|

30.11.2020 13:00:00

|

Can-Fite Reports Third Quarter 2020 Financial Results & Provides Clinical Update

Can-Fite BioPharma Ltd. (NYSE American: CANF) (TASE:CFBI), a biotechnology company advancing a pipeline of proprietary small molecule drugs that address inflammatory, cancer and liver diseases, today announced financial results for the nine months ended September 30, 2020.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20201130005411/en/

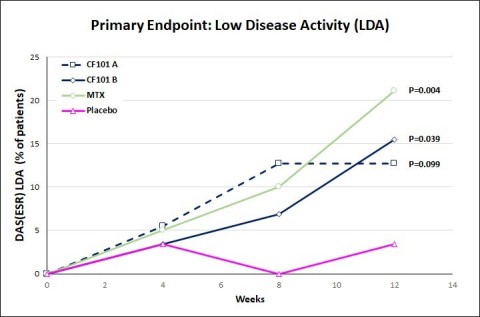

RA Primary Endpoint: Low Disease Activity (Graphic: Business Wire)

Clinical Developments and Corporate Highlights for the Third Quarter and Recent Weeks Include:

Positive Interim Analysis in Phase III Comfort™ Trial of Piclidenoson in the Treatment of Psoriasis – The Independent Data Monitoring Committee (IDMC) for Can-Fite’s Phase III trial of Piclidenoson in the treatment of moderate-to-severe plaque psoriasis recommended the Company continue the study with the original sample size and drop one dose group based on the positive data from its interim analysis. While the interim data continue to be blinded to Can-Fite, the Company considers the IDMC’s recommendations highly encouraging. As the optimal dose has been identified, Can-Fite believes the study can be concluded earlier than originally planned. The majority of costs associated with the Phase III Comfort™ study have been previously paid. Piclidenoson is out-licensed for the indication of psoriasis in nine countries through agreements that include milestone payments and royalties on revenues upon regulatory approval.

Data from the Interim Analysis of the Acrobat™ Rheumatoid Arthritis Study - The IDMC recommended not to continue this study. The Company conducted a detailed analysis which showed that although Piclidenoson efficacy was significantly superior to placebo, the study missed the primary endpoint which was non-inferiority vs. the comparator methotrexate. The Company decided to stop this Phase III study and to focus on the developments that showed promising data including psoriasis, NASH and liver cancer.

Phase II COVID-19 IND Application for Piclidenoson Approved by FDA - The U.S. Food and Drug Administration (FDA) issued a "safe to proceed” notice for Can-Fite’s Investigational New Drug (IND) application for a Phase II study of Piclidenoson in the treatment COVID-19. The 28-day study will enroll 40 patients hospitalized with "moderate” COVID-19 per U.S. National Institutes of Health Coronavirus Disease 2019 (COVID-19) Treatment Guidelines. The randomized, double blind study will evaluate patients who will receive Piclidenoson in addition to standard supportive care, as compared to patients who receive standard supportive care with placebo. The Company expects to commence patient enrollment in Q4 2020.

Namodenoson Abstract of Phase II Data Selected as ‘Best of The Liver Meeting’ in the NASH Category of the American Association of Liver Diseases (AASLD) - Dr. Rifaat Safadi, Principal Investigator of Can-Fite’s Phase II study of Namodenoson in the treatment of Non-Alcoholic Fatty Liver Disease (NAFLD) and Non-Alcoholic Steatohepatitis (NASH) delivered a late-breaking oral presentation at the prestigious American Association for the Study of Liver Diseases (AASLD) conference, The Liver Meeting Digital Experience™ 2020. Presenting to the world’s leading scientists and health care professionals committed to preventing and curing liver diseases, Dr. Safadi concluded that "Namodenoson’s very impressive study data may result in a promising drug for the treatment of NAFLD/NASH due to the combination of good efficacy and favorable safety.” Can-Fite’s presentation was selected as ‘Best of The Liver Meeting’ in the NAFLD/NASH category. This selection is a singular honor and indicates the high level with which the AASLD review committee regards Can-Fite’s research.

