|

12.04.2021 23:15:00

|

New Pacific Acquires the Carangas Silver Project, Bolivia

Trading Symbol: | TSX: NUAG |

OTCQX: NUPMF |

VANCOUVER, BC, April 12, 2021 /PRNewswire/ - New Pacific Metals Corp. ("New Pacific" or the "Company") (TSX: NUAG) (OTCQX: NUPMF) is pleased to announce that the Company has signed an agreement with a private Bolivian company (the "Vendor"), to acquire a 98% interest in the Carangas silver project (the "Carangas Project" or the "Project"), located in the Oruro Department, Bolivia. New Pacific will cover 100% of the future expenditures on exploration, mining, development, and production activities. The agreement has a term of 30 years and is renewable for an additional 15 years. An initial discovery diamond drill program is planned to commence upon receipt of the related permit from the local authorities.

CARANGAS PROJECT HIGHLIGHTS:

- Former silver mining district, located on La Ruta de la Plata (the Silver Road), containing broad zones of outcropping silver mineralization and historically exploited high-grade silver veins;

- Highlights of due diligence sampling include 30 meters ("m") at an average grade of 101 grams per tonne ("g/t") silver, 15 m at an average grade of 252 g/t silver, and 8 m at an average grade of 512 g/t silver;

- Near surface bulk tonnage and high-grade vein targets identified;

- Leverages New Pacific's exploration and project development expertise and cements the Company's first mover status in an under-explored silver district; and

- 5,000-meter discovery diamond drill program planned for 2021.

Dr. Mark Cruise, CEO of New Pacific, stated, "The addition of the Carangas Project fits well with the Company's strategy to become a premier Latin American focused precious metal explorer and developer. Initial field work, including target generation, positions us well for a successful drill program and compliments our planned exploration programs at our Silverstrike Project, in addition to the advanced exploration and development studies currently in progress on our flagship Silver Sand project."

CARANGAS PROJECT OVERVIEW

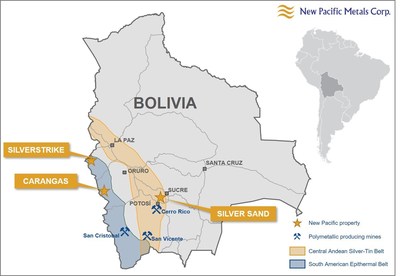

The Carangas Project consists of two exploration concessions totaling 6.25 square kilometers ("km"), located approximately 180 km southwest of the city of Oruro, in southwest Bolivia (Figure 1). Situated in the Bolivian altiplano at an average elevation of 3,800 m, access to the Project is via paved Highway 12 and a municipally maintained 30 km gravel road.

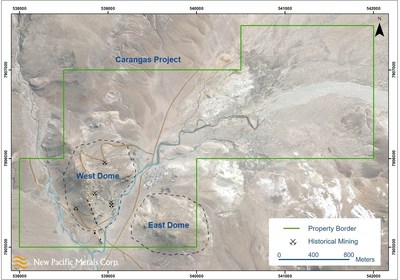

Geologically, the Project lies within the South American Epithermal Belt which hosts large precious metal deposits and operations in neighboring countries but remains under-explored in Bolivia. The Project is comprised of a Tertiary volcanic complex approximately 1.6 km long in east-west direction and 1.4 km wide in north-south direction, which stands 150 m above the surrounding fluvial plains. An ephemeral stream divides the volcanic complex into two separate domes known as West and East Domes, respectively (Figure 2).

Figure 1: Location of the Carangas Project in the Department of Oruro, Bolivia

Figure 2: Satellite Imagery of the Carangas Project, Bolivia, including West and East Domes

GEOLOGY AND MINERALIZATION

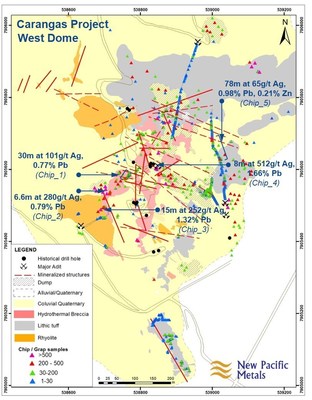

West Dome consists of felsic to dacitic volcanic facies (lithic and/or ash fall tuffs) cross-cut by multi-phase mineralized hydrothermal and/or structural breccia bodies and rhyo-dacitic dykes. East Dome consists of lithic tuffs cut by faults and associated minor breccia zones.

