

Amortization of intangible assets | 1,332 | 1,232 | 5,027 | 5,103 | |||||||||||||||||

Stock-based compensation (3) | 4,585 | 3,661 | 16,862 | 14,573 | |||||||||||||||||

Gross profit (Non-GAAP) | $ | 184,363 | $ | 185,521 | (1) | % | $ | 611,705 | $ | 628,470 | (3) | % | |||||||||

Income (loss) from operations (GAAP) | $ | 15,453 | $ | 38,518 | (60) | % | $ | (17,032) | $ | 93,177 | * | ||||||||||

Amortization of intangible assets | 2,935 | 2,859 | 11,443 | 12,338 | |||||||||||||||||

Stock-based compensation (3) | 16,289 | 13,384 | 63,862 | 53,313 | |||||||||||||||||

Income from operations (Non-GAAP) | $ | 34,677 | $ | 54,761 | (37) | % | $ | 58,273 | $ | 158,828 | (63) | % | |||||||||

Net income (GAAP) | $ | 16,413 | $ | 40,595 | (60) | % | $ | 10,617 | $ | 98,548 | (89) | % | |||||||||

Amortization of intangible assets | 2,935 | 2,859 | 11,443 | 12,338 | |||||||||||||||||

Stock-based compensation (3) | 16,289 | 13,384 | 63,862 | 53,313 | |||||||||||||||||

Other | — | 1,678 | — | 1,678 | |||||||||||||||||

Income tax effects (4) | (5,482) | (21,027) | (32,620) | (62,415) | |||||||||||||||||

Net income (Non-GAAP) | $ | 30,155 | $ | 37,489 | (20) | % | $ | 53,302 | $ | 103,462 | (48) | % | |||||||||

Diluted earnings per share (GAAP) | $ | 0.20 | $ | 0.49 | (59) | % | $ | 0.13 | $ | 1.19 | (89) | % | |||||||||

Amortization of intangible assets | 0.04 | 0.03 | 0.14 | 0.15 | |||||||||||||||||

Stock-based compensation (3) | 0.20 | 0.16 | 0.77 | 0.64 | |||||||||||||||||

Other | 0.00 | 0.02 | 0.00 | 0.02 | |||||||||||||||||

Income tax effects (4) | (0.08) | (0.25) | (0.40) | (0.75) | |||||||||||||||||

Diluted earnings per share (Non-GAAP) | $ | 0.36 | $ | 0.45 | (20) | % | $ | 0.64 | $ | 1.25 | (49) | % | |||||||||

Diluted weighted-average number of common shares outstanding (GAAP and Non-GAAP) | 82,536 | 83,168 | (1) | % | 83,064 | 82,832 | — | % | |||||||||||||

* not meaningful | |||||||||||||||||||||

(1) On January 1, 2018, we adopted the ASC 606 revenue recognition standard and have adjusted prior periods to conform. | |||||||||||||||||||||

(2) Our non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP. | |||||||||||||||||||||

Our non-GAAP financial measures reflect adjustments based on the following items, as well as the related income tax effects: | |||||||||||||||||||||

| |||||||||||||||||||||

For additional information about our use of Non-GAAP measures, the reasons why management uses these measures, the usefulness of these measures, and the material limitations on the usefulness of these measures, see "Discussion of non-GAAP financial measures" included earlier in this release and below. | |||||||||||||||||||||

(3) Stock-based compensation was as follows: | |||||||||||||||||||||

Year Ended | |||||||||||

(in thousands) | 2018 | 2017 | 2016 | ||||||||

Cost of revenues | $ | 16,862 | $ | 14,573 | $ | 11,459 | |||||

Selling and marketing | 23,237 | 15,720 | 12,464 | ||||||||

Research and development | 15,274 | 13,618 | 10,043 | ||||||||

General and administrative | 8,489 | 9,402 | 6,513 | ||||||||

Acquisition-related | — | — | 342 | ||||||||

$ | 63,862 | $ | 53,313 | $ | 40,821 | ||||||

Income tax benefit | $ | (13,383) | $ | (12,113) | $ | (12,198) | |||||

(4) Effective income tax rates were as follows: | |||||||||||

Year Ended | |||||||||||

2018 | 2017 | ||||||||||

GAAP | 192 | % | (14) | % | |||||||

Non-GAAP | 16 | % | 33 | % | |||||||

The difference between our GAAP and non-GAAP effective income tax rates for the year ended December 31, 2018 and 2017 primarily related to the impact of the following items on our GAAP effective income tax rate: | |||||||||||