Patent Protecting Namodenoson in Treatment of NASH Approved in Europe – A patent titled "An A3 Adenosine Receptor For Use In Treating Ectopic Fat Acculturation” was issued to Can-Fite by the European Patent Office. The patent’s claims include use of the A3 adenosine receptor (A3AR), the target of Can-Fite’s platform technology, in reducing ectopic fat accumulation particularly in fatty liver as manifested in NAFLD and NASH.

Completed Development of Assay to Identify Clinically Active Cannabis Derived Compounds – Can-Fite completed the development of a biological cell-based in vitro assay which can identify clinically active cannabis derived compounds that bind to and activate A3AR, the target of Can-Fite’s platform technology. In addition to using this assay in the development of its own cannabis derived compound-based therapeutics, Can-Fite plans to market the assay on a ‘fee for service’ basis to researchers and other cannabis companies worldwide.

"We are very pleased with the results of the IDMC’s interim analysis and recommendation for our Phase III psoriasis study. Piclidenoson has a clear value proposition in the psoriasis market we believe, based on its demonstrated safety and efficacy to date, and the benefit of being an oral drug among a growing number of injectable biologics. Oral drugs are cost effective and more convenient for the patient. Both of these factors are preferred by psoriasis patients based on a 2018 study published in an industry journal,” stated Can-Fite CEO Dr. Pnina Fishman. "This quarter we anticipate enrolling the first COVID-19 patient in our U.S. FDA Phase II study. Piclidenoson’s anti-inflammatory and anti-viral properties make it a promising candidate in the fight against this pandemic. We are also very encouraged by the level of interest in Namodenoson in the treatment of NAFLD/NASH from the scientific and business communities.”

Financial Results

Revenues for the nine months ended September 30, 2020 were $0.61 million compared with $1.84 million for the same period of 2019. The decrease in revenues was mainly due to the recognition of a lower portion of advance payments received under distribution agreements from Gebro, Chong Kun Dung Pharmaceuticals, and Cipher Pharmaceuticals.

Research and development expenses for the nine months ended September 30, 2020 were $9.05 million compared with $7.01 million for the same period of 2019. Research and development expenses for the nine months ended September 30, 2020 comprised primarily of expenses associated with the Phase II studies for Namodenoson in the treatment of NASH and HCC, as well as expenses for ongoing Phase III studies of Piclidenoson in the treatment of rheumatoid arthritis and psoriasis. The increase is primarily due to increased costs associated with the accelerating rate of absorption of patients for the Phase III clinical trial of Piclidenoson for the treatment of rheumatoid arthritis and for psoriasis during this period.

General and administrative expenses were $2.14 million for the nine months ended September 30, 2020 compared to $2.22 million for the same period in 2019. The decrease is primarily due to a decrease in professional services and travel expenses which was partly offset by an increase in salaries and related benefits and insurance expenses.

Financial expenses, net for the nine months ended September 30, 2020 was $0.22 million compared to $0.44 million for the same period in 2019. The decrease in financial expenses, net is mainly due to fair value revaluation of the investment in Wize Pharma Inc’s shares which is classified under short term investment.

Can-Fite's net loss for the nine months ended September 30, 2020 was $10.81 million compared with a net loss of $7.84 million for the same period in 2019. As of September 30, 2020, Can-Fite had cash and cash equivalents of $10.22 million as compared to $2.69 million at December 31, 2019. The increase in cash during the nine months ended September 30, 2020 is due to an aggregate of $17.68 million net proceeds received through a warrant exercise transaction in January 2020, a public offering in February 2020, partial exercises in March, April and May 2020 of warrants issued in the February 2020 public offering, and a registered direct offering in June and July 2020 which was offset by net cash used in operating activity of $10.16 million.

The Company's consolidated financial results for the nine months ended September 30, 2020 are presented in accordance with US GAAP Reporting Standards.

Conference Call

Management will host a conference call today, November 30, 2020 at 9:15 a.m. ET. Investors in the U.S. are invited to dial 877-423-9813. International investors may dial 201-689-8573. The conference ID is 13713545. Investors may also participate via webcast: http://public.viavid.com/index.php?id=142533

A replay of the webcast will be archived on Can-Fite’s website for a period of time.

