|

20.04.2020 23:30:00

|

280+ AEC firms representing $102 billion in revenues report on COVID-19's impact on backlog, projects, layoffs, and M&A

NEW YORK, April 20, 2020 /PRNewswire/ -- Industry-leading corporate finance and M&A advisory firm, AEC Advisors (www.aecadvisors.com), has been conducting bi-weekly surveys and CEO Forum webinars to analyze and discuss the impact of COVID-19 on the Architecture, Engineering, and Consulting ("AEC") industry.

Over 280 AEC firms representing ~$102 billion in combined revenues (or ~90% of the North American AEC industry), participated in the most recent April 17th survey, with a diverse cross-section of participants by size (i.e. ~20 firms generating >$1 billion in revenues, but also 97 firms with <$25 million), ownership (e.g. public, employee-owned/ESOP, private equity-owned), and markets (e.g. transportation, water/wastewater, infrastructure, buildings, oil & gas, environmental, etc.). Additionally, 450+ CEOs and executives joined our 3rd CEO Forum webinar as the CEOs of Arcadis NA, GHD US, and Murraysmith, shared insights in a 90-minute discussion on their current strategies and outlook.

Survey highlights include:

- Median "% of backlog delayed" stabilized at ~7.5% over the last two weeks; median % of backlog "earmarked for delay" also stabilized at ~10%

- 2020 revenues projected to decline slightly under 10% today, vs. slightly over 10% two weeks ago; earnings are projected to decline 10 - 15%, but it's possible that firms are underestimating the impact of revenue declines on earnings

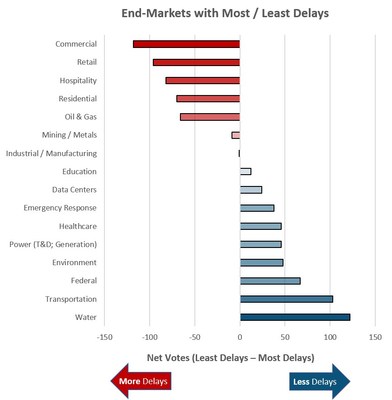

- Private sector buildings projects face the most delays, while public sector infrastructure projects face the least delays

- Most sectors facing significant declines in project pursuits, implying a prolonged negative impact, likely into 2021

- 38% of firms have implemented layoffs/furloughs (up from 26% two weeks ago) and another 12% are still planning to make cuts. However, the combined % of layoffs and "planned to make layoffs" has not increased from two weeks ago.

- While some firms are billing more quickly, 82% are still billing monthly (vs. 91% pre-pandemic). Whereas 72% of firms are expecting a slowdown in payments, only 39% are paying their own subconsultants and vendors more slowly – suggesting a negative cash flow impact.

- M&A activity expected to decline, although some firms are being more aggressive

Our next survey on April 27th will capture the latest impacts of COVID-19, as well as growth and profitability metrics for 2019 (actual) and 2020/2021 (projections).

Visit our website (www.aecadvisors.com/conferences) for upcoming webinars, including this week's speakers below:

- Gord Johnston, Stantec, CEO

- Alex L'Heureux, WSP, CEO

- Paul Gabriel, Environmental Partners, CEO

- Louis Armstrong, Kleinfelder, CEO

Contact: Tyler Albright, talbright@aecadvisors.com

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/280-aec-firms-representing-102-billion-in-revenues-report-on-covid-19s-impact-on-backlog-projects-layoffs-and-ma-301043852.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/280-aec-firms-representing-102-billion-in-revenues-report-on-covid-19s-impact-on-backlog-projects-layoffs-and-ma-301043852.html

SOURCE AEC Advisors LLC

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!