The Domes are dissected by a series of laterally extensive, steeply dipping to sub-vertical, extensional fault and fracture zones of half meter to more than one meter wide, predominantly striking east-west, west-northwest and northwest. Silver-rich polymetallic mineralization occurs as millimeter to multi-meter-wide veins (which were historically exploited), veinlets and disseminations in the matrix of the breccias and/or associated volcanic host units.

The area between the West Dome and East Dome is a flat valley, approximately 200 m wide, filled by fluvial sediments (Figure 2).

HISTORY OF MINING AND EXPLORATION

Mining is thought to have commenced in the sixteenth century and continued intermittently until the early twentieth century. The Project, and in particular West Dome, contains extensive surface workings in addition to underground mine adits, shafts and associated processing and smelting infrastructure. There is no active mining at the present time.

Modern mineral exploration, by local mining interests, occurred in the early 1980's. The first drill program comprising of nine reverse circulation holes for a total of 1,000 m was carried out in 1995. Written records for the program report a drill intercept (1) of 116 m at an average grade of 95 g/t silver (from 18 m to 134 m downhole), including 16 m at 325 g/t silver (from 66 m to 82 m downhole), including a 4-m mined-out interval in hole RC-05.

A second drill program was conducted in 2000, also by a local Bolivian group, with six diamond drill holes for a total of 914 m completed. The results are in line with prior exploration and include a drill intercept (1) of 76 m at an average grade of 90 g/t silver, 0.96% lead, and 0.12% zinc (from 0 m to 76 m downhole), including 8 m at 266 g/t silver, 1.02% lead, and 0.06% zinc (from 26m to 34 m downhole) in hole DDH-01. No exploration activities were recorded after the year 2000.

Note: | |

(1) | The drill results are historic in nature and should not be relied upon. The historical drill intercepts were not verified by the Company as the drill cores and sample pulp/rejects are not available and there are other inherent limitations and uncertainties. The drill intercepts are not considered as true width of mineralization due to little knowledge of spatial morphology of mineralization at this early stage. |

NEW PACIFIC DUE DILLIGENCE

New Pacific conducted reconnaissance scale geological, structural and alteration mapping and geochemical sampling of the Project including the collection of representative characterization ("grab") (1) and continuous channel chip samples (2) from surface outcropping mineralization, historical mine dumps and, where safely accessible, underground workings.

A total of 282 characterization samples and 729 continuous channel rock chip samples were collected from surface outcrop, underground mining faces, and open pit walls. The grab samples returned an average silver grade of 229 g/t (range of 1 g/t to 1,950 g/t); an average lead grade of 1.02% (range of 0% to 7.33%), and an average zinc grade of 0.16% (range of 0% to 3.28%), reflecting the presence of widespread geochemically anomalous mineralization. In general, continuous chip samples intercepted multiple wide mineralized zones, where outcrop or underground workings are accessible. Table 1 contains a summary of selected composite intervals of continuous chip samples.

Table 1: Selected Composite Intervals of Continuous Chip Samples from the Carangas Project, Bolivia.

Target | Location | From (m) | To (m) | Interval (m) | Ag (g/t) | Pb (%) | Zn (%) | Note |