CONSOLIDATED STATEMENTS OF BALANCE SHEETS |

||||||||

In thousands (except for share and per share data) |

||||||||

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2020 |

|

|

2019 |

|

||

|

|

Unaudited |

|

|

Audited |

|

||

|

|

|

|

|

|

|

||

ASSETS |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

CURRENT ASSETS: |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

10,222 |

|

|

$ |

2,697 |

|

Other receivable and prepaid expenses |

|

|

2,961 |

|

|

|

4,383 |

|

Short-term investment |

|

|

57 |

|

|

|

64 |

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

13,240 |

|

|

|

7,144 |

|

|

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other non-current receivables |

- |

912 |

||||||

Operating lease right of use assets |

|

|

58 |

|

|

|

82 |

|

Property, plant and equipment, net |

|

|

28 |

|

|

|

36 |

|

|

|

|

|

|

|

|

|

|

Total long-term assets |

|

|

86 |

|

|

|

1,030 |

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

13,326 |

|

|

$ |

8,174 |

|

CONSOLIDATED STATEMENTS OF BALANCE SHEETS |

||||||||

In thousands (except for share and per share data) |

||||||||

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2020 |

|

|

2019 |

|

||

|

|

Unaudited |

|

|

Audited |

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

CURRENT LIABILITIES: |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Trade payables |

|

$ |

784 |

|

|

$ |

2,156 |

|

Current maturity of operating lease liability |

|

|

34 |

|

|

|

36 |

|

Deferred revenues |

|

|

603 |

|

|

|

469 |

|

Other accounts payable |

|

|

398 |

|

|

|

610 |

|

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

1,819 |

|

|

|

3,271 |

|

|

|

|

|

|

|

|

|

|

NON-CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term operating lease liability |

|

|

15 |

|

|

|

39 |

|

Deferred revenues |

|

|

1,951 |

|

|

|

2,422 |

|

|

|

|

|

|

|

|

|

|

Total long-term liabilities |

|

|

1,966 |

|

|

|

2,461 |

|

|

|

|

|

|

|

|

|

|

CONTINGENT LIABILITIES AND COMMITMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY ATTRIBUTABLE TO EQUITY HOLDERS OF THE COMPANY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary shares of NIS 0.25 par value - Authorized: 500,000,000 shares at September 30, 2020 and December 31, 2019; Issued and outstanding: 462,419,463 shares as of September 30, 2020; 120,652,683 shares as of December 31, 2019 |

|

|

32,936 |

|

|

|

8,225 |

|

Additional paid-in capital |

|

|

97,314 |

|

|

|

103,401 |

|

Accumulated other comprehensive income |

|

|

1,127 |

|

|

|

1,127 |

|

Accumulated deficit |

|

|

(121,836 |

) |

|

|

(110,311 |

) |

|

|

|

|

|

|

|

|

|

Total equity |

|

|

9,541 |

|

|

|

2,442 |

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity |

|

$ |

13,326 |

|

|

$ |

8,174 |

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS |

||||||||

In thousands (except for share and per share data) |

||||||||

|

|

Nine months ended September 30, |

|

|||||

|

|

2020 |

|

|

2019 |

|

||

|

|

Unaudited |

|

|||||

|

|

|

|

|

|

|

||

Revenues |

|

$ |

613 |

|

|

$ |

1,840 |

|

|

|

|

|

|

|

|

|

|

Research and development expenses |

|

|

(9,055 |

) |

|

|

(7,016 |

) |

General and administrative expenses |

|

|

(2,144 |

) |

|

|

(2,220 |

) |

|

|

|

|

|

|

|

||

Operating loss |

|

|

(10,586 |

) |

|

|

(7,396 |

) |

|

|

|

|

|

|

|

|

|

Total financial expenses, net |

|

|

(224 |

) |

|

|

(445 |

) |

|

|

|

|

|

|

|

|

|

Net loss |

|

|

(10,810 |

) |

|

|

(7,841 |

) |

|

|

|

|

|

|

|

|

|

Total comprehensive loss |

|

|

(10,810 |

) |

|

|

(7,841 |

) |

|

|

|

|

|

|

|

|

|

Deemed dividend |

|

|

(715 |

) |

|

|

- |

|

|

|

|

|

|

|

|

|

|

Net loss attributed to ordinary shareholders |

|

$ |

(11,525 |

) |

|

$ |

(7,841 |

) |

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share |

|

|

(0.03 |

) |

|

|

(0.11 |

) |

|

|

|

|

|

|

|

|

|

Weighted average number of ordinary shares used in computing basic and diluted net loss per share |

|

|

323,360,926 |

|

|

|

74,451,754 |

|

About Can-Fite BioPharma Ltd.