| |||||||||||

PEGASYSTEMS INC. | |||||||

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (1) | |||||||

(in thousands) | |||||||

December 31, 2018 | December 31, 2017 | ||||||

Assets | |||||||

Total cash, cash equivalents, and marketable securities | $ | 207,423 | $ | 223,748 | |||

Total receivables (billed and unbilled) | 504,765 | 543,527 | |||||

Goodwill | 72,858 | 72,952 | |||||

Other assets | 197,507 | 172,526 | |||||

Total assets | $ | 982,553 | $ | 1,012,753 | |||

Liabilities and stockholders' equity | |||||||

Accrued expenses, including compensation and related expenses | $ | 130,177 | $ | 111,548 | |||

Short-term deferred revenue | 185,145 | 165,850 | |||||

Deferred income tax liabilities | 6,939 | 38,463 | |||||

Other liabilities | 38,761 | 41,022 | |||||

Stockholders' equity | 621,531 | 655,870 | |||||

Total liabilities and stockholders' equity | $ | 982,553 | $ | 1,012,753 | |||

(1) On January 1, 2018, we adopted the ASC 606 revenue recognition standard and have adjusted prior periods to conform. | |||||||

PEGASYSTEMS INC. | |||||||

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (1) | |||||||

(in thousands) | |||||||

Year Ended | |||||||

2018 | 2017 | ||||||

Operating activities: | |||||||

Net income | $ | 10,617 | $ | 98,548 | |||

Adjustment to reconcile net income to cash provided by operating activities: | |||||||

Change in operating assets and liabilities, net | 20,712 | (34,076) | |||||

Stock-based compensation expense | 63,862 | 53,313 | |||||

Amortization of intangible assets and depreciation | 25,295 | 24,713 | |||||

Amortization of deferred contract costs | 17,271 | 12,106 | |||||

Other non-cash | (33,401) | 3,631 | |||||

Cash provided by operating activities | 104,356 | 158,235 | |||||

Cash used in investing activities | (48,196) | (14,759) | |||||

Cash used in financing activities | (101,460) | (54,229) | |||||

Effect of exchange rates on cash and cash equivalents | (2,557) | 2,438 | |||||

Net (decrease) increase in cash and cash equivalents | (47,857) | 91,685 | |||||

Cash and cash equivalents, beginning of period | 162,279 | 70,594 | |||||

Cash and cash equivalents, end of period | $ | 114,422 | $ | 162,279 | |||

(1) On January 1, 2018, we adopted the ASC 606 revenue recognition standard and have adjusted prior periods to conform. | |||||||

PEGASYSTEMS INC. | |||

Reconciliation of Forward-Looking Guidance | |||

(in millions, except per share amounts) | |||

Year Ended | |||

2019 | |||

Net loss (GAAP) | $ | (17.5) | |

Amortization of intangible assets | 5.9 | ||

Stock-based compensation | 80.8 | ||

Income tax effects | (27.1) | ||

Net loss (Non-GAAP) | $ | 42.1 | |

Diluted loss per share (GAAP) | $ | (0.22) | |

Amortization of intangible assets | 0.07 | ||

Stock-based compensation | 1.03 | ||

Income tax effects | (0.34) | ||

Incremental dilutive shares for non-GAAP | (0.04) | ||

Diluted earnings per share (Non-GAAP) | $ | 0.50 | |

Diluted weighted-average number of common shares outstanding (GAAP) | 78.8 | ||

Incremental dilutive shares for non-GAAP | 5 | ||

Diluted weighted-average number of common shares outstanding (Non-GAAP) | 83.8 | ||

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/cloud-drives-strong-2018-performance-and-year-over-year-growth-300799149.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/cloud-drives-strong-2018-performance-and-year-over-year-growth-300799149.html

SOURCE Pegasystems Inc.

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!