West Dome | Chip_1 | 0.0 | 30.0 | 30.0 | 101 | 0.77 | 0.03 | composite |

Chip_2 | 0.0 | 6.6 | 6.6 | 280 | 0.79 | 0.01 | composite | |

Chip_3 | 0.0 | 15.3 | 15.3 | 252 | 1.32 | 0.02 | composite | |

Chip_4 | 0.0 | 8.0 | 8.0 | 512 | 1.66 | 0.06 | composite | |

Chip_5 | 2.0 | 80.0 | 78.0 | 65 | 0.98 | 0.21 | composite | |

East Dome | Chip_6 | 14.0 | 68.0 | 54.0 | 52 | 0.30 | 0.14 | composite |

Chip_7 | 18.0 | 56.0 | 38.0 | 98 | 0.66 | 0.21 | composite | |

Chip_8 | 0.0 | 2.0 | 2.0 | 1,100 | 0.62 | 0.25 | single sample | |

Chip_9 | 0.0 | 1.0 | 1.0 | 1,755 | 0.93 | 0.59 | single sample |

At East Dome (Figure 3), mineralization occurs as fracture and fault zones cutting the lithic tuff host unit. Continuous rock chip sampling returned broad mineralized zones, including up to 54.0 m at 52 g/t silver, 0.30% lead and 0.14% zinc, and 38.0 m at 98 g/t silver, 0.66% lead and 0.21% zinc. Sampling also confirmed the presence of numerous high grade narrow zones of silver-rich mineralization including up to 2.0 m at 1,100 g/t silver, 0.62% lead and 0.25% zinc, and 1.0 m at 1,755 g/t silver, 0.93% lead and 0.59% zinc.

At West Dome (Figure 4), channel chip sampling confirmed the presence of multiple mineralized zones including up to 30.0 m at 101 g/t silver and 0.77% lead, 6.6 m at 280 g/t silver and 0.79% lead, and 15.0 m at 252 g/t silver and 1.32% lead. Encouraging intervals of continuous rock chip sampling from underground include 8.0 m at 512 g/t silver and 1.66% lead, and 78.0 m at 65 g/t silver, 0.98% lead and 0.21% zinc. All channel chip samples were collected from mineralized hydrothermal breccias, which are cut by mineralized fractures and faults.

Notes: | |

(1) | Grab samples are selective in nature and are not representative of the average in-situ mineralization. |

(2) | Rock chip samples were taken across mineralized structures from surface outcrops and underground faces. Sample interval is close to true width of mineralization. |

Figure 3: Geology Map of East Dome, Carangas Project, Bolivia, including Sample Results

Figure 4: Geology Map of West Dome, Carangas Project, Bolivia, including Sample Results

NEAR-TERM STRATEGY AND NEXT STEPS

Based on the historical mining activities evidenced by widespread mine dumps and numerous surface and underground mining workings, historical exploration results, and the results of the Company's initial exploration programs, the Company believes that the Carangas Project has the potential to host near surface bulk tonnage mineralization and high-grade mineralization, controlled by narrow structures, at relatively shallow depths.

Permitting is in progress and the Company plans an initial discovery diamond drill program of up to 5,000 m in 2021. Upon completion of the program, New Pacific will provide an update on the results. Contingent on these drill results, additional drilling may be conducted to expand upon and define any new discoveries.

QUALITY ASSURANCE AND QUALITY CONTROL

All samples in respect of the exploration program at the Carangas Project, conducted by the Company and discussed in this news release, were shipped in securely-sealed bags by New Pacific staff in the Company's vehicles, directly from the field to ALS Global in Oruro, Bolivia for preparation, and ALS Global in Lima, Peru for geochemical analysis. ALS Global is an ISO 17025 accredited laboratory independent from New Pacific. All samples are first analyzed by a multi-element ICP package (ALS code ME-MS41) with ore grade over specified limits for silver, lead and zinc further analyzed using ALS code OG46. Further silver samples over specified limits are analyzed by gravimetric analysis (ALS code of GRA21).

The assay results of the grab samples are used for reconnaissance purpose and, therefore, no certified reference materials and blank materials were inserted to the normal sample sequence in the field. Internal Quality Assurance/Quality Control ("QAQC") results from ALS Global did not show any significant bias of analysis or contamination during sample preparation. For rock chip samples, certified reference materials, blank samples and field duplicate samples were inserted to normal sample sequences prior to delivery to the laboratory for preparation and analysis. The results of QAQC samples did not show any significant bias of analysis or contamination during sample preparation.

QUALIFIED PERSON

The scientific and technical information contained in this news release has been reviewed and approved by Alex Zhang, P. Geo., Vice President of Exploration, who is a Qualified Person for the purposes of National Instrument 43-101 — Standards of Disclosure for Mineral Projects ("NI 43- 101"). The Qualified Person has verified the information disclosed herein, including the sampling, preparation, security and analytical procedures underlying such information, and is not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein.

ABOUT NEW PACIFIC

New Pacific is a Canadian exploration and development company, which owns the flagship Silver Sand Project, located in the Potosi Department of Bolivia, the Silverstrike Project, in the La Paz Department of Bolivia and the Carangas Project in the Oruro Department of Bolivia. The Company is focused on progressing the development of its flagship project, while growing Mineral Resources through the exploration and acquisition of properties in the Americas.