Can-Fite BioPharma Ltd. (NYSE American: CANF) (TASE: CFBI) is an advanced clinical stage drug development Company with a platform technology that is designed to address multi-billion dollar markets in the treatment of cancer, liver, inflammatory disease and COVID-19. The Company's lead drug candidate, Piclidenoson, is currently in a Phase III trial for psoriasis and a Phase II study in the treatment of moderate COVID-19. Can-Fite's liver drug, Namodenoson, is headed into a Phase III trial for hepatocellular carcinoma (HCC), the most common form of liver cancer, and successfully achieved its primary endpoint in a Phase II trial for the treatment of non-alcoholic steatohepatitis (NASH). Namodenoson has been granted Orphan Drug Designation in the U.S. and Europe and Fast Track Designation as a second line treatment for HCC by the U.S. Food and Drug Administration. Namodenoson has also shown proof of concept to potentially treat other cancers including colon, prostate, and melanoma. CF602, the Company's third drug candidate, has shown efficacy in the treatment of erectile dysfunction. These drugs have an excellent safety profile with experience in over 1,500 patients in clinical studies to date. For more information please visit: www.can-fite.com.

Forward-Looking Statements

This press release may contain forward-looking statements, about Can-Fite’s expectations, beliefs or intentions regarding, among other things, market risks and uncertainties, its product development efforts, business, financial condition, results of operations, strategies or prospects. In addition, from time to time, Can-Fite or its representatives have made or may make forward-looking statements, orally or in writing. Forward-looking statements can be identified by the use of forward-looking words such as "believe,” "expect,” "intend,” "plan,” "may,” "should” or "anticipate” or their negatives or other variations of these words or other comparable words or by the fact that these statements do not relate strictly to historical or current matters. These forward-looking statements may be included in, but are not limited to, various filings made by Can-Fite with the U.S. Securities and Exchange Commission, press releases or oral statements made by or with the approval of one of Can-Fite’s authorized executive officers. Forward-looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause Can-Fite’s actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause Can-Fite’s actual activities or results to differ materially from the activities and results anticipated in such forward-looking statements. Factors that could cause our actual results to differ materially from those expressed or implied in such forward-looking statements include, but are not limited to: our history of losses and needs for additional capital to fund our operations and our inability to obtain additional capital on acceptable terms, or at all; uncertainties of cash flows and inability to meet working capital needs; the impact of the COVID-19 pandemic; the initiation, timing, progress and results of our preclinical studies, clinical trials and other product candidate development efforts; our ability to advance our product candidates into clinical trials or to successfully complete our preclinical studies or clinical trials; our receipt of regulatory approvals for our product candidates, and the timing of other regulatory filings and approvals; the clinical development, commercialization and market acceptance of our product candidates; our ability to establish and maintain strategic partnerships and other corporate collaborations; the implementation of our business model and strategic plans for our business and product candidates; the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and our ability to operate our business without infringing the intellectual property rights of others; competitive companies, technologies and our industry; statements as to the impact of the political and security situation in Israel on our business; and risks and other risk factors detailed in Can-Fite’s filings with the SEC and in its periodic filings with the TASE. In addition, Can-Fite operates in an industry sector where securities values are highly volatile and may be influenced by economic and other factors beyond its control. Can-Fite does not undertake any obligation to publicly update these forward-looking statements, whether as a result of new information, future events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20201130005411/en/

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu Can Fite Biopharma Ltd (spons. ADRs)mehr Nachrichten

| Keine Nachrichten verfügbar. |