To receive company news by e-mail, please register using New Pacific's website at www.newpacificmetals.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain of the statements and information in this news release constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian provincial securities laws. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects", "is expected", "anticipates", "believes", "plans", "projects", "estimates", "assumes", "intends", "strategies", "targets", "goals", "forecasts", "objectives", "budgets", "schedules", "potential" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information. Such statements include, but are not limited to: statements regarding anticipated exploration, drilling, development, construction, and other activities or achievements of the Company; timing of receipt of permits and regulatory approvals; and estimates of the Company's revenues and capital expenditures.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to: global economic and social impact of COVID-19; fluctuating equity prices, bond prices, commodity prices; calculation of resources, reserves and mineralization, general economic conditions, foreign exchange risks, interest rate risk, foreign investment risk; loss of key personnel; conflicts of interest; dependence on management, uncertainties relating to the availability and costs of financing needed in the future, environmental risks, operations and political conditions, the regulatory environment in Bolivia and Canada, risks associated with community relations and corporate social responsibility, and other factors described under the heading "Risk Factors" in the Company's Annual Information Form for the year ended June 30, 2020 and its other public filings.

This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements or information.

The forward-looking statements are necessarily based on a number of estimates, assumptions, beliefs, expectations and opinions of management as of the date of this news release that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates, assumptions, beliefs, expectations and options include, but are not limited to, those related to the Company's ability to carry on current and future operations, including: the duration and effects of COVID-19 on our operations and workforce; development and exploration activities; the timing, extent, duration and economic viability of such operations; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company's ability to meet or achieve estimates, projections and forecasts; the stabilization of the political climate in Bolivia; the Company's ability to obtain and maintain social license at its mineral properties; the availability and cost of inputs; the price and market for outputs; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits, including the ratification and approval of the Mining Production Contract with COMIBOL by the Plurinational Legislative Assembly of Bolivia; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry.

Although the forward-looking statements contained in this news release are based upon what management believes are reasonable assumptions, there can be no assurance that actual results will be consistent with these forward-looking statements. All forward-looking statements in this news release are qualified by these cautionary statements. Accordingly, readers should not place undue reliance on such statements. Other than specifically required by applicable laws, the Company is under no obligation and expressly disclaims any such obligation to update or alter the forward-looking statements whether as a result of new information, future events or otherwise except as may be required by law. These forward-looking statements are made as of the date of this news release.

CAUTIONARY NOTE TO US INVESTORS

The disclosure in this news release and referred to herein was prepared in accordance with NI 43-101 which differs significantly from the requirements of the U.S. Securities and Exchange Commission (the "SEC"). The terms "proven mineral reserve", "probable mineral reserve" and "mineral reserves" used in this news release are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum Standards (the "CIM Definition Standards"), which definitions have been adopted by NI 43-101. Accordingly, information contained in this news release providing descriptions of our mineral deposits in accordance with NI 43-101 may not be comparable to similar information made public by other U.S. companies subject to the United States federal securities laws and the rules and regulations thereunder.

Investors are cautioned not to assume that any part or all of mineral resources will ever be converted into reserves. Pursuant to CIM Definition Standards, "Inferred mineral resources" are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures.

Canadian standards, including the CIM Definition Standards and NI 43-101, differ significantly from standards in the SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the "SEC Modernization Rules"), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "Measured Mineral Resources", "Indicated Mineral Resources" and "Inferred Mineral Resources". In addition, the SEC has amended its definitions of "Proven Mineral Reserves" and "Probable Mineral Reserves" to be substantially similar to corresponding definitions under the CIM Definition Standards. During the period leading up to the compliance date of the SEC Modernization Rules, information regarding mineral resources or reserves contained or referenced in this news release may not be comparable to similar information made public by companies that report according to U.S. standards. While the SEC Modernization Rules are purported to be "substantially similar" to the CIM Definition Standards, readers are cautioned that there are differences between the SEC Modernization Rules and the CIM Definitions Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/new-pacific-acquires-the-carangas-silver-project-bolivia-301267088.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/new-pacific-acquires-the-carangas-silver-project-bolivia-301267088.html

SOURCE New Pacific Metals Corp.